BTC/USD

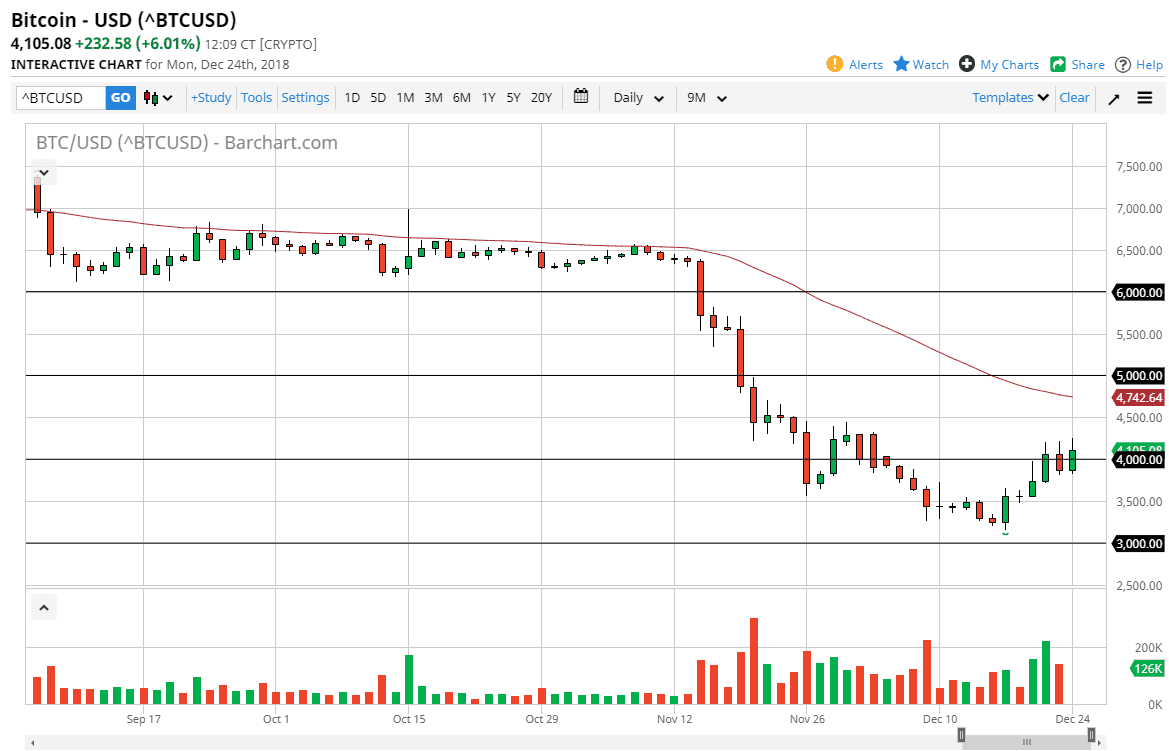

Bitcoin markets rallied a bit during the trading session on Monday, breaking above the $4000 level. That is a psychologically important figure, and by breaking above there it is a bullish sign. However, there are multiple reasons to think that perhaps we are going to struggle just above. The $4500 level has been the scene of resistance previously, and the 50 day EMA is just above that level as well. As the EMA starts to flatten out in that area, I think it’s possible that we may start to see the beginning of consolidation.

I don’t think that the market will break above $4500, at least not for a longer-term move. At this point, I believe that the bearish pressure will pick back up, and the bounce is more of a “dead cat bounce” than anything else. It makes sense that we would see it near the $3000 level and heading into the holidays. I’m waiting to see signs of exhaustion that I can take advantage of, perhaps on shorter-term charts. If we do break above the 50 day EMA, then we could reach towards the $5000 level, which of course is even more psychological resistance.

We are in a longer-term downtrend, so I think at this point looking for an opportunity to jump back into that downtrend is the best way to go forward. The $3000 level underneath could offer support again, but I fully anticipate that this market is going to break down through that level. Ultimately, I think the volatility will of course be an issue but that shouldn’t be much of a surprise considering what we have seen lately. Bitcoin is going to continue to plummet longer-term, but even in the fiercest of downtrend you will see the occasional bounce.