Gold prices ended Thursday’s session down $3.75 an ounce as traders started to focus on the Federal Reserve’s December 18-19 monetary policy meeting. The European Central Bank left benchmark interest rates unchanged and decided to end its asset purchase scheme. ECB President Mario Draghi gave a downbeat assessment of the region’s economy at his press conference after the meeting.

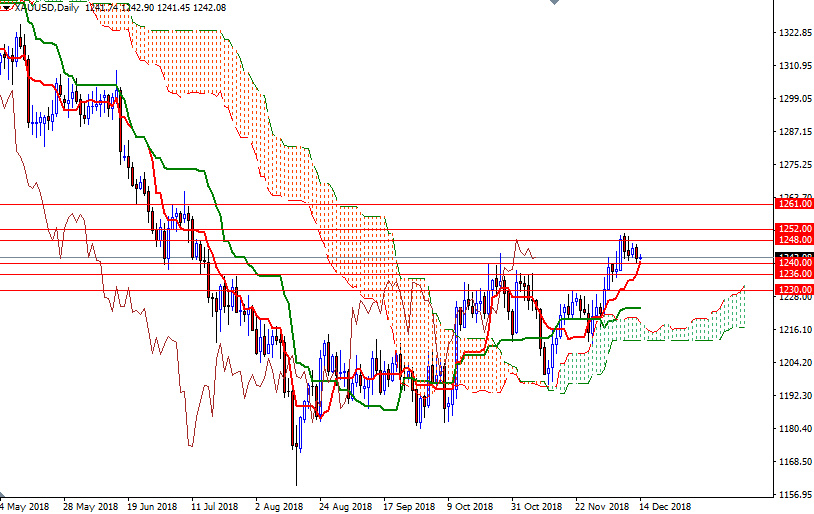

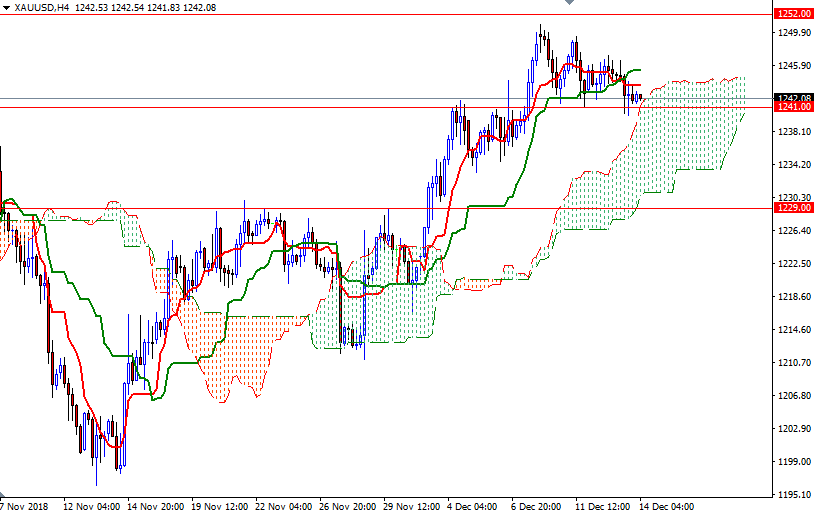

XAU/USD is trading below the Ichimoku clouds on the H1 and the M30 charts. On the H4 chart, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are flat. It looks like the market is going to revisit the 1241/0 zone. This area has provided support this week so we need to get down below there to continue to the downside. In that case, the next target will be 1236. If this support is broken, the market will be aiming for 1233.

To the upside, the initial resistance sits in the 1245.15-1244 area, occupied by the hourly Ichimoku cloud. If XAU/USD successfully penetrates the hourly cloud, we may head higher to retest 1252/48. The bulls have to produce a daily close above 1252 to set sail for 1261/0.