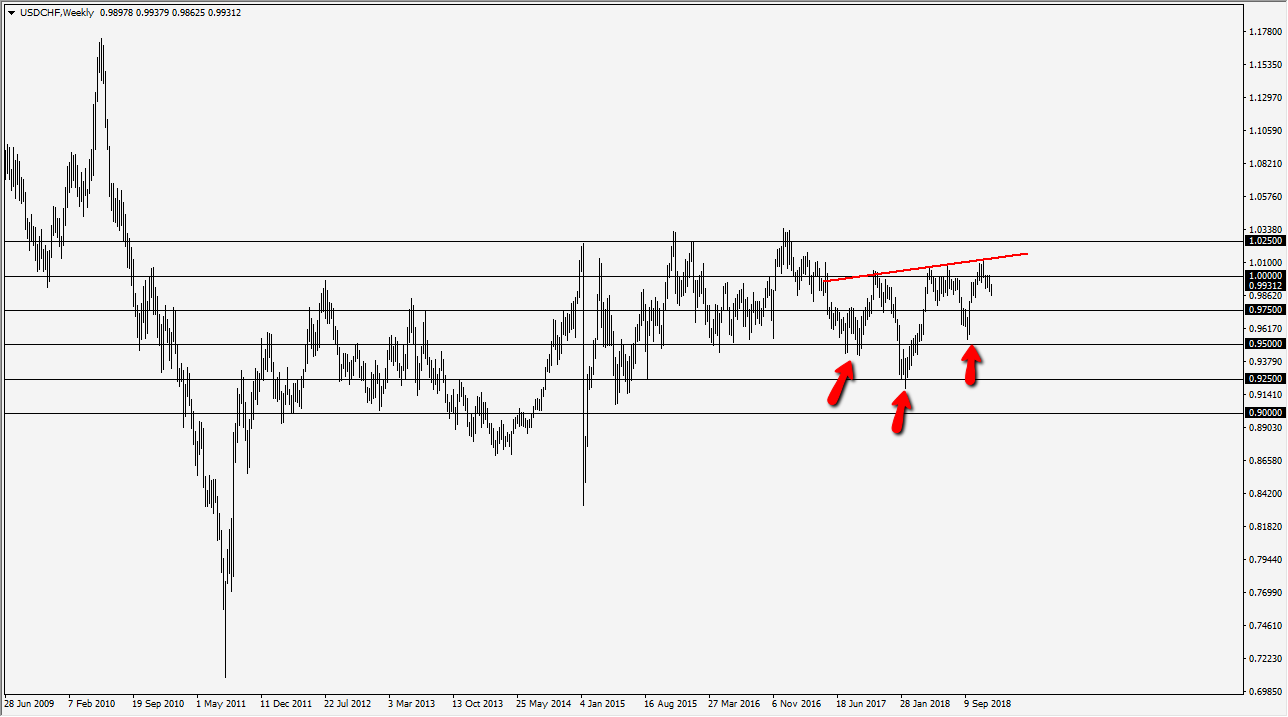

The US dollar is potentially forming an inverted head and shoulders as I write this article. As you can see on the chart, I have the neck line drawn, and if we can break above the neckline I think that it projects for a move to the 1.08 handle. So the question is how do we get there?

The US dollar strengthening against the Swiss franc could be caused by a lot of different things. The first variable could be the fact that the Swiss National Bank is essentially one of the world’s largest hedge funds and holds a lot of potentially toxic assets. Beyond that, Switzerland is unfortunately surrounded by the European Union, which has a lot of major issues. If the European Union continues to struggle, this means that one of Switzerland’s biggest customers are essentially broke.

Beyond that, Switzerland is in the middle of trying to formalize relations with the EU, something that is currently handled by 100 accords instead of an actual agreement. There are spats of ugliness between the EU and the Swiss right now, and this could of course affect trade. If things get ugly, and they certainly have taken a little bit more of an ominous tone lately, the Swiss franc will probably get hammered.

Ultimately, the inverted head and shoulders is still only a potential inverted head and shoulders, but once we break that neck line I am going to be long of this market, and simply hold. Otherwise, we very well could see the market drifting down to the 0.95 handle. This market is notoriously slow at times, but it should also be noted that the interest rate differential certainly favors the US dollar as the Swiss are still with negative real rates. I suspect that we are about to see a move higher in 2019. Breaking below the 0.95 level negates the inverted head and shoulders, and drives this pair towards the 0.90 level, a move that I currently have at about 20% probability.