WTI Crude Oil

The WTI Crude Oil market broke to the downside again on Wednesday, reaching towards the $50 level. This is an area that of course is psychologically significant, so it makes sense that we could see a bit of support here. However, if we break down below the $50 level, then the market will probably go down to the $48 level. However, I would expect to see a lot of support at the $50 level, as it is such an important figure. It’s been an important level more than once in the past, so I would expect a significant fight here. This is why I think that if we break down below the $50 level on a daily close, this market could pick up more momentum. If we do rally from here, I think that the $55 level will be massive resistance.

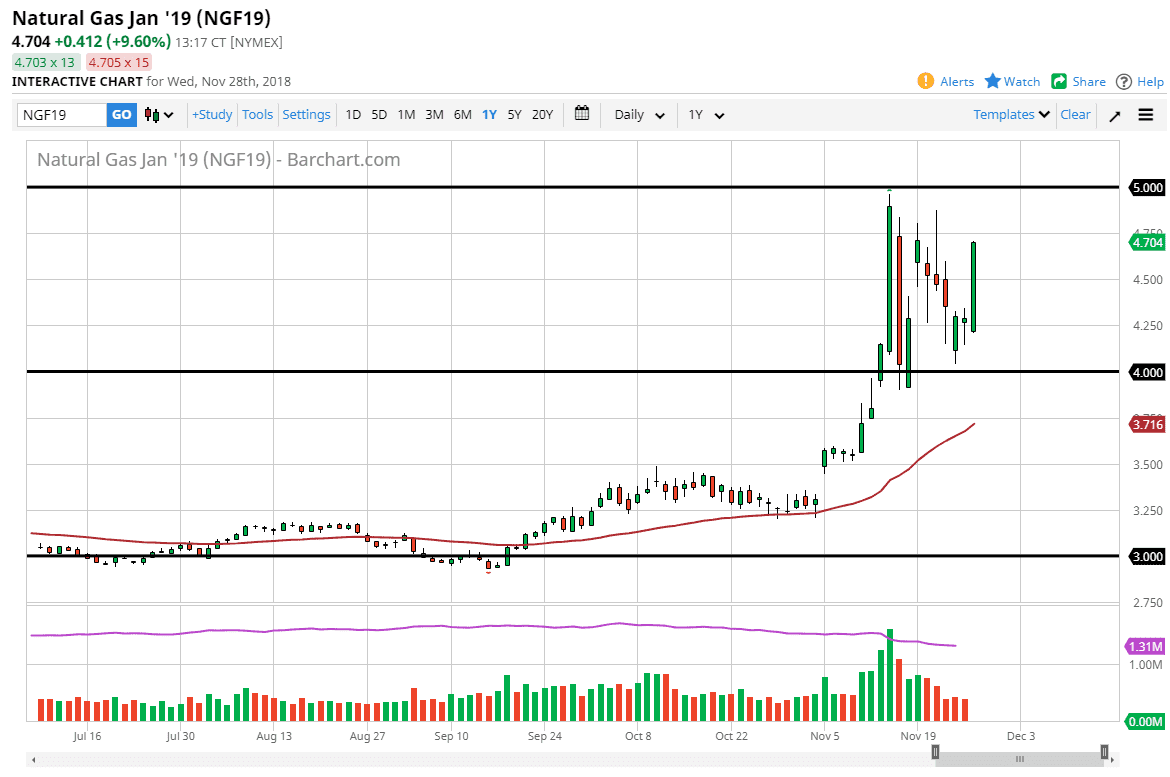

Natural Gas

Natural gas markets rallied significantly during the trading session on Wednesday, reaching the $4.75 level. That’s an area that of course is rather important as it is the beginning of major resistance extending to the $5.00 level. I think that’s the high for the year, but it is rather cold in the United States of demand is still certainly therefore natural gas. That being said, I think that it’s only a matter time before suppliers flood the market with more of the commodity, as these high prices are very attractive.

The $4.00 level underneath is massive support though, and I think it would be very difficult to break down through there even though I like the idea of selling rallies. I would look to short term charts the place these trades, as it can help you find tune your entry. If we did break above the $5.00 level, then we can really take off as it would be such a major hurdle overcome.