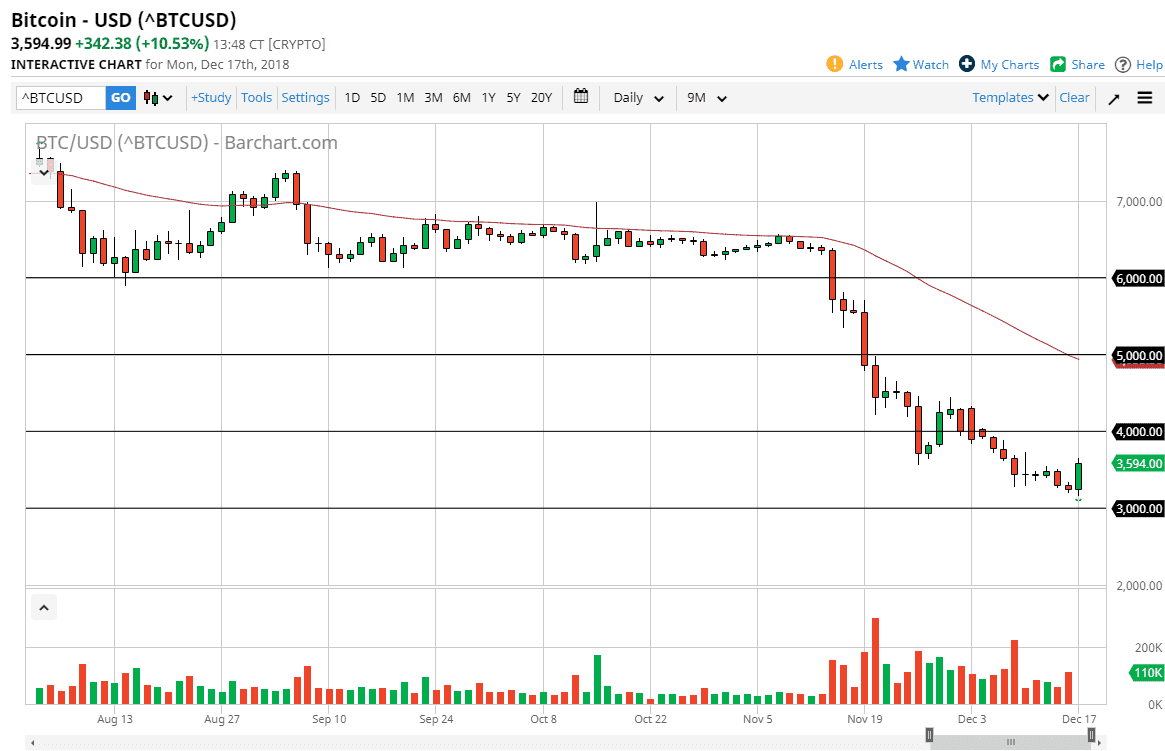

Bitcoin rallied significantly during the trading session on Monday, showing signs of strength based upon the candlestick. This has been something that a lot of Bitcoin traders have been waiting for, as the pressure has been a negative deluge repeatedly. I think at this point, the best trade to take a simply wait for signs of exhaustion near the $4000 level, perhaps on an hourly chart. The $4500 level is also resistance, and then of course the 50 day EMA which is currently near the $5000 level.

Overall, I think that the Bitcoin market will get the occasional bounce, as the market can’t go straight down forever. At this point, I think you simply look for an opportunity to take advantage of what is a very strong downtrend, and of course a move that is obvious. The $3000 level currently offers a lot of support, and I think that if we break down below there we probably extend losses down to the $2500 level.

Bitcoin causes a lot of headaches for the community, because most analysts are paid to keep you interested in the website. However, I count myself very lucky working for Daily Forex, because we are given carte blanche when it comes to our opinions. I have made no bones about it, I believe that the future for Bitcoin is absolutely dreadful. While I do believe in blockchain technology, I don’t like the idea of the currency. In order for Bitcoin to become a viable currency, it would have to become stable in that something that we are quite away from.

Adding even more bearish pressure to Bitcoin is the fact that 15 central banks are now exploring the idea of their own cryptocurrencies. This includes the Federal Reserve and the Bank of England, both of which are obviously major players in the world. Ask yourself this question: “Will the average person trusts a crypto currency created by the Federal Reserve, or an unknown person named Satoshi?” I think once you start to ask that question about the general public and more importantly general adoption, you can see why we are in the predicament we are in. Beyond that, those retail traders that have been burnt so nastily by crypto currency aren’t coming back.