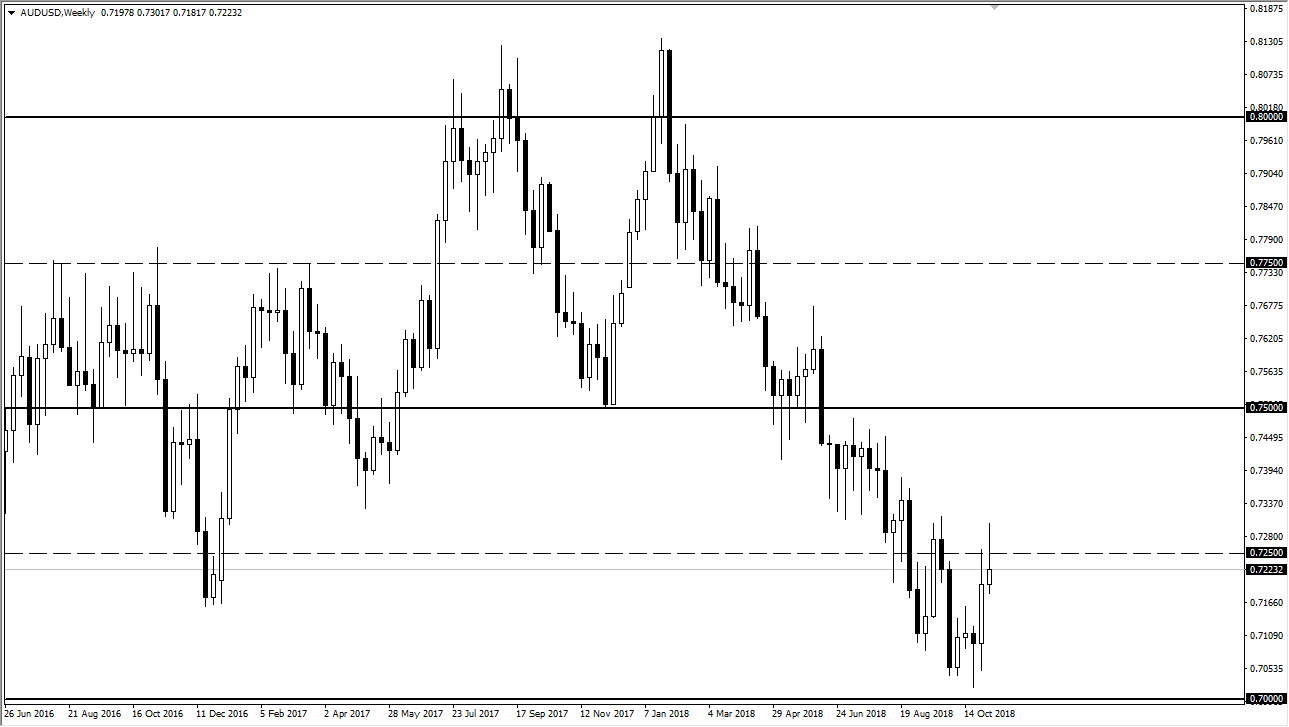

AUD/USD

The Australian dollar spent most the week rallying but ran into a lot of resistance above the 0.7250 level to turn around and form a bit of a shooting star. A break down below the bottom of the shooting star should send sellers back into this market, and I believe that there is a lot of negativity out there considering that the Sino-American relations have not gotten any better. I believe that short-term rallies are going to be selling opportunities this week.

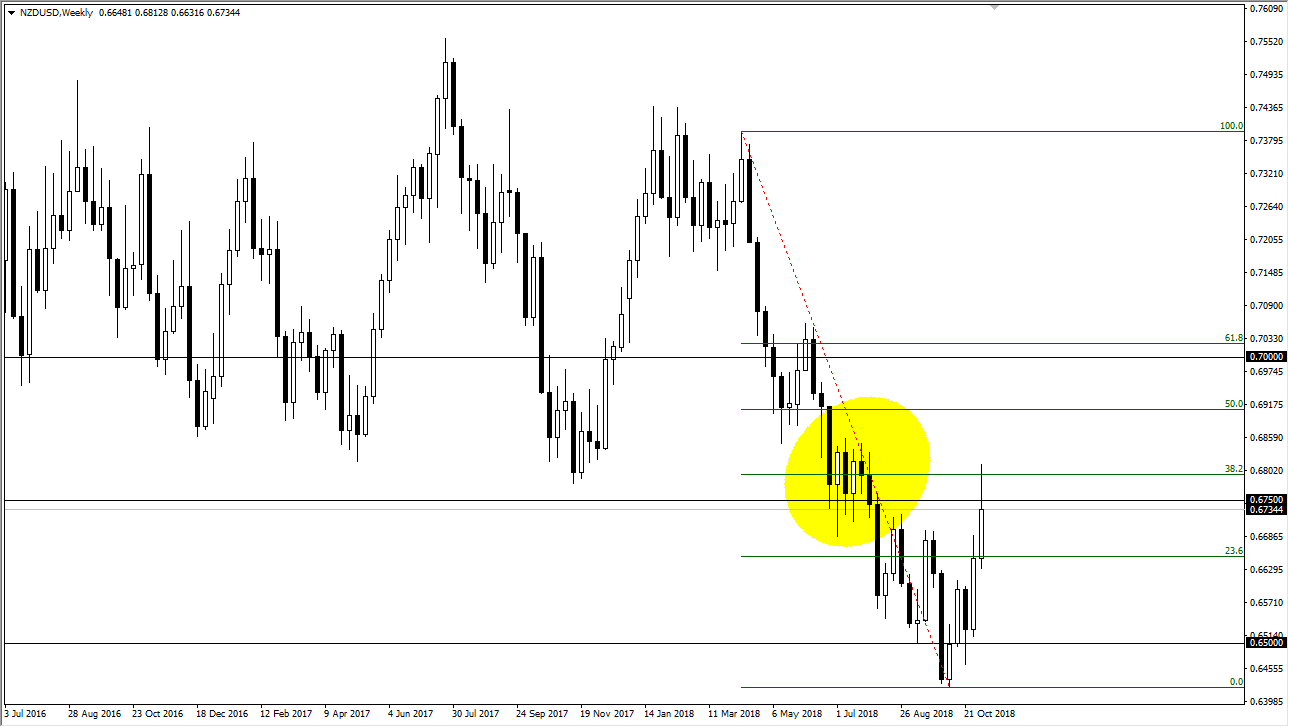

NZD/USD

The New Zealand dollar rallied during most of the week but ran into trouble at the 0.68 handle, giving back enough of the gains to fall below the 0.6750 level. This is an area that offers a lot of resistance structurally, so it would not be surprising at all to see the New Zealand dollar also fall this week. I’m not looking for some type of major meltdown, but a pullback to somewhere near the 0.6675 level makes a lot of sense. However, if we break above the highs of the week, that could send this market towards the 0.69 level.

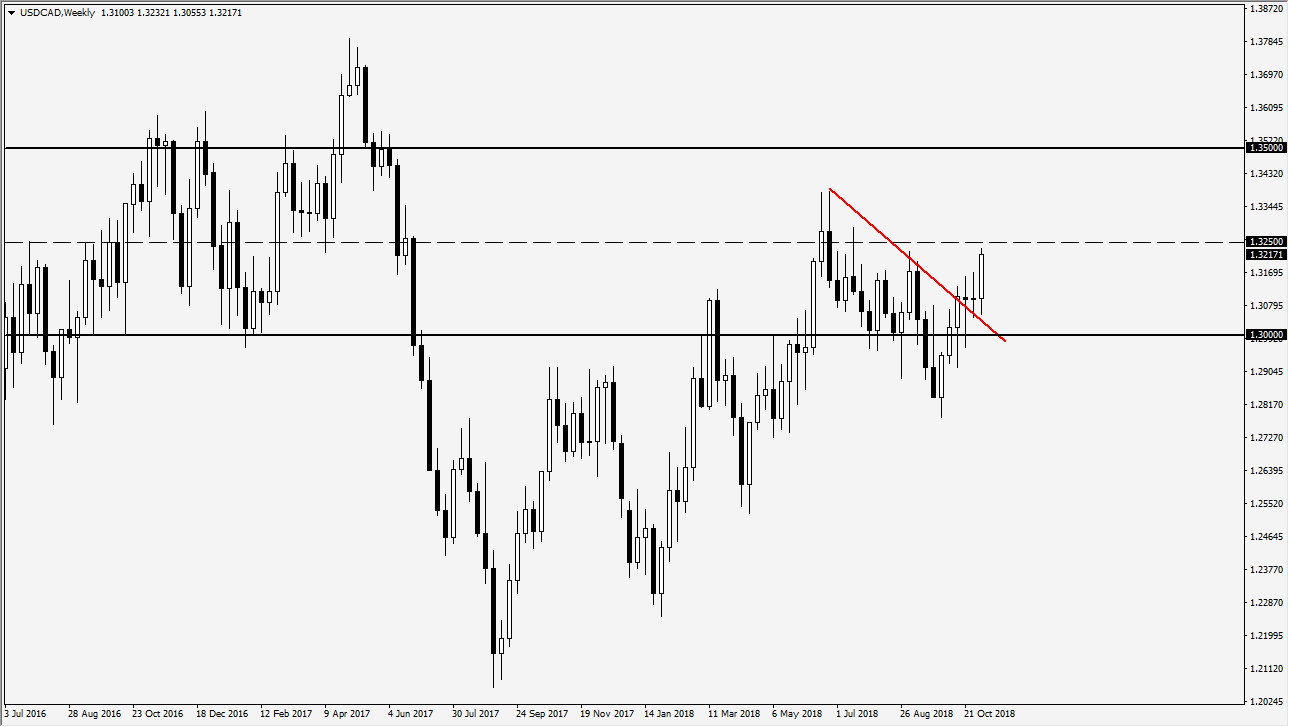

USD/CAD

The US dollar initially pulled back against the Canadian dollar for the week, but found support yet again at the 1.3080 level, an area that has proven itself a couple of times now. We have recently broken through a downtrend line, and we managed to rally towards the 1.3250 level, an area that I considered to be “fair value” in the potential consolidation area that we are in. If we can break above that level, then I think we will go looking towards 1.35 level, but that is probably a story for several weeks from now. Otherwise, look at pullbacks as potential buying opportunities.

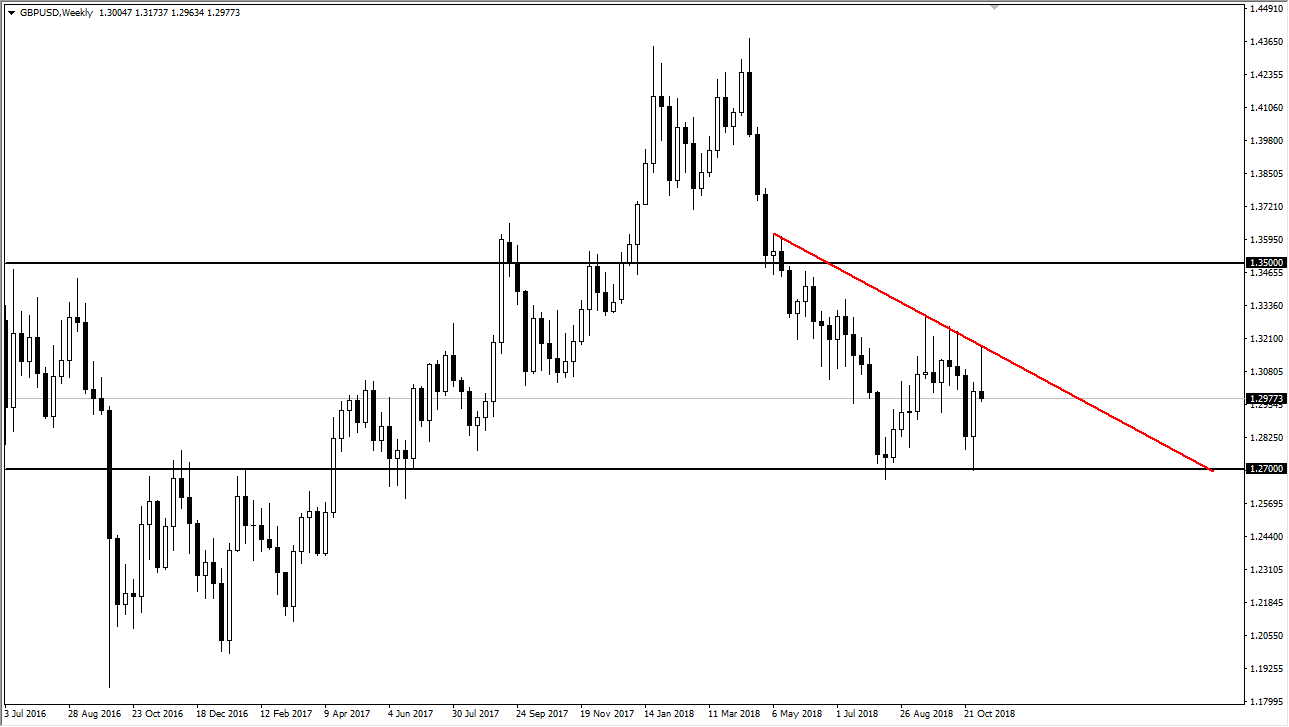

GBP/USD

With the Brexit headlines continuing to get in the way of the British pound, we ended up falling after the initial move higher. The down trending line should continue to offer resistance, and therefore I think that rallies are to be sold at this point as the market could roll over down to the 1.27 handle.