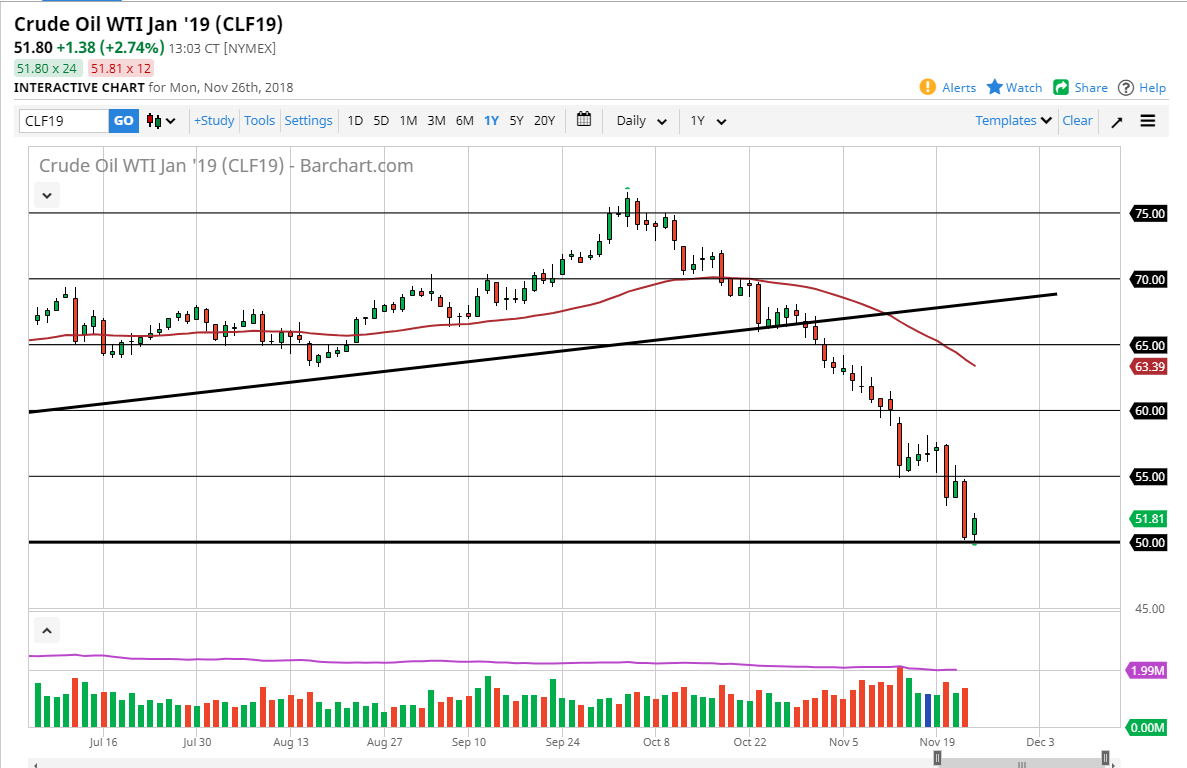

WTI Crude Oil

The WTI Crude Oil market initially fell a bit during the trading session on Monday but found enough support at the $50 level to turn around and show signs of life again. The market is oversold, so this bounce was probably expected as it is at such a large round figure. I think that at this point we should probably continue to bounce a bit and we will probably see sellers step back in sooner, rather than later. I would anticipate that the $55 level should offer resistance, so I think at this point simply waiting for an exhaustive candle will be the way going forward. If we can break above the $57.50 level, then I might get a bit more bullish. In the meantime, I think it continues to be a “sell the rallies” type of situation.

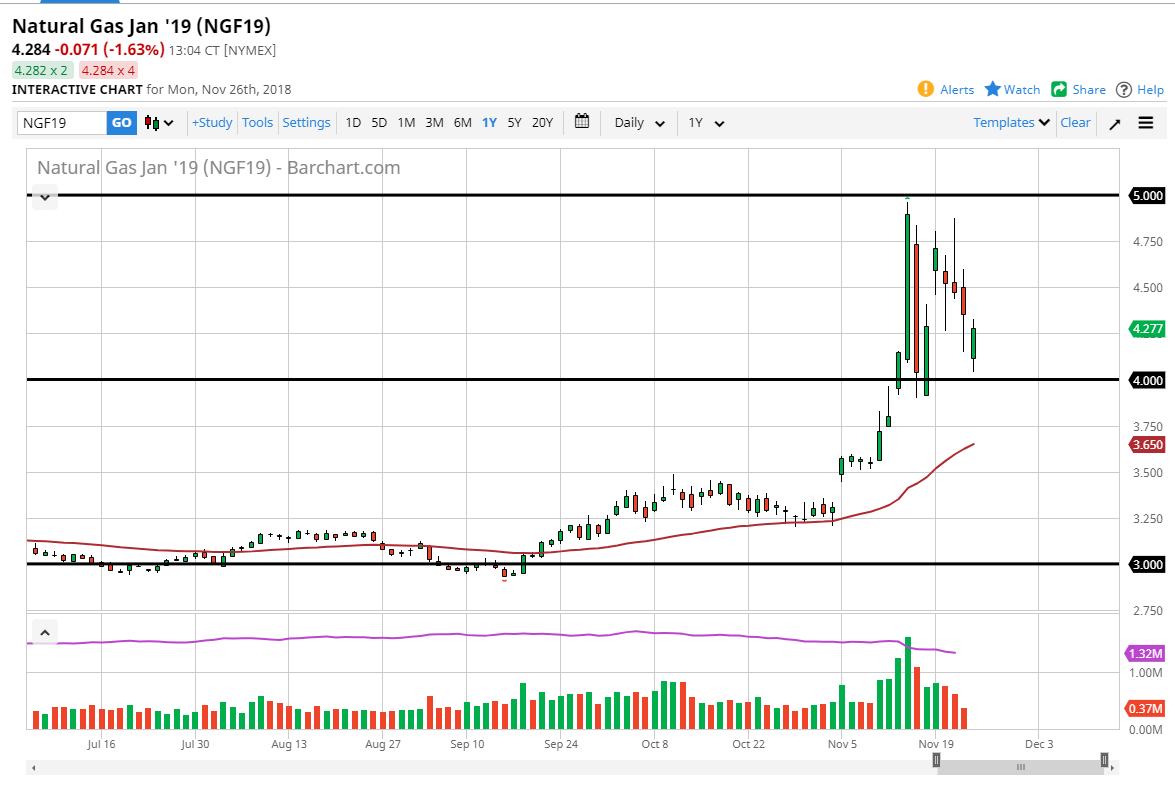

Natural Gas

Natural gas markets gapped lower to kick off the trading session on Monday, reaching close to the $4.00 level before bouncing to try to fill the gap. The market looks likely to continue to see volatility in this market as we have a lot of competing forces at work right now. It’s obviously the coldest time a year in the United States, and that drives up demand for natural gas. Beyond that, we have seen inventory break down rather significantly, but at the end of the day there are plenty of sellers out there waiting to get involved. At these high levels, lot of sellers are willing to come in and take advantage of these temporarily high prices. If we break down below the $4.00 level, then we could go down to the $3.75 level. Rallies at this point I think continue to attract sellers on the first signs of exhaustion. If we did somehow break above the $5.00 level, then we could continue to go higher. Ultimately I think we have hit the highs for the year.