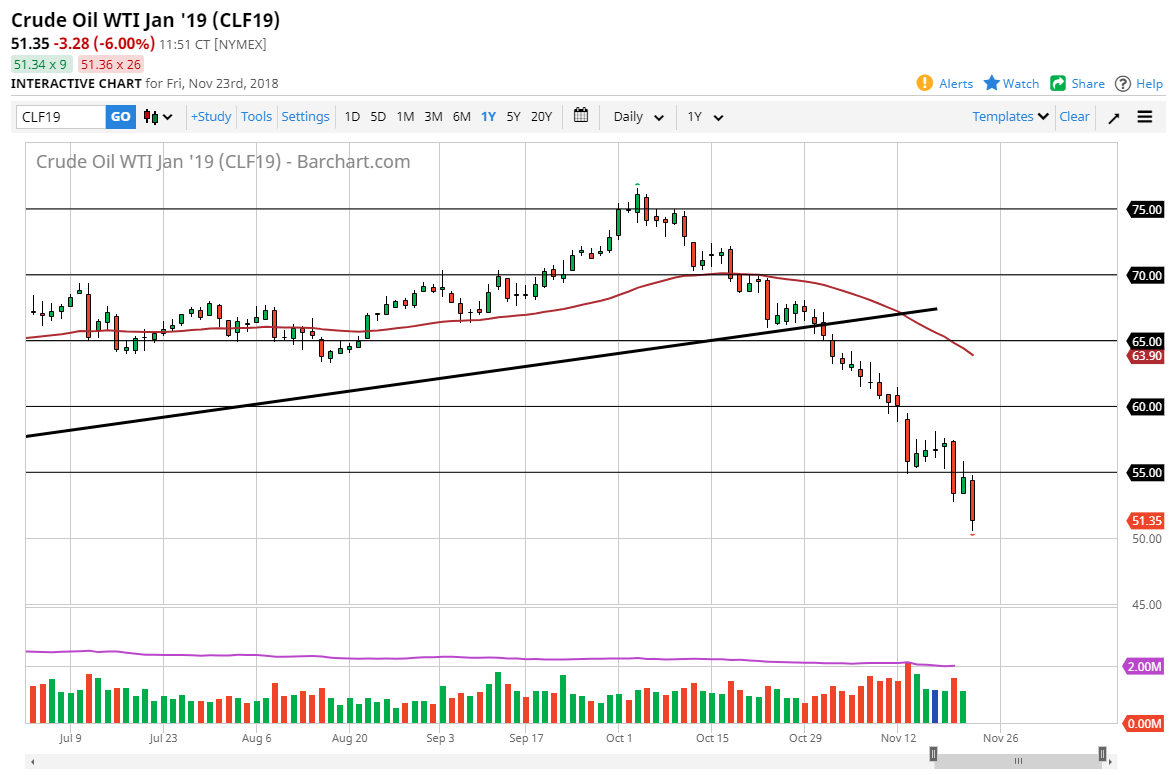

WTI Crude Oil

The WTI Crude Oil market broke down significantly again during the trading session on Friday, reaching towards the $50 level. This is a market that looks terrific, and it seems as if the bloodshed will never end. However, the $50 level underneath offers a significant amount of psychological support as well as structural. I think at this point we will get a supportive candle that we can take advantage of, but we clearly don’t have it yet. In the short term, I believe it’s easier to simply sell this market on failed rallies, and I think that the $55 level above is resistance. The Iranian oil sanctions that drove the price of oil up so high recently have so many holes poked in them that supplies still is far exceeding demand at this point. A strengthening US dollar of course doesn’t help the situation either.

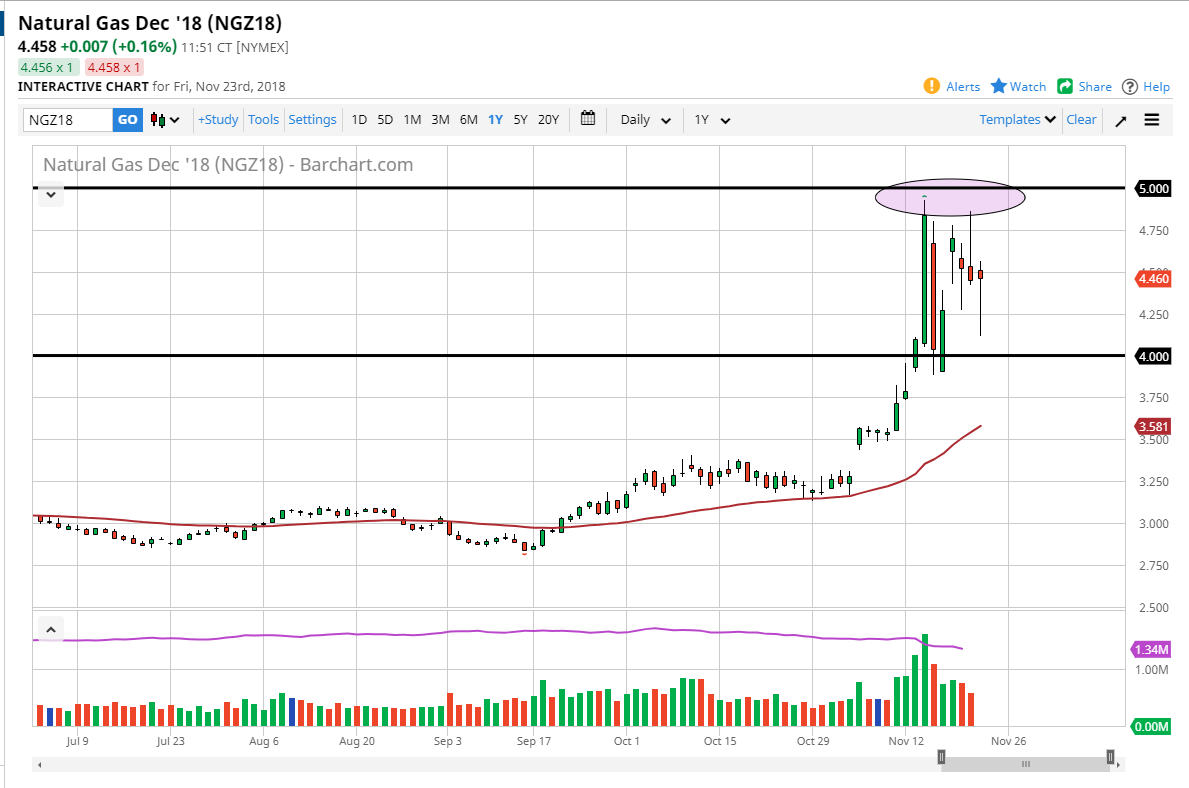

Natural Gas

Natural gas markets initially fell during the trading session on Friday, wiping out a lot of value before turning around to form a hammer. The hammer of course is a bullish sign, but it is preceded by a shooting star. I think this clearly defines the doll market has gotten itself far ahead of reality, and now I think we are going to consolidate between $4.00 on the bottom and $5.00 on the top. Overall, I do favor shorting this market on rallies though, because it is overbought, and we will eventually get warmer temperatures coming to the United States and start trading spring time contract. That will drive demand through the floor, not to mention the fact that there is a massive amount of supply out there just waiting to be extracted from the ground. I believe that the $5.00 level could very well be the highs of the year.