NZD/USD

The New Zealand dollar spent most of the week rallying, slamming into the 0.67 handle. However, the Friday candle ended up forming a shooting star, which of course is a negative sign. With that being the case I suspect that the market is probably going to spend some considerable time to the downside this coming week. I would look to sell rallies and am not impressed until we can break above the 0.6750 level.

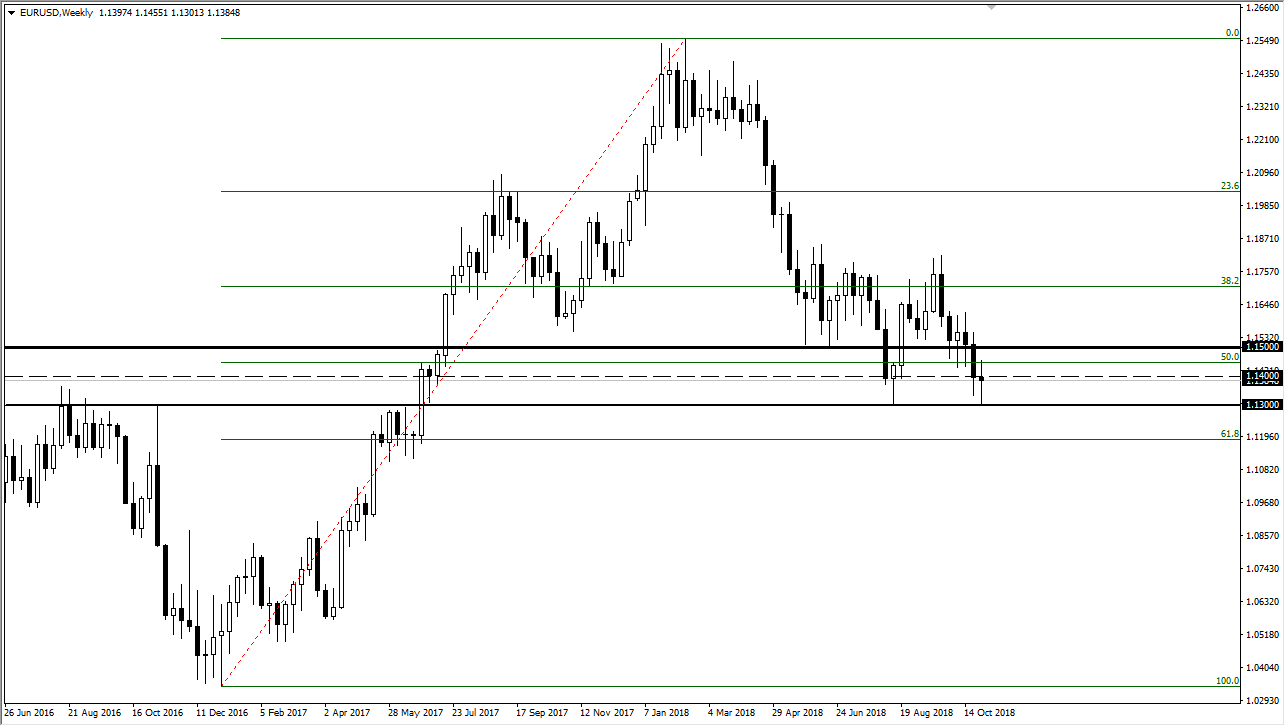

EUR/USD

The Euro went back and forth against the US dollar during the week, forming a relatively neutral candle and showing signs of support at the 1.13 handle. That of course is a sign of stability, something that the market needed. However, it’s not exactly convincing. I think what this candlestick is telling us is that we will probably continue to consolidate between the 1.13 level on the bottom and the 1.15 level on the top.

AUD/USD

The Australian dollar spent most of the week trying to go higher but found enough resistance at the 0.7250 level to roll over again, a sign that suggests that the downtrend is still very much intact and that the sellers continue to push things around. Ultimately, I believe that this market will continue to struggle as long as there are problems between the Americans and the Chinese, and there doesn’t seem to be in into that issue. On Friday, the Americans threw cold water on the idea that there was some type of trade deal being worked out behind the scenes.

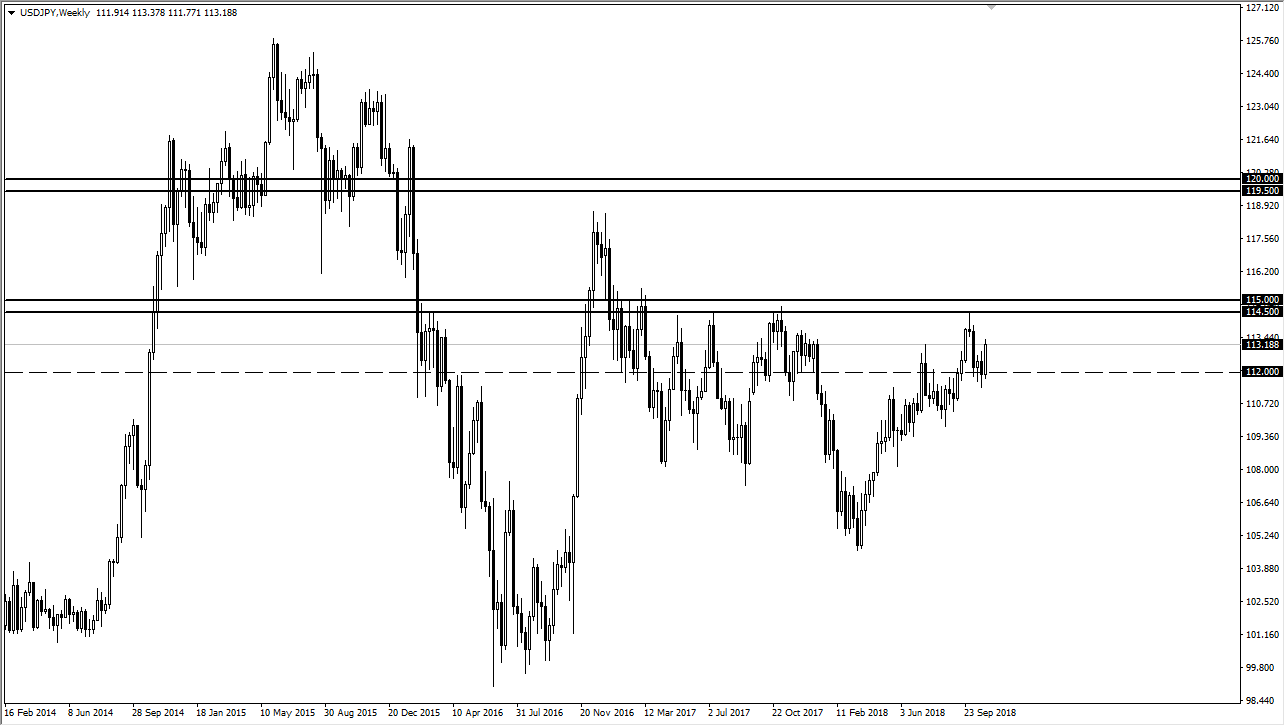

USD/JPY

The US dollar rallied significantly against the Japanese yen which of course makes sense considering that the jobs number on Friday came out so strong. Beyond that, we have been in and uptrend for some time but it’s been a significant grind, so keep in mind that there is a lot of work to do. I see a significant amount of resistance near the ¥114.50 level.