EUR/USD

The Euro initially tried to rally during the week but as you can see we have failed it near the 1.15 level yet again. Because of this, and the hammer from the previous week, I think what we are looking at is a scenario where we will see a lot of choppiness but with a downward negative bias. I think rallies are to be sold, at least until we can break above the 1.15 handle. I do anticipate a lot of support below at the 1.12 and the 1.11 handle’s.

USD/JPY

The US dollar formed a relatively benign candle for the week, as we are continuing to see support from the uptrend line of the up trending channel. The ¥112 level looks to be supportive as well, so I think at this point buyers will continue to come in and try to pick up value on small dips. That being said, I also recognize that the ¥114.50 level begins a massive resistance extending to the ¥115 level.

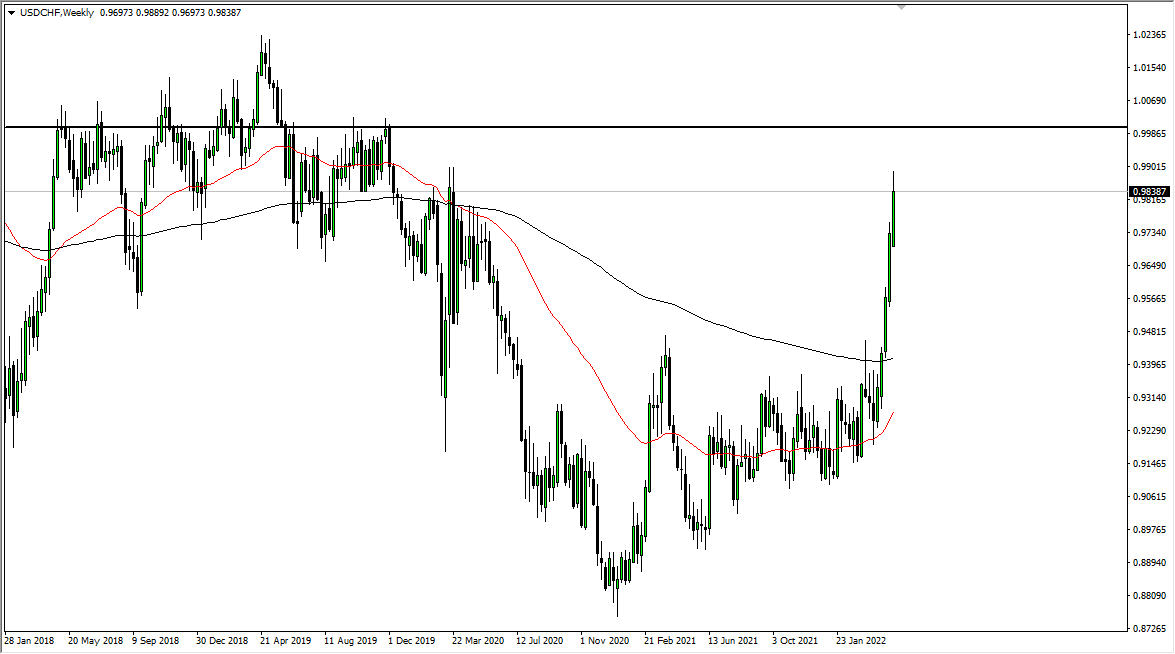

USD/CHF

The US dollar fell significantly against the Swiss franc during the week but has recovered quite nicely. If we can break above the parity level, I anticipate that this market will probably reach towards the 1.0060 level above. I do believe that dips are to be bought, and that the 0.99 level will offer significant support this week. The US dollar continues to strengthen overall, and I think that will be any different against the Swiss franc than other currencies.

USD/CAD

The US dollar rallied significantly during the trading this week but found resistance above the 1.3250 level. I think at this point we will probably roll over and go looking towards 1.30 level. However, if we were to break above the highs from this past week, then it opens the door to the 1.35 handle.