Gold prices rose $7.25 an ounce on Monday as a weaker dollar lent support to the market and some investors recalibrated their views on U.S. interest rates. Fed Chairman Jerome Powell’s dovish remarks on U.S. monetary policy last week led many to believe the Fed could hold off on further rate hikes. Interest-rate futures traders are pricing in only one rate hike in 2019. A truce in the U.S.-China trade war was also a bullish element the metals markets, as China is a major importer of metals.

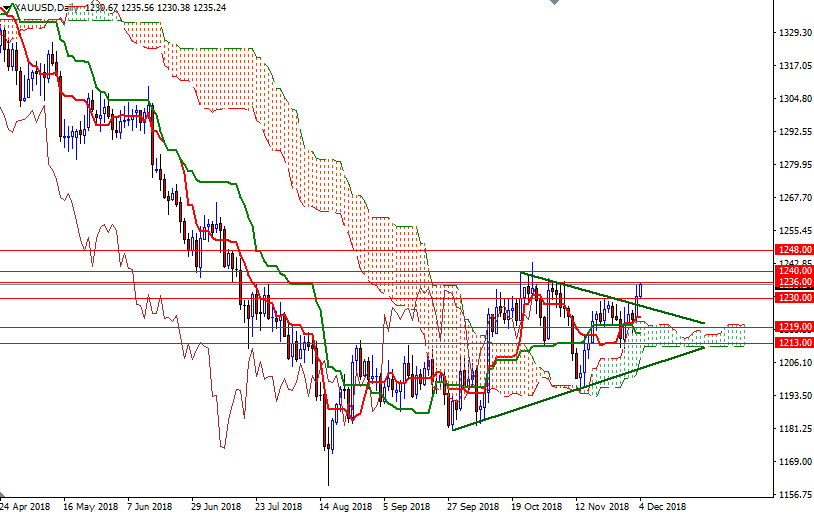

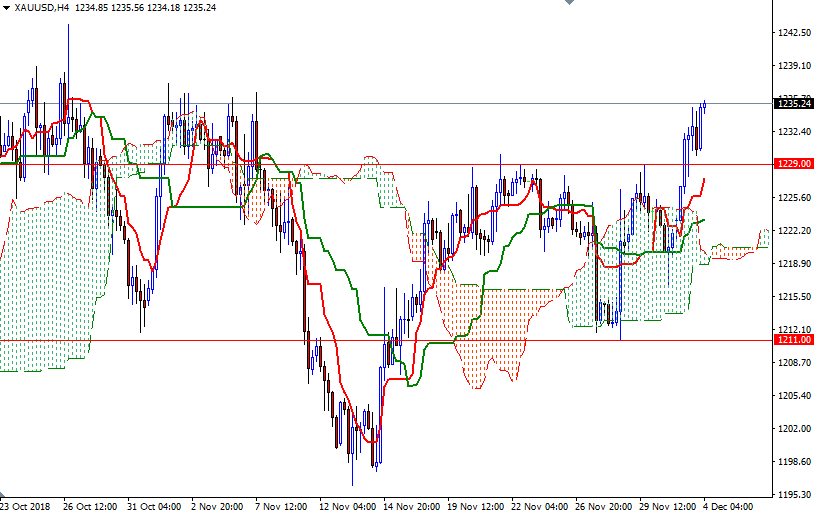

XAU/USD is trading above the Ichimoku clouds on the daily and the 4-hourly charts. In addition, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned. If the market climbs above 1236, we may visit 1238.50-1237.25. A break above 1238.50 suggests the market is targeting 1241/0. The bulls need to lift prices above there to gain momentum for 1245.50

To the downside, the initial support sits in 1230/29. Breaking below 1229 implies that we are heading back to 1226/4. If prices get back below 1224, look for further downside with 1222 and 1220.50-1219.50 (the area occupied by the 4-hourly cloud) as targets.