BTC/USD

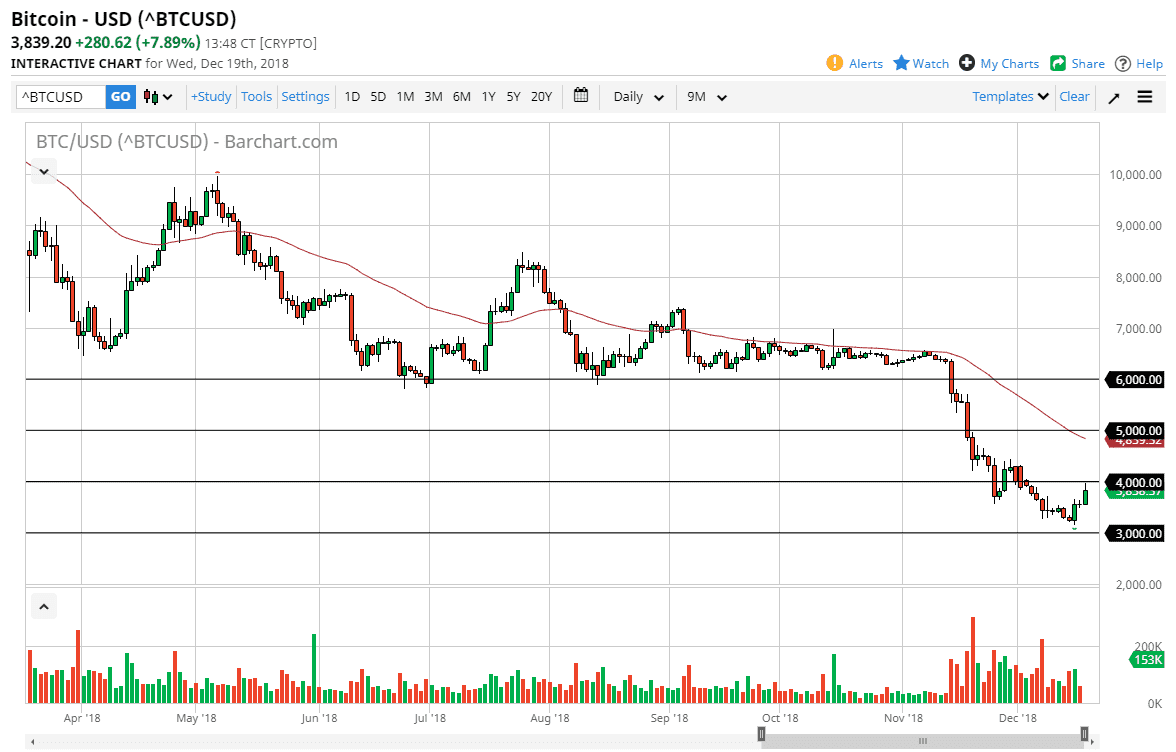

Bitcoin markets rallied a bit during the trading session on Wednesday, reaching as high as $4000. This of course is a large come around, psychologically significant figure, and that of course carries a certain amount of weight when it comes to the idea of psychological resistance. Beyond that, we have seen a lot of clustering and chopping in this area, so it looks as if we are trying to retest the previous support for resistance. Ultimately, I think that will end up being the case and we are starting to see selling towards the end of the session.

At this point, I believe that the markets continue to chop around with a downward slope, and most certainly the 50 day EMA does suggest that in fact we are still very much in a downtrend. I believe that there is a lot of resistance between the $4000 level and the $4500 level and breaking above that would take a certain amount of momentum. If we could get that momentum, then obviously that would be a very bullish sign. In the meantime though, I think it’s likely that we will get more of the same, simply people jumping in the market to start selling bitcoin again. Bitcoin and simply cannot hang onto gains, and I don’t see anything changing in the short term that’s going to change that. I still believe that we are going to zero dollars, or at least something like that. Now that the central banks around the world are starting to tinker with crypto currency, it’s only a matter of time before a government-backed version comes out that Main Street will be using. They’re just simply won’t be adoption of a large-scale. I continue to sell rallies when they offer signs of exhaustion.