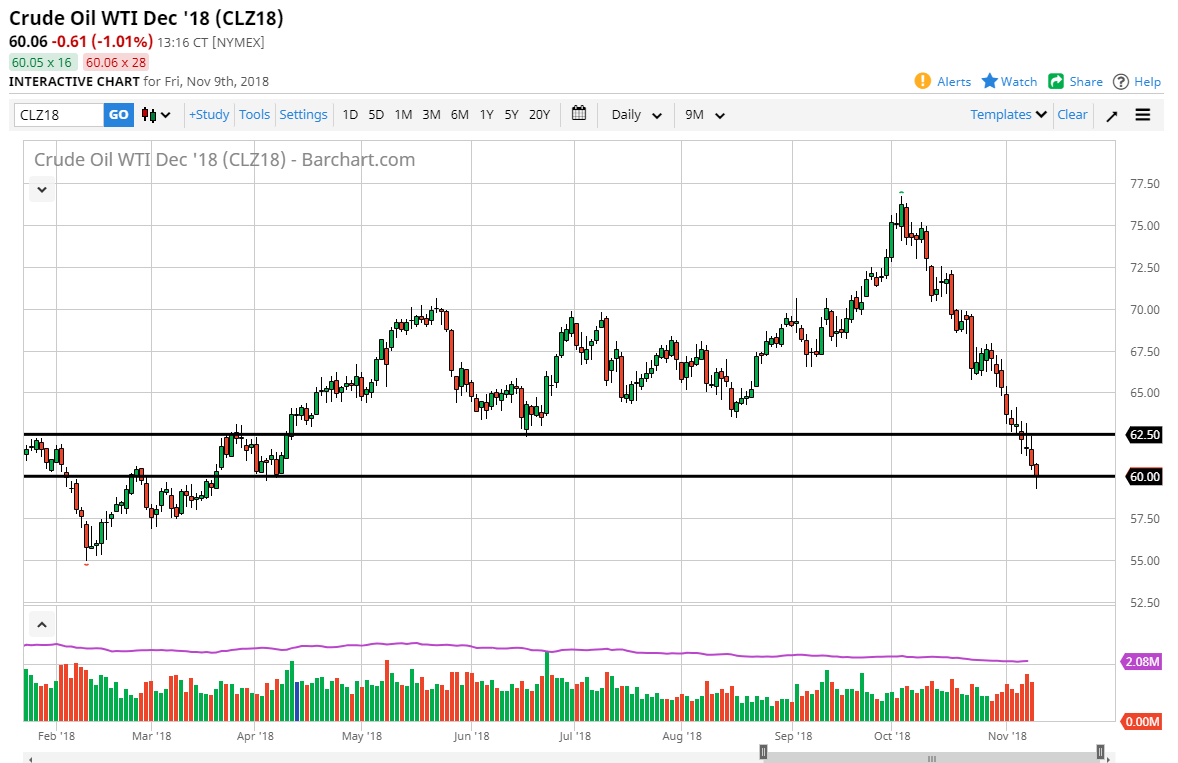

WTI Crude Oil

The WTI Crude Oil market fell again on Friday, breaking below the $60 level at one point. However, towards the end of the day buyers came in and picked it back up, or perhaps it was short covering going into the weekend? I suspect it’s the latter of the two, but it does coincide with the $60 handle, which of course will have a certain amount of psychological importance. The 78.6% Fibonacci retracement level is right there as well, so there could be a bit of an effect from that also. All things being equal though, if we break down below the bottom of the candle stick from the Friday session it should wipe out the entirety of the move, perhaps sending this market down to $55. As far as buying is concerned, I have no interest in doing so until we break above the $62.50 level, which would show a nice turnaround. If we break above that level, then I think the market would go to the $66 level.

Natural Gas

Natural gas markets spiked again during the day on Friday, showing signs of life even though we are so overbought at this point. The $3.80 level should offer slight resistance, and I think that the $4.00 level will offer even more psychological resistance. At this point, I think what we need to see is a pullback to fill the massive gap as the futures markets tend to fill the gap. The $3.25 level underneath is the floor. I think at this point it’s likely that the buyers would come in to pick up plenty of value, as we are in a seasonably strong time of year anyway. I would not be buyers appear though, simply because it is a great way to lose money when you chase the trade.