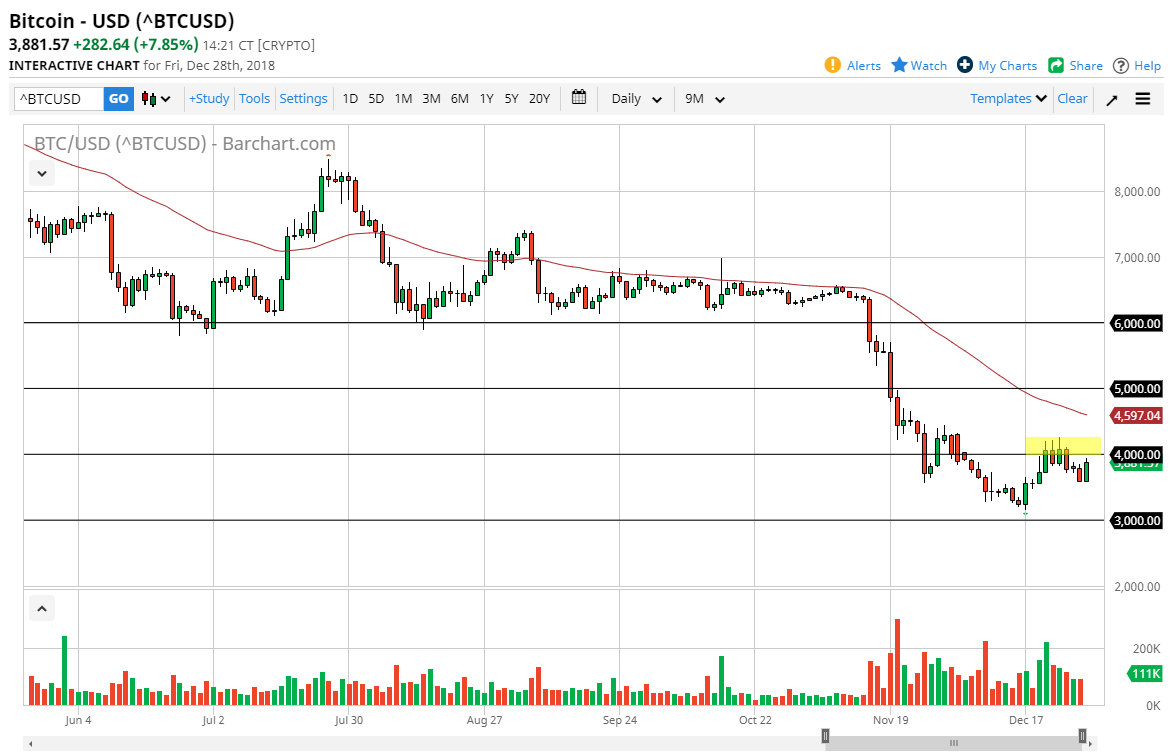

BTC/USD

Bitcoin markets rallied during the day on Friday, gaining almost 8%. While that sounds great, the reality is that we are still consolidating just below the $4000 handle, and although 8% sounds like a lot, unless you are day trading Bitcoin you aren’t making much. At this point, I suspect that the $4250 level should offer resistance, and then of course we have the 50 day EMA after that, found near the $4600 level. I think that with the low liquidity over the next couple of sessions, we could see this market rally a bit, but it is probably only a matter time before the sellers will come back in and start pushing this market lower.

At this point, we may be entering a new range, perhaps between the $3000 level underneath and the $4500 level above. Even if we break above there, I think that the $5000 level will also offer resistance based upon the psychological importance of that figure. The overall attitude of this market has been horrible for quite some time as you know, and even if we were to turn things around, it’s going to take months if not years to have that happen.

I think at this point the market offers plenty of selling opportunities on rallies that show signs of exhaustion, because that’s the only trade that’s worked for quite some time. Now that we have broken down to a fresh, new level over the last month or so, it’s likely that we may need to consolidate in general to measure where risk appetite is when it comes to crypto currencies. I don’t know that 2019 is going to be any better, and I think that it wouldn’t take much to start the selling yet again.