Gold prices rose $8.63 an ounce on Thursday as volatility in stock markets boosted demand for the safe-haven metal. The dollar was weaker yesterday, weighed down by a partial U.S. government shutdown and a weaker-than-expected consumer confidence report. The Conference Board said that its index of U.S. consumer confidence dropped to 128.1 in December, down from 136.4 in November.

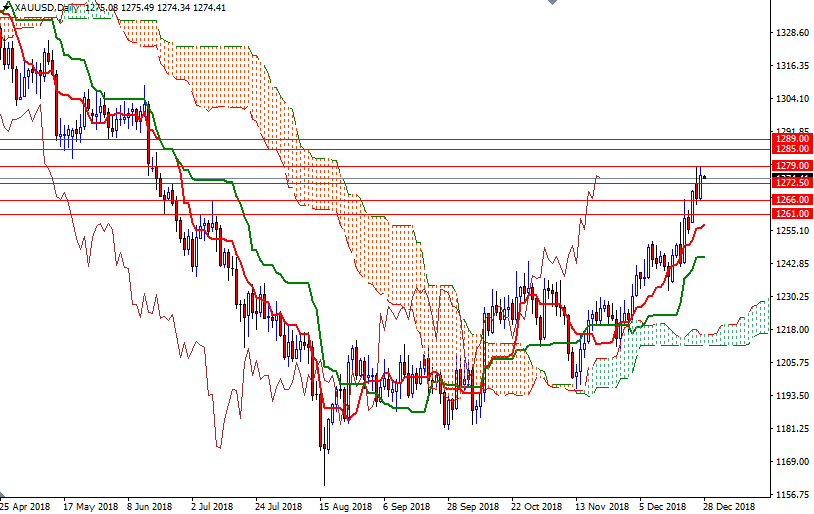

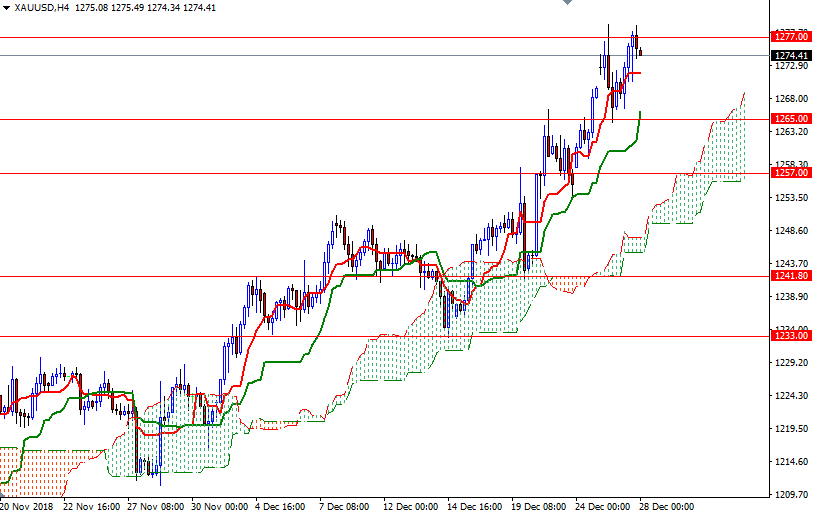

XAU/USD is trading above the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned on the weekly and the daily charts. These suggest that the bulls have the overall near-term technical advantage. However, the bulls need to lift prices above the 1279/7 area to challenge the next barrier in 1285/3. A break through there brings in 1289.

To the downside, keep an eye on the 1272.50-1270 area. If this support is broken, prices may retreat to 1266/5. The bears have to capture this strategic camp to drag the market towards the 4-hourly cloud. In that case, look for further downside with 1261/59 and 1257 as targets.