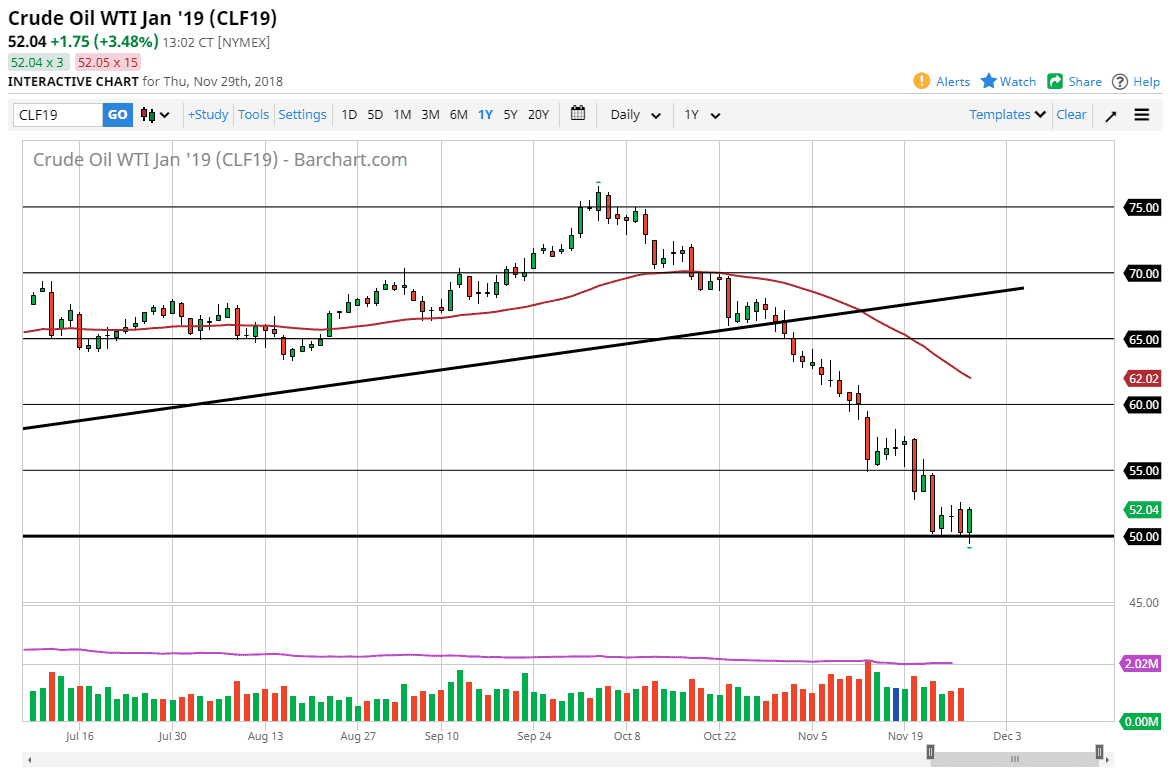

WTI Crude Oil

The WTI Crude Oil market initially pulled back during the trading session on Thursday but found enough support just below the $50 level to turn things around. This was partially directed by the reports that Russia may be looking into cutting production, and perhaps trying to talk to other oil producing companies to do the same. Ultimately, I think that the market will try to bounce from here, perhaps reaching towards the $55 level above. That’s an area that should be resistance based not only upon a large, round, psychologically significant figure, but the fact that it was a major negative candle that formed last Friday at that level is also a sign that there will be a lot of selling pressure there. Regardless though, we are oversold and a bounce makes perfect sense for the short term.

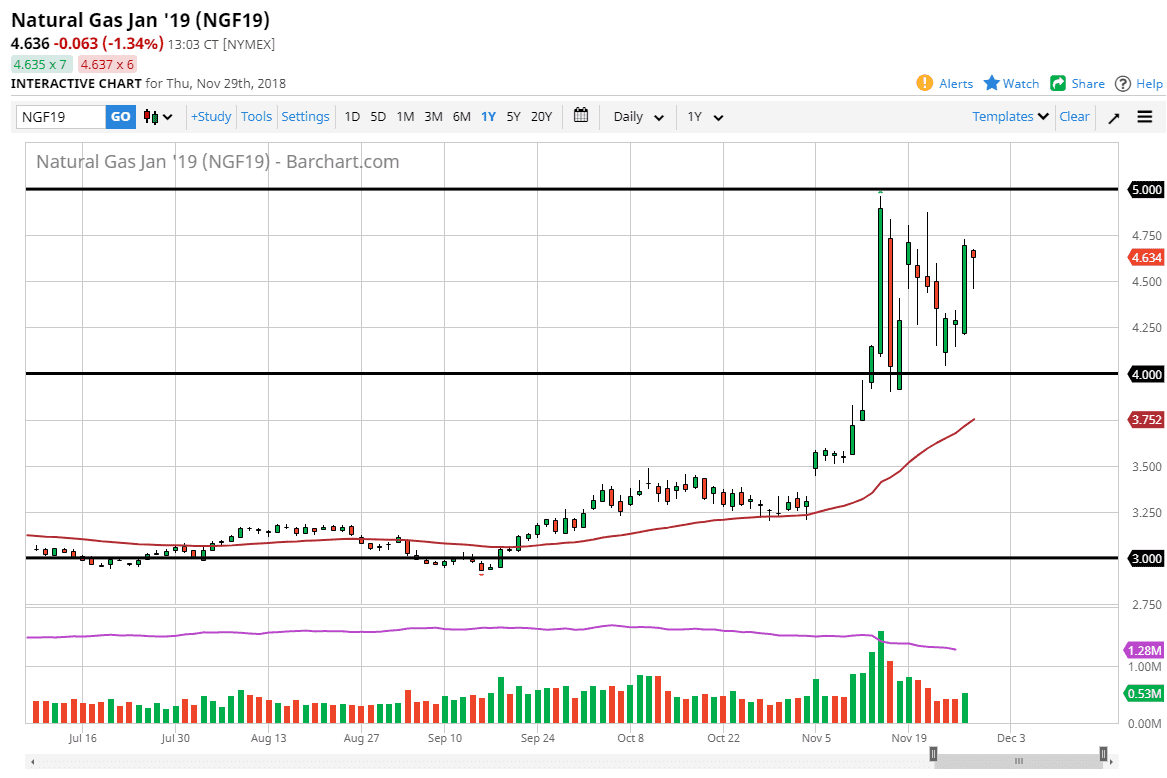

Natural Gas

Natural gas markets initially fell during the day on Thursday but turned around and recovered from the $4.50 level. I think this is an opportunity to start selling at a higher level, as I think the $4.75 level is the beginning of resistance that extends to the $5.00 level. At this point, I think that the first signs of exhaustion will be sold on short-term charts, as we continue to bounce around between the $4.00 level on the bottom and the $5.00 level on the top. This is one of the most bullish times a year, so it makes sense that we are a bit levitated at this point. However, I think that the market will be highly cognizant of the fact that suppliers will be willing to jump natural gas at these higher levels. Once we get to the warmer months in the futures markets, this market will fall apart.