USD/CAD

The US dollar has rallied a bit against the Canadian dollar but struggled at the 1.3250 level. We rolled over to form a bit of a shooting star, and this suggests that we are going to struggle to go higher. However, if we clear the 1.3250 level, then the market should go higher. The 1.30 level underneath is supportive, just as the uptrend line of the up trending channel. I think at this point, we will find buyers on these dips.

EUR/USD

The Euro fell a bit during the week but found enough support near the 61.8% Fibonacci retracement level to turn around of form a bit of a hammer. However, this is preceded by a shooting star, and therefore I think we are looking at a situation where we are going to go back and forth and show signs of consolidation. The 1.15 level above is going to be massive resistance, just as the 1.11 level underneath is massive support. I think short-term traders will continue to sell signs of exhaustion.

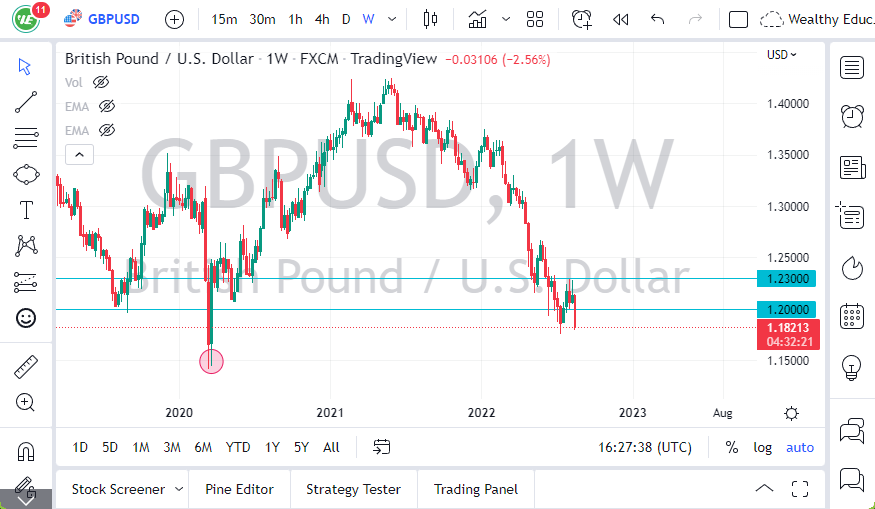

GBP/USD

The British pound fell significantly during the week but did recover a bit on Friday. The 1.27 level underneath is massive support, and I think that it is going to be difficult for traders to break down below there, but if we do the market will probably go down to the 1.22 handle, as we have seen a massive descending triangle form. In general, I think that break above the downtrend line of the triangle could send this market looking towards the 1.3250 level, but it’s going to take good news about the Brexit.

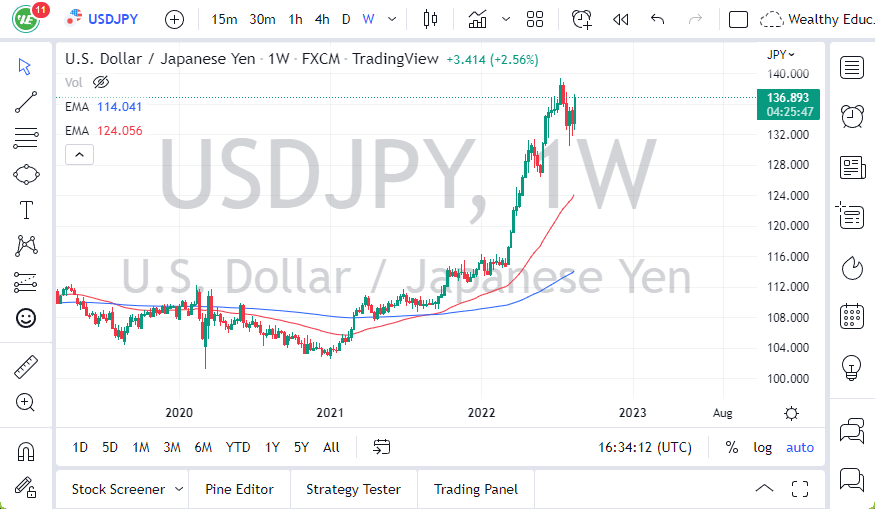

USD/JPY

The US dollar fell significantly during the week, but remains in and uptrend channel, and I think the ¥111.50 level offers a significant support. I think that if we break down to lower levels than that, we could unwind rather drastically. Otherwise, I would look for buyers to show up around the ¥112 level.