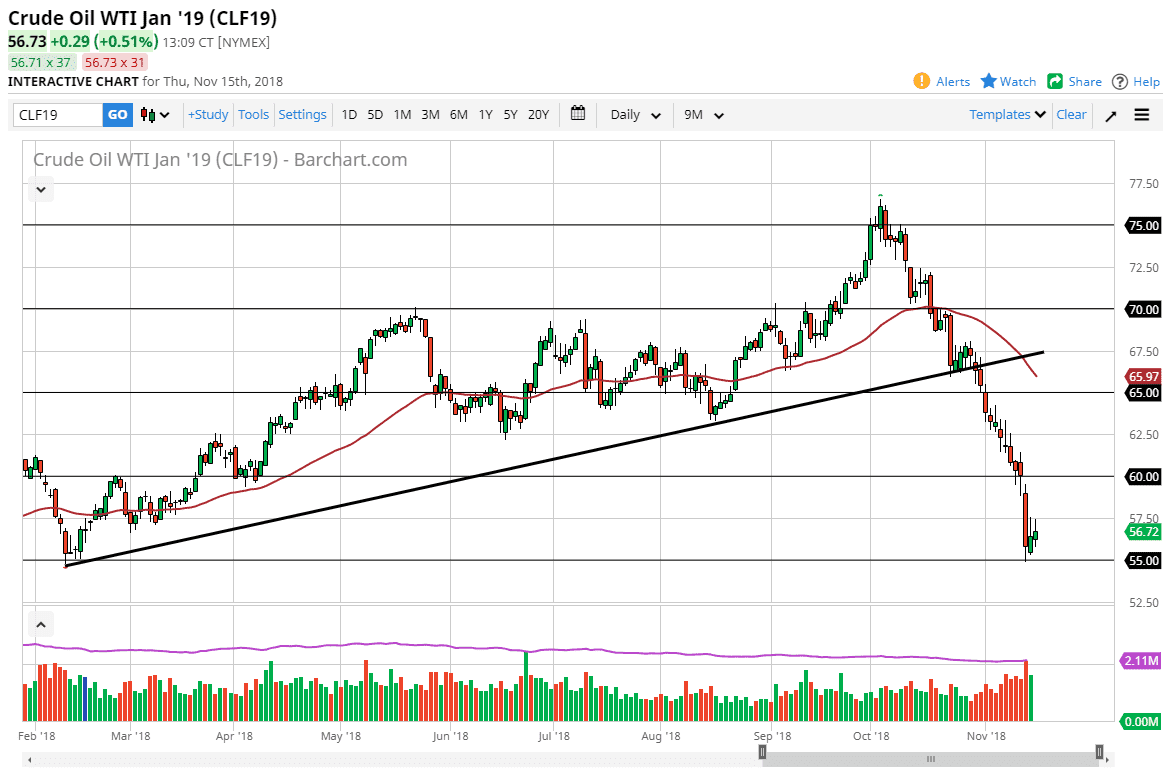

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session on Thursday but did see some gains just as we did on Wednesday. The Wednesday candle is now essentially an inverted hammer if we can break above the top of it, and the market has shown that the $57.50 level is crucial, as breaking above that level would negate the resistance from two days’ worth of trading. If we can break above the $57.50 level, then I think we go looking towards the gap just under the $60 level. At this point, I think if we can break down below the $55 level, then it becomes an extraordinarily negative sign. That would probably send the market down to the $50 handle, but it does look like we are trying to form some type of supportive action, and perhaps stability, which is the most important thing that the market needs.

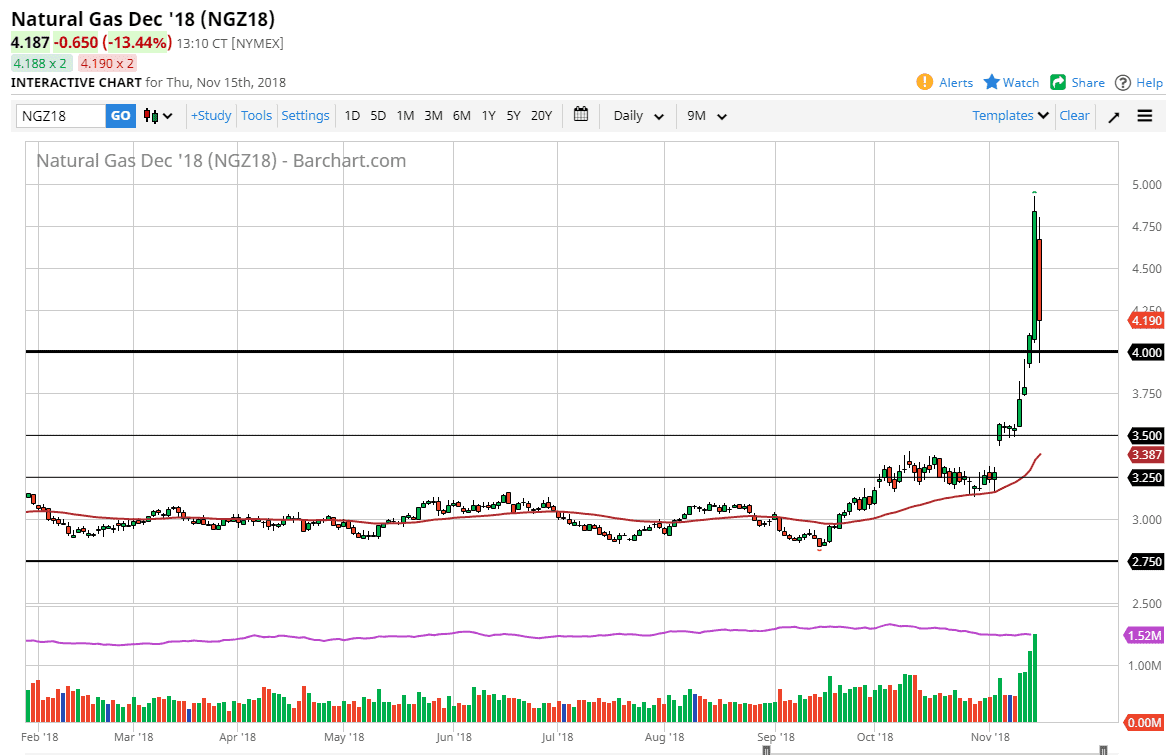

Natural Gas

Natural gas markets have been an absolute mess during trading on Thursday, reaching all the way down to the $4.00 level and below, only to turn around and rally again. These markets extraordinarily erratic, but I think at this point we are seeing the great move higher unwind a bit, so it’s very likely that we will see a continued selling on rallies. The $5.00 level above has caused a lot of resistance, and I think that should continue to be the case as it is a large, round, psychologically significant figure. Beyond that, the market has gone parabolic previously so it makes sense that it would be difficult to hang on to this type of momentum. We are in a seasonably strong time of year, but the gains have been ridiculous. This market desperately needs to pullback regardless of what’s going to happen in the future.