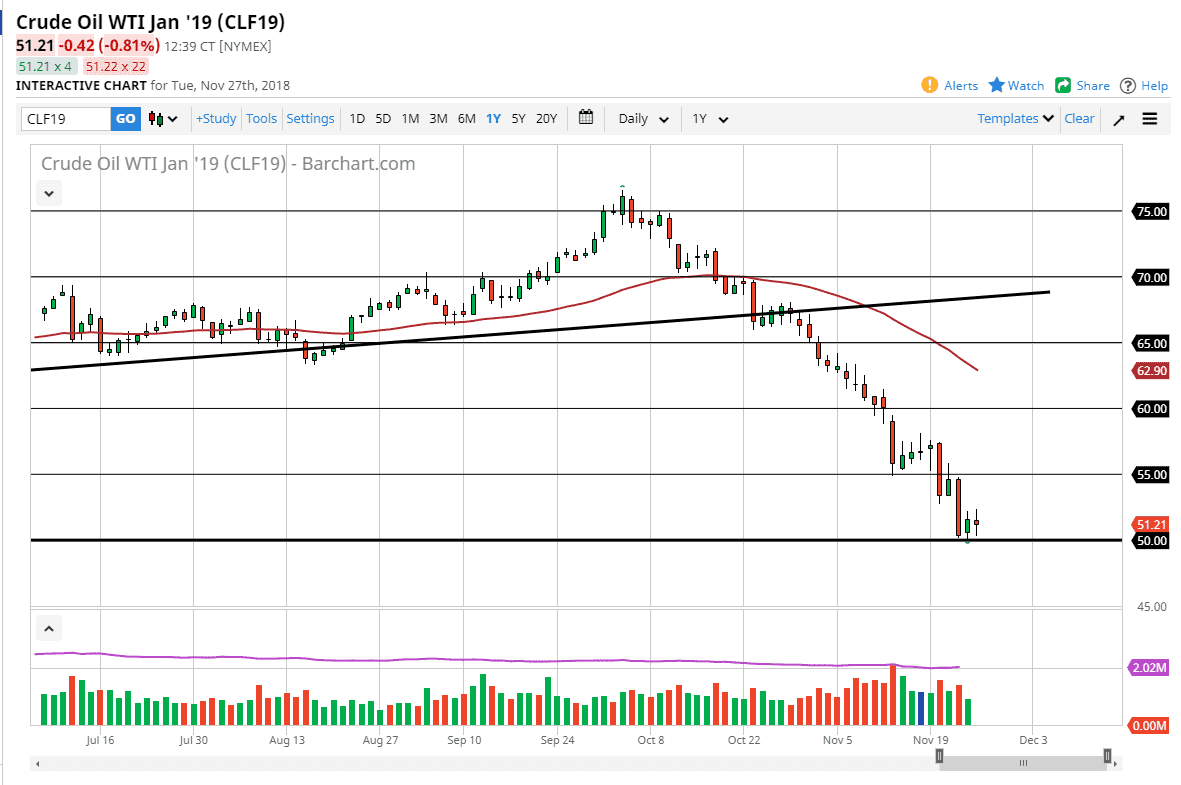

WTI Crude Oil

The WTI Crude Oil market was a rather quiet during the trading session on Tuesday, which you would have to think is a bit of a victory, as it has been so negative for so long. The $50 level of course is a psychologically important level that would attract a lot of attention to the market. By forming a quiet candle after a positive one on Monday, this is possible signs that we are getting ready to bounce. If we can break down below the $50 level, it’s very likely that the crude oil market will continue to go much lower. However, if we can clear the top of the candle stick from the Tuesday session, I anticipate that the market will probably try to bounce towards the $55 level, and considering we are so oversold it wouldn’t be a huge surprise.

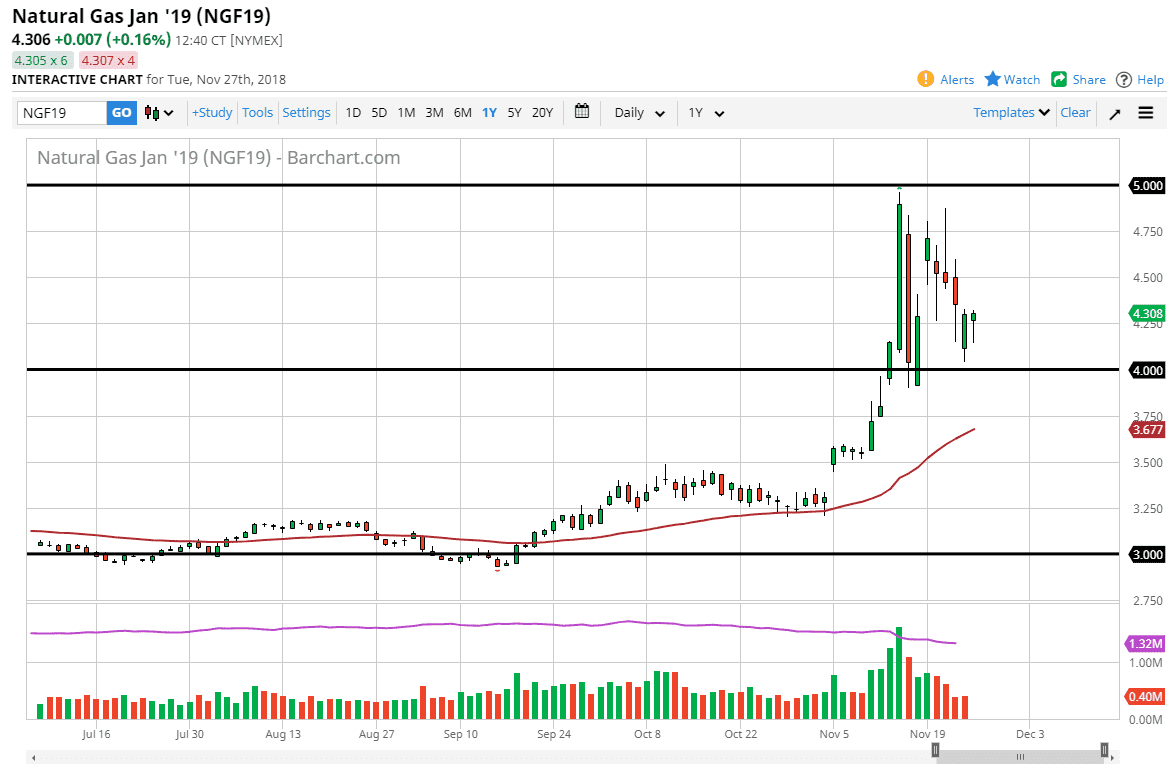

Natural Gas

Natural gas markets initially fell during Tuesday but turned around to show signs of life. The market continues to be very noisy, as we have been over bought and of course it is the seasonally bullish time of year as temperatures in the United States are cold. However, at these high levels suppliers will certainly jump into the market and start dumping as much natural gas as they can, and I think it’s only a matter of time before break back down. In the meantime, I believe we consolidate between the $4.00 level on the bottom, and the $5.00 level at the top.

Ultimately, I think that eventually we will get that breakdown so I feel much more comfortable fading rallies as they occur and show signs of exhaustion. If we do break down below the $4.00 level, then I think we probably go looking towards the $3.75 level and perhaps the 50 day EMA after that.