The US dollar has been very volatile and choppy against the Japanese yen during the month of October, and I think at this point that is to be expected. After all, we have a scenario where the US dollar has higher interest rates pushing it to the upside, and of course the US stock market had essentially outperformed most stock markets around the world. This pair tends to follow the interest rate differential between the United States and Japan via the 10 year notes, but also will follow the S&P 500 in general.

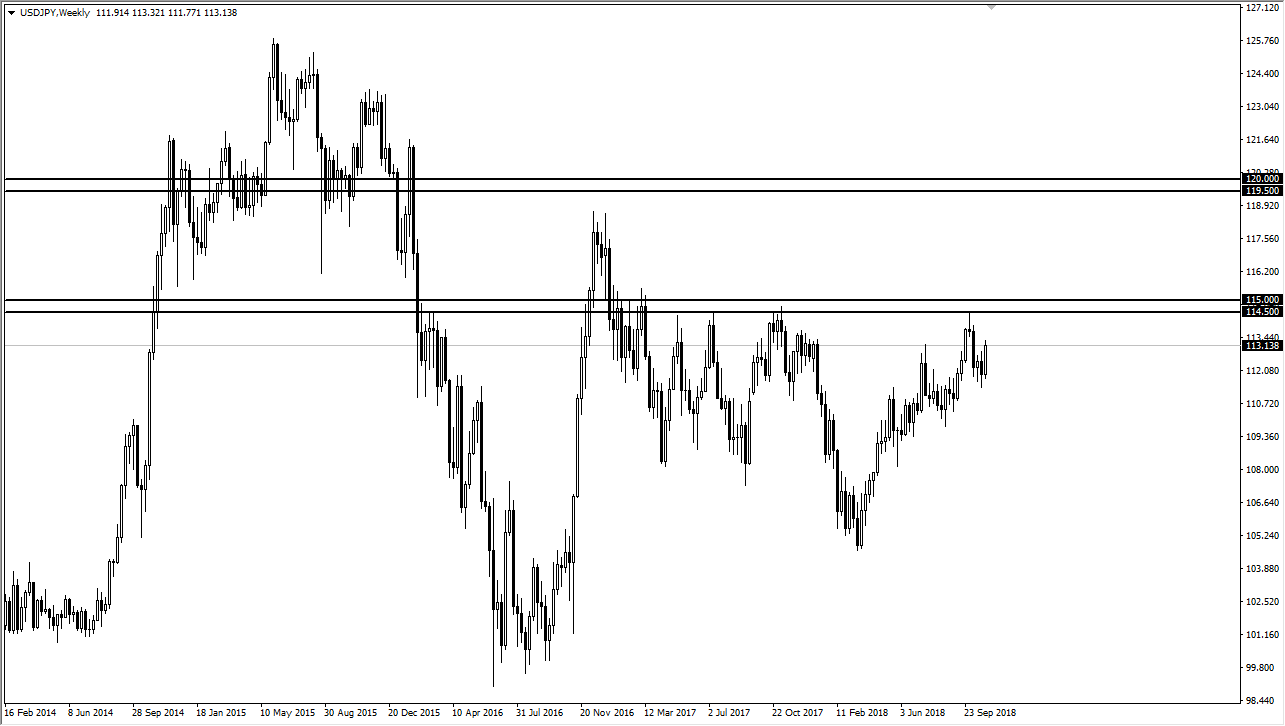

The ¥114.50 level begins significant resistance to the ¥115 level. I believe this area is going to be very difficult to break above, and I think this is the biggest question for the month of November, whether we can break above there or not. Obviously, if we do break above the ¥115 level, the market should go much higher, perhaps as high as the ¥120 level over the longer-term. I think a lot of this will come down to the shaky economic realities of the global economy, and while the Japanese yen does tend to strengthen when people are concerned, the US dollar does as well, so this market probably won’t fall as far as the other JPY-related markets will. I think there is a significant amount of support underneath at the ¥112 level, and again at the ¥110 level. I don’t think we break down below the ¥110 level, but if we do that would be very negative.

I think the most likely scenario for the month of November is bouncing around between the ¥112 level on the bottom, and the ¥114.50 level on the top. Obviously, we can have geopolitical or economic events that break us out of this range, but I think this is going to be a very choppy month ahead of us.