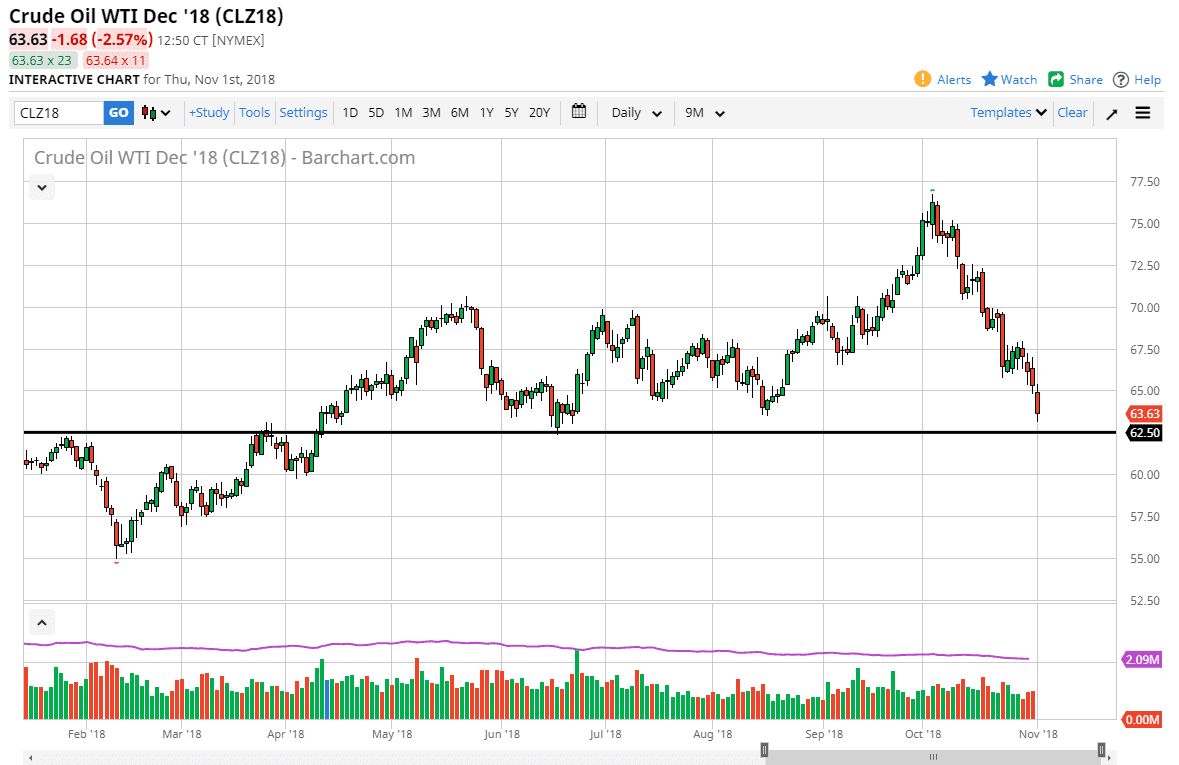

WTI Crude Oil

The WTI Crude Oil markets gapped lower to kick off the session on Thursday, turned around to fill that gap, and then broke down again. Ultimately, this is a market that I think is going to continue to struggle but we are starting to run into significant support near the $62.50 level. Because of this, I think that we could very well see a bounce relatively soon. With the jobs number coming out today that could be the catalyst. However, if we break down below the $62.50 level, we could slide down to the $62 level. If we do rally from here, the $67.50 level above will be rather resistive. A break above that level of course would be extraordinarily bullish. At this point, waiting to sell short-term rallies until we get that breakout.

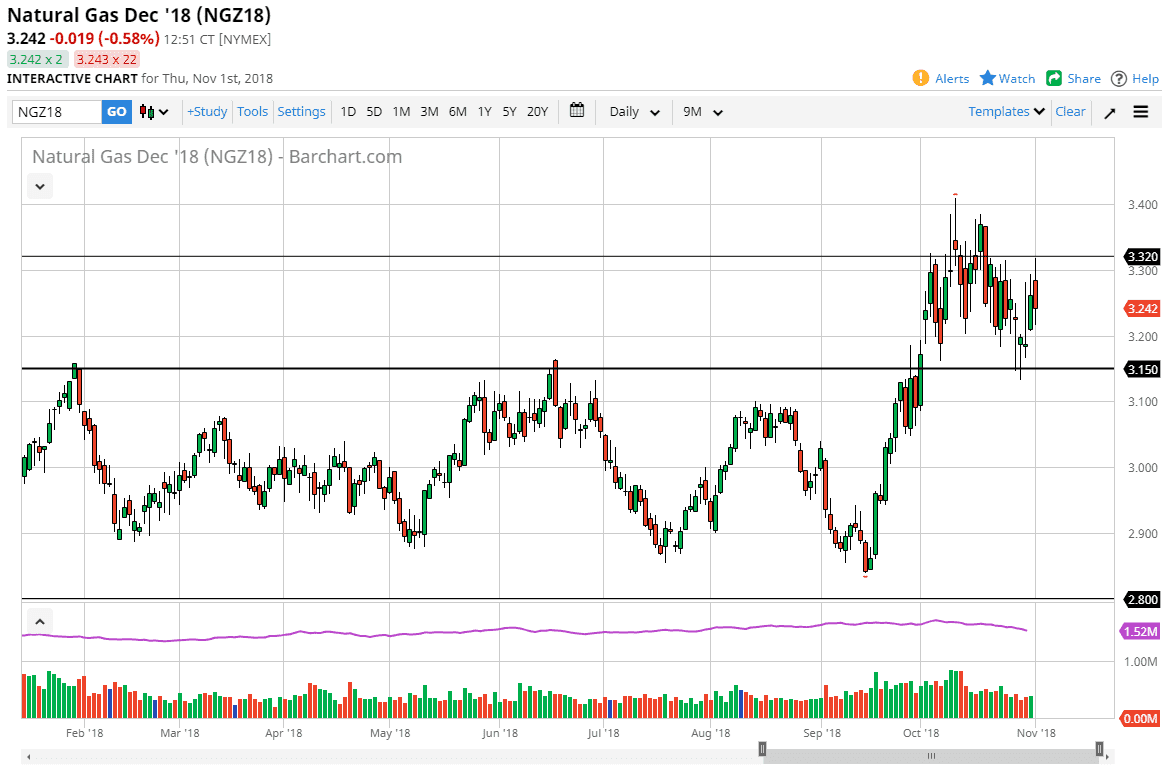

Natural Gas

Natural gas markets went back and forth during the trading session on Thursday, as we continue to see a lot of volatility in this market. The $3.32 level above is resistance, as we have seen selling in that area recently. The $3.20 level underneath is supportive as well, and I think that extends down to the $3.15 level. A breakdown below that level would be pretty negative for this market, but I think overall we are looking at is a continuation of the choppiness that we have seen for a while now. Because of this, I look for short-term opportunities in both directions, but I do recognize that there is certainly a lot of bearish pressure above, so I’m starting to tilt my expectations down a bit as the market may have gotten a bit overextended.