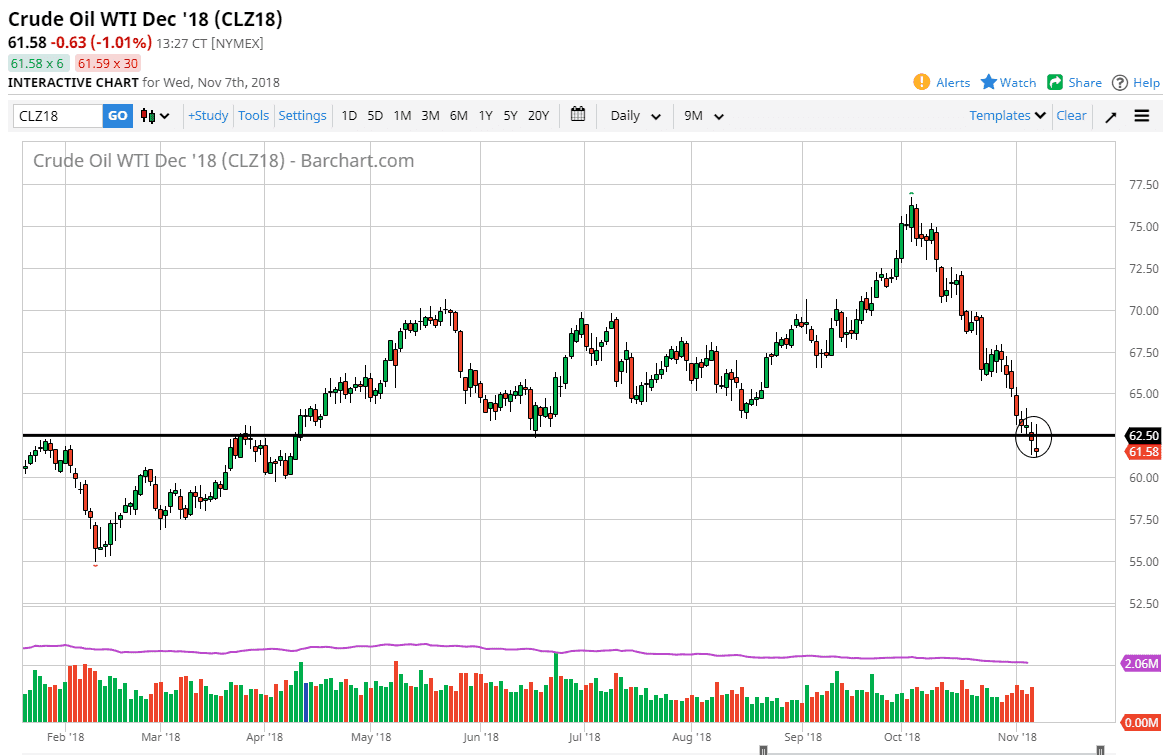

WTI Crude Oil

The WTI Crude Oil market continues to fall lower, breaking significantly below the $62.50 level during the Wednesday session. I believe that ultimately we continue to have very bearish conditions, but we are a bit oversold. I believe that the $60 level underneath is likely to be the next target, as it is a large, round, psychologically significant figure. The gap suggests there is still plenty of selling pressure, but I do think that the $60 level will cause a lot of interest. Ultimately, if we can break above the top of the candle stick for the session on Monday, that would be a welcome sign for the buyers, at least for the short term. The $65 level above there will be a target, and a break above there could even send the market to the $67.50 level. Ultimately though, I think shorting short-term rallies probably continues to work.

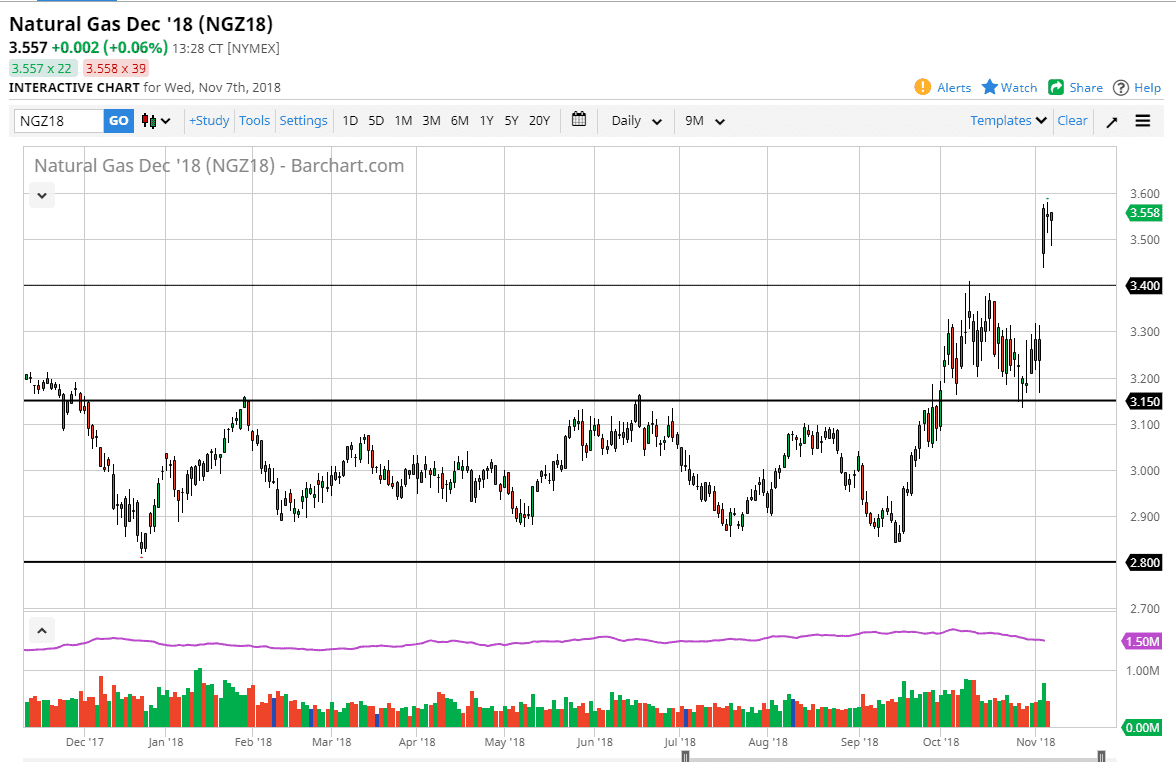

Natural Gas

Natural gas markets continue to show bullish pressure, going back and forth. I believe that the market is still extraordinarily positive, but at this point I think that there is far too much in the way of a gap and an overbought scenario to jump in here. I certainly would short this market, but I am waiting to see some type of pullback towards the $3.30 level to pick up a bit of value. I think at this point, it’s not until we break down below the $3.15 level that we can consider selling. At this point, I think it’s only a matter of time before buyers would return especially considering that the gap was so obvious. There is a significant rally underway due to the bullish flag on the chart, and of course the colder temperatures that are predicted. As long as we are trading winter contracts, it makes sense we will continue to see buyers.