WTI Crude Oil

The WTI Crude Oil market initially rallied during the trading session on Friday, but you can see that we have rolled over and formed a shooting star. This is a market that looks likely to continue to struggle, but if we break above the top of the candle stick from Friday, then I think we should continue to grind towards the $60 level. That’s a gap that should be filled, given enough time. However, if we break above the $60 level, it’s likely that we will continue to see a bearish pressure, at least in the short term. However, if we can stay above the $55 level, then it’s likely that we will try to find value hunters and perhaps a bit of a bounce. If we break down below the $55 level, then I think the market breaks down to the $50 handle after that which of course would attract even more attention.

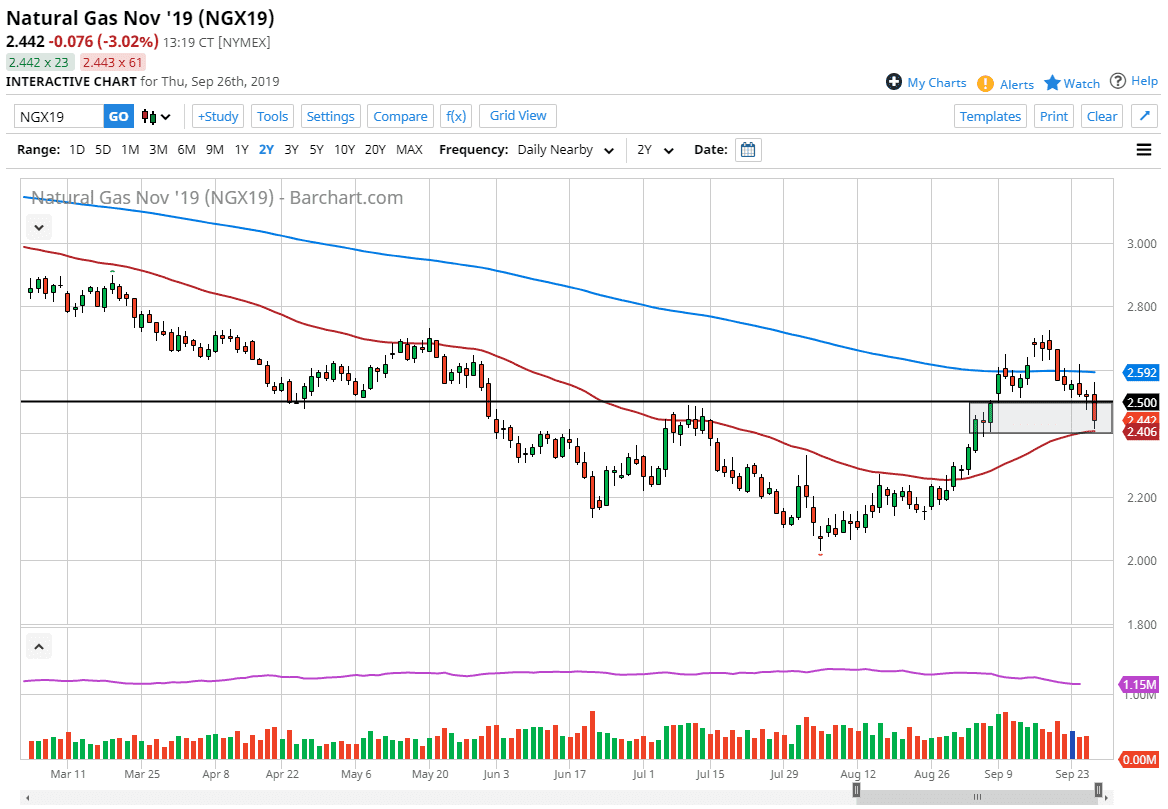

Natural Gas

Natural gas markets gapped lower to kick off the Friday session and then shot through the $4.00 level again. We closed at the $4.33 level, and it looks likely that we are going to continue to see a lot of volatility. At this point though, I think that it’s only a matter of time before the sellers come back into this market, as we have seen a blow off top. I understand that the market has been very bullish and of course we have seen a lot of bullish seasonality to this market, and I like the idea of feeding this rally as it got too far ahead of itself. There are more than enough reasons to think that the market has peaked for the year, and I think at this point we are simply looking for signs of exhaustion to short as there are plenty of gaps to be filled underneath.