Gold prices ended Friday’s session down $0.93 an ounce, as the dollar drifted higher following a jobs report that was stronger than market expectations. Figures from the Labor Department showed that the economy added 250000 jobs in October, and average hourly earnings rose 0.2%. September’s employment gain was revised down to 118000 from the previously reported 134000. However, that decline was offset by an upward revision to August’s numbers. Markets will be closely watching the upcoming U.S. congressional elections, which will determine whether the Republicans or Democrats control the U.S. Congress.

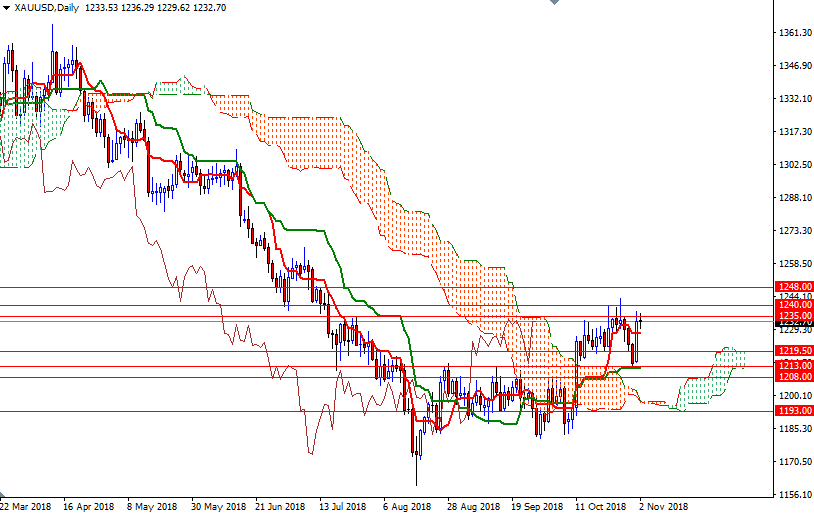

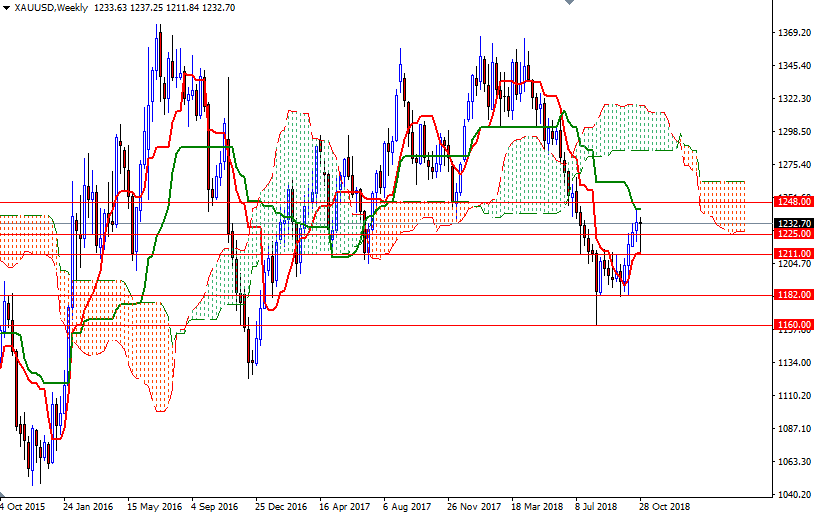

On the daily chart, the market is trading above the Ichimoku cloud, and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. After testing the support in the in the 1213/1 area, XAU/USD revisited a key technical resistance in the 1240/35 - forming a long lower shadow on the weekly candle which suggests that buying interest continues to emerge on dips. However, beware that prices are still below the weekly cloud, and the Chikou-span (closing price plotted 26 periods behind, brown line) hasn’t penetrated the daily cloud yet.

The bulls have to convincingly push the market above the 1240 level to regain the overall near-term technical advantage. In that case, look for further upside with 1245.50 and 1252/48 as targets. A daily close above 1252 indicates that the 1261/0 area will be the next port of call. Beyond there, the 1266/5 zone stands out as a strategic technical resistance. The clouds on the H1 and the M30 time frames overlap in the 1229/8 area, so the bears will need to drag prices below there to tackle the next support in 1225/4. If XAU/USD pierces below the hourly cloud, then the next stop will be the 1220.50-1219.50 zone. Closing below 1219.50 on a daily basis could inspire the technically biased sellers and open the door to 1213/1. A successful drop below 1211 could foreshadow a move to 1208/5.