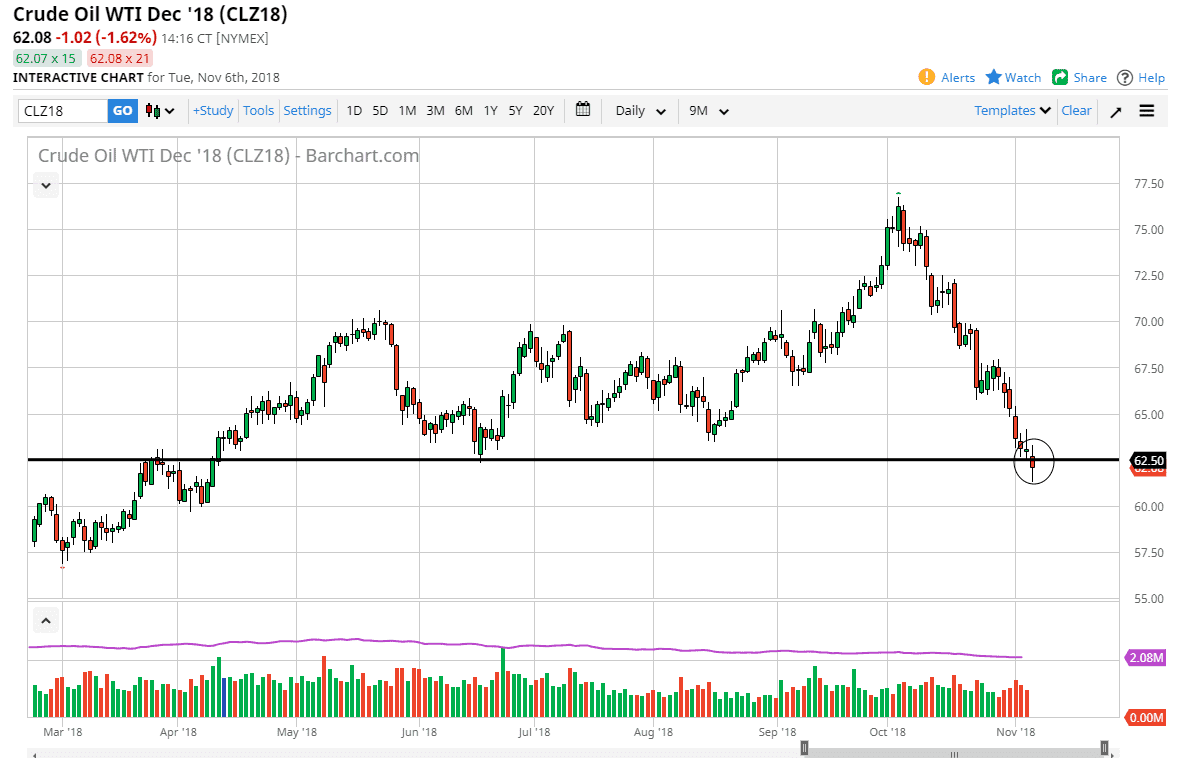

WTI Crude Oil

The WTI Crude Oil market has struggled a bit again during the trading session on Tuesday as we hover around the $62.50 level. This is an area that of course will attract a lot of attention as it has been major support, and when you look at the candlestick before the action on Tuesday there was a bit of a continuation shooting star formed. This tells you just how parishes market is, but we did recover some of the losses late in the day. If we can break above the candle stick from the Monday session, then I think we have a chance at running towards the $65 level, followed by the $66 level. If we break down below the action on Tuesday, lookout below as we will almost certainly go down to the $60 handle. Regardless of what happens next, the one thing I think you can say now is that we are most certainly oversold.

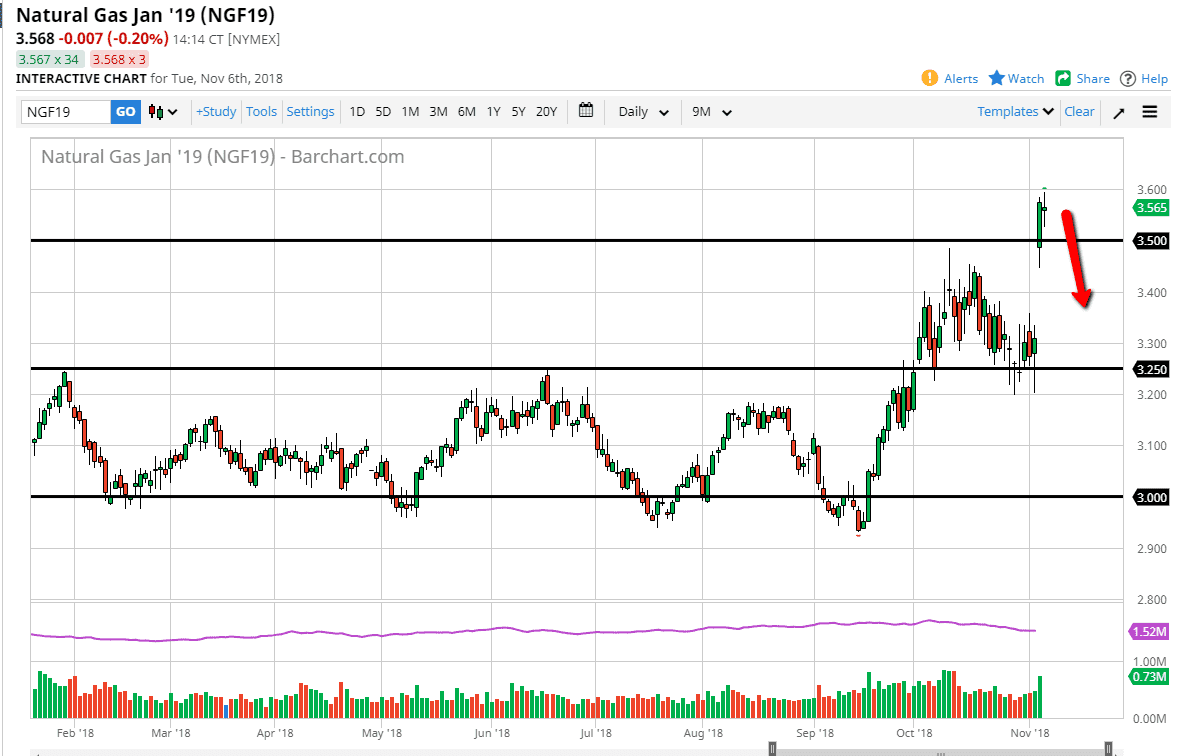

Natural Gas

Natural gas markets went back and forth during trading on Tuesday, forming a neutral looking candle. Ultimately, I think this market is ready to pull back in based upon the candlestick during the session on Tuesday, so I think that the market would fill the gap given half a chance. That means we could drop as low as $3.30, and I think that buyers are waiting for an opportunity. Ultimately, gaps do typically get filled and it’s likely that the reason we gapped higher remains embedded in the minds of traders, as we have a colder than anticipated winter forecasted as of late. There is an El Niño winter possible as well though, so we could see the demand drop significantly based upon warmer temperatures. Either way, the short term I think buying the dips works.