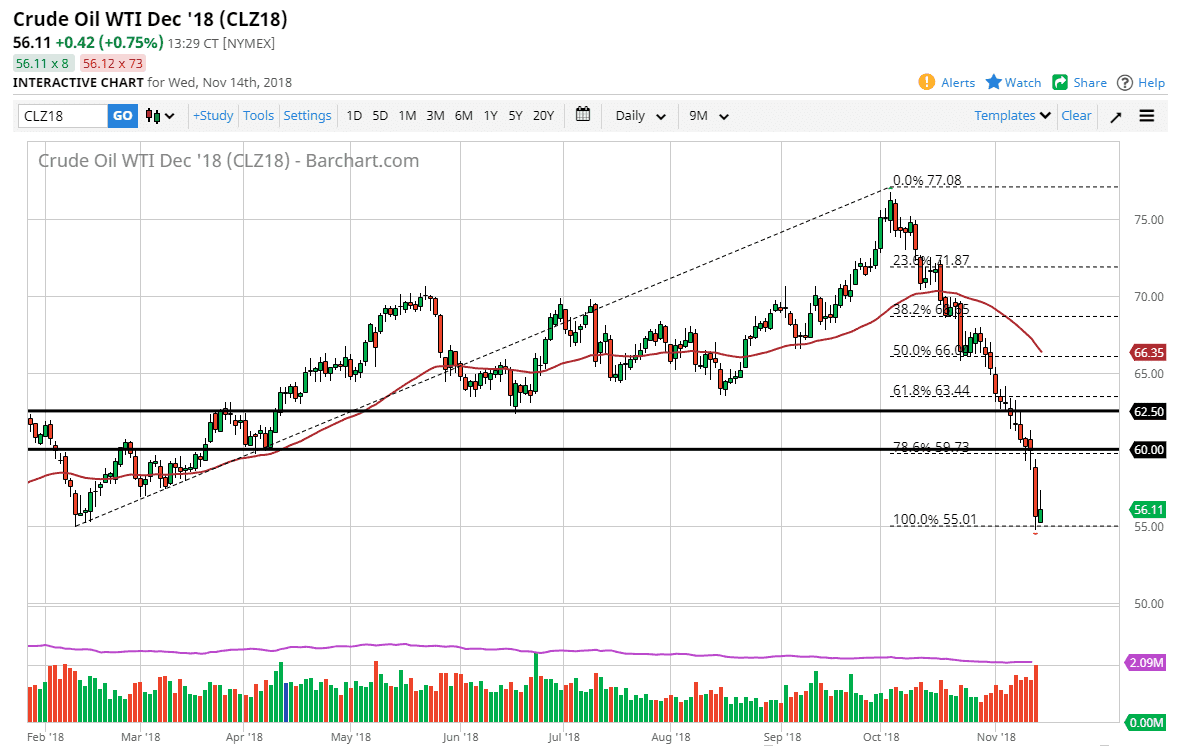

WTI Crude Oil

The WTI Crude Oil market has rallied a bit during the trading session on Wednesday but gave back much of the gains. However, we are above the $55 level in this the first sign of perhaps seeing a bit of stability. I think at this point; the market will perhaps trying to find buyers at the $55 level. If that level can hold support, then we could start to see buyers come in based upon value. I think at this point in time, it’s difficult to sell this market regardless, because it has been so brutally negative. I think if you are trying to pick up a bit of value here, you can probably wait a few days as it’s going to take quite a bit of confidence building to turn things around. The first sign of course would be breaking above the highs from the session on Wednesday. If we break down below $55, then I think we probably go to $50.

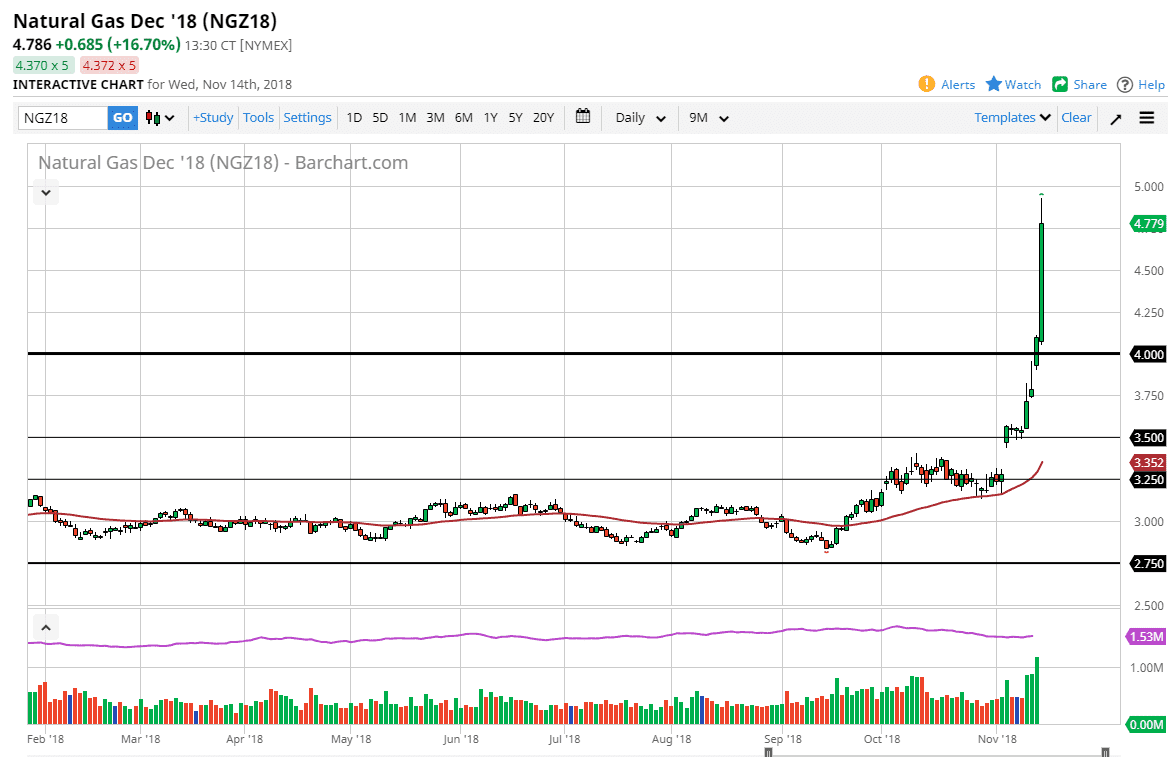

Natural Gas

If you ever wanted to see an example of gravity being defied, look no further. We reached towards the five dollars level during the trading session, gave back about $0.40, and have regained about 20 of those same cents. Natural gas storage is that a 15 year low, but it’s very likely that we will eventually see a flood of natural gas being sold into the market as these levels are extraordinarily profitable for natural gas drillers, something that is welcome in a market that longer-term has a lot of problems associated with oversupply.

Beyond that, the market tends to move in the opposite direction of crude oil which of course has fallen off of a cliff. It seasonally bullish this time of year anyway, so it makes sense that we will continue to see buyers jump in on these dips.