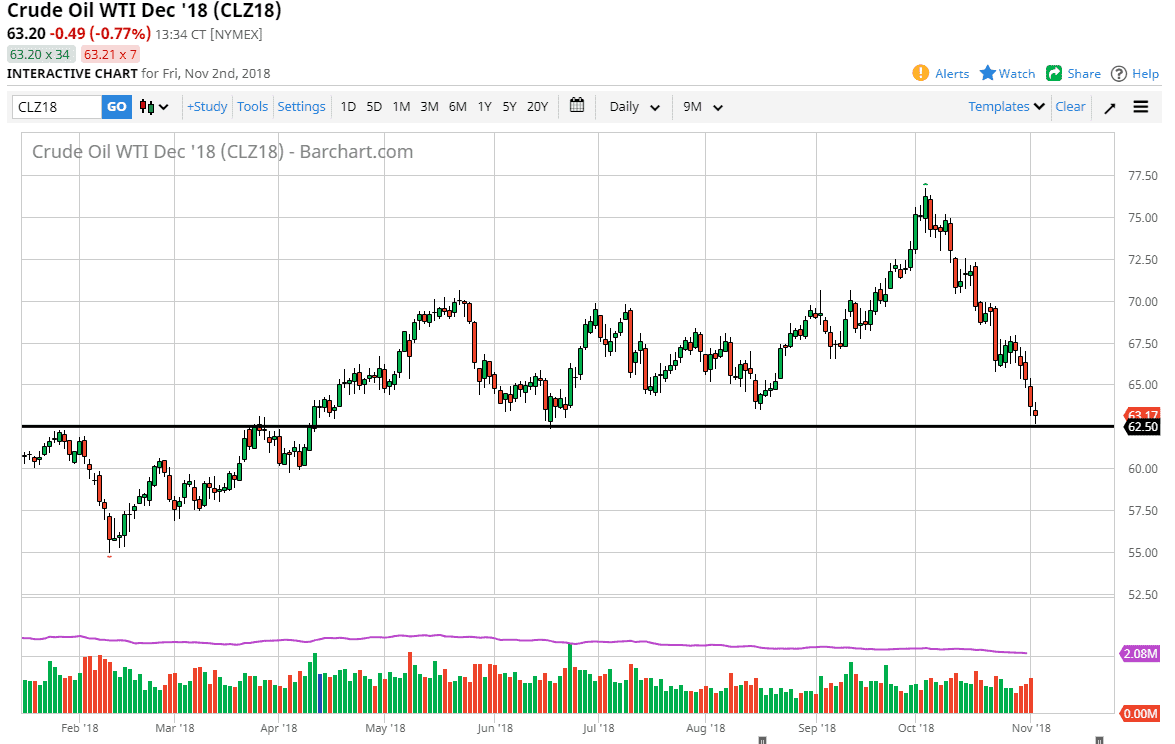

WTI Crude Oil

The WTI Crude Oil market gapped up a bit lower at the open on Friday, turned around to rally, and then broke down towards the $62.50 level. That’s an area that is supported on longer-term charts so it’s not a huge surprise that we turned around to rally from there. I think at this point, it’s likely that we will continue to see buyers in this area but if we break down below the $62.50 level, then the market could go down to the $60 handle. Otherwise, if we continue to rally from here, it’s possible that we could go to the $65 level. That’s an area that is a large come around, psychologically significant figure, and of course could cause a bit of bearish pressure. Iranian sanctions are being reinstated by the United States today, so it’ll be interesting to see whether that has an effect on the market.

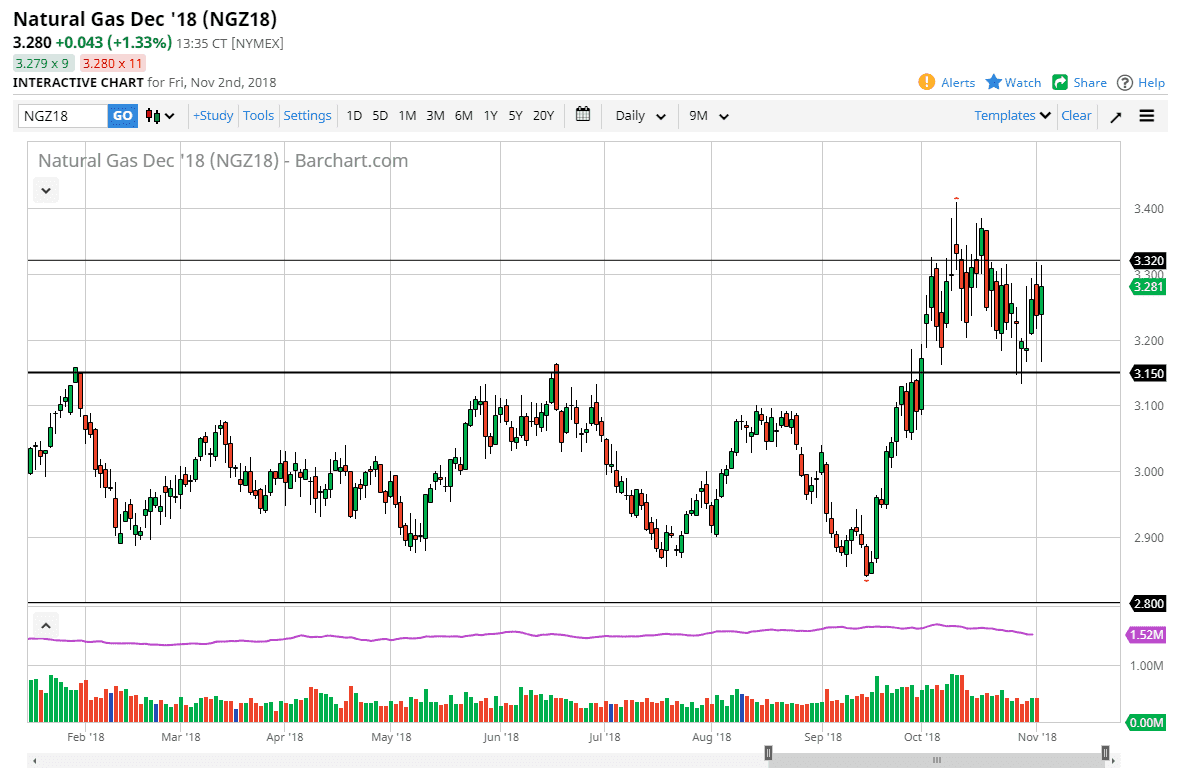

Natural Gas

Natural gas markets pulled back a bit during the trading session on Friday but found enough support near the $3.15 level to turn around and shoot straight up to the $3.03 dollars $0.32 level. At this point, I think we continue to go back and forth, and I think that the volatility and choppiness will probably continue as this is a seasonably strong time a year for natural gas, but at the same time we are going to have a warmer than usual winter from most reports in the United States, so I think we have a real “push/pull” situation at this point.

At this point, I think we continue to trade back and forth in little bits and pieces and between the $3.15 level on the bottom and the $3.32 level above. I wouldn’t put too much money into the market in one shot, but I also believe that range bound short-term trading could be very profitable.