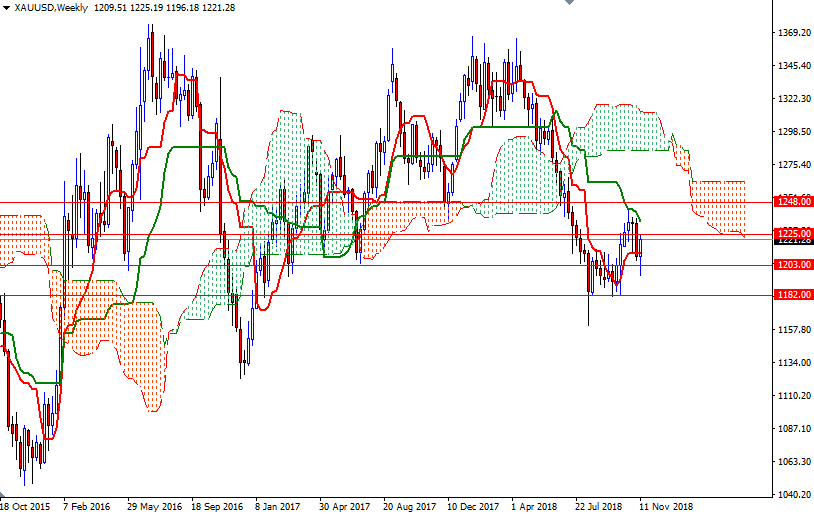

Gold prices ended the week up $11.77 at $1221.28 an ounce on safe-haven demand as U.S. stock indexes backed down from the previous week’s highs. The precious metals markets also got a solid boost from lower U.S. Treasury yields and a big drop in the U.S. dollar index. Fed officials are widely expected to lift interest rates when they meet next month, but Federal Reserve Chairman Jerome Powell’s comments last week raised questions about how many times the Fed will hike rates next year.

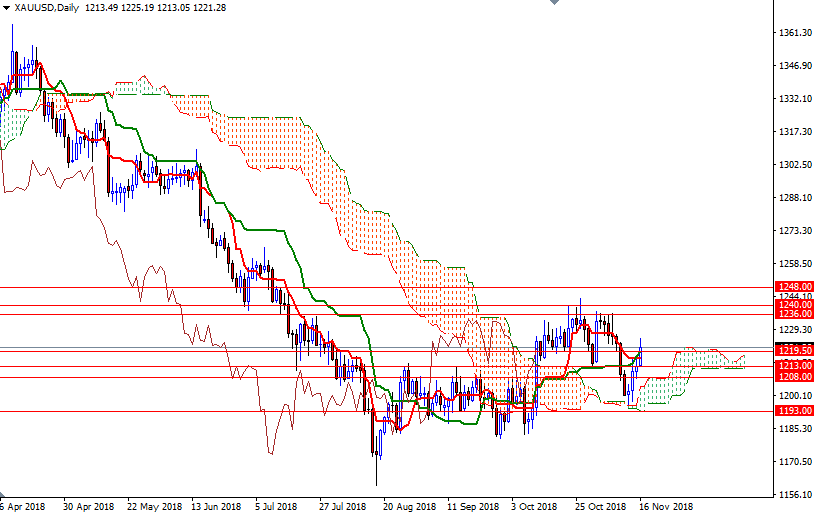

XAU/USD initially pulled back to the daily Ichimoku cloud as expected, but found strong support there to reverse its course. The market reached the 1227/5 area after the resistance at 1216.50 was broken. Prices are above Ichimoku clouds on the daily and the 4-hourly charts, to suggest that the bulls have the near-term technical advantage. If XAU/USD can stay above the daily cloud, we may go to 1240/36, the confluence of the 200-week moving average and the 38.2% retracement of the bearish run from 1365.10 to 1160.05. But, of course, in order to reach there the bulls have to convincingly lift prices above the 1227/5 zone (the 100-day moving average). A push above the 1240/35 zone implies that the bulls are ready for their next upside advance. In that case, look for further upside with 1245.50 and 1252/48 as targets.

To the downside, the initial support stands at 1216.50, the top of the 4-hourly cloud. If this support is broken, XAU/USD may revisit 1213. The bears will need to drag prices below 1213 to gain momentum for 1208 and 1200-1198. A daily close below 1198 indicates that the market is about to retest the support at around the 1193 level. Further weakness below 1193 could lead to a drop to 1187.