Gold prices ended a choppy, two-sided trading session slightly lower on Tuesday as a recovery in global stock markets dented the appeal of safe haven assets. A higher U.S. dollar index was also a negative for gold. The pound’s slide and political concerns in Europe gave the dollar a lift. In economic news, the Labor Department said Tuesday that the producer price index edged up 0.1% last month after rising 0.6% in October. XAU/USD inched higher in early Asian trading on Wednesday as investors awaited the U.S. inflation data.

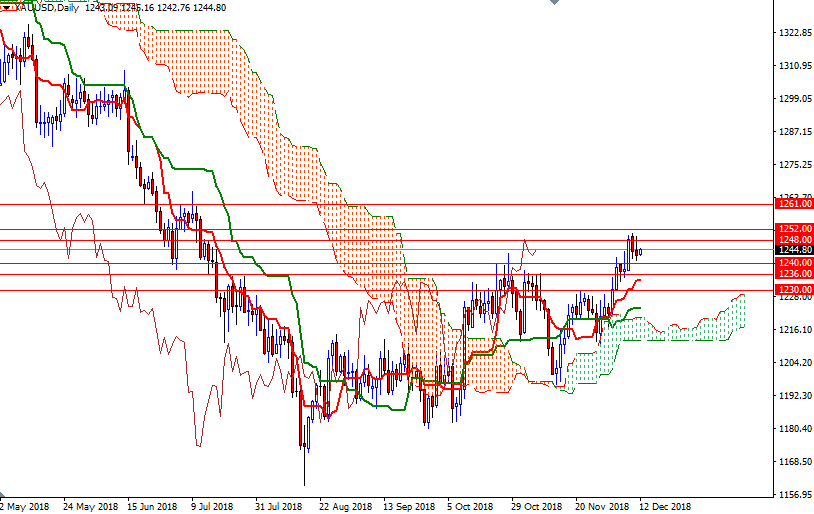

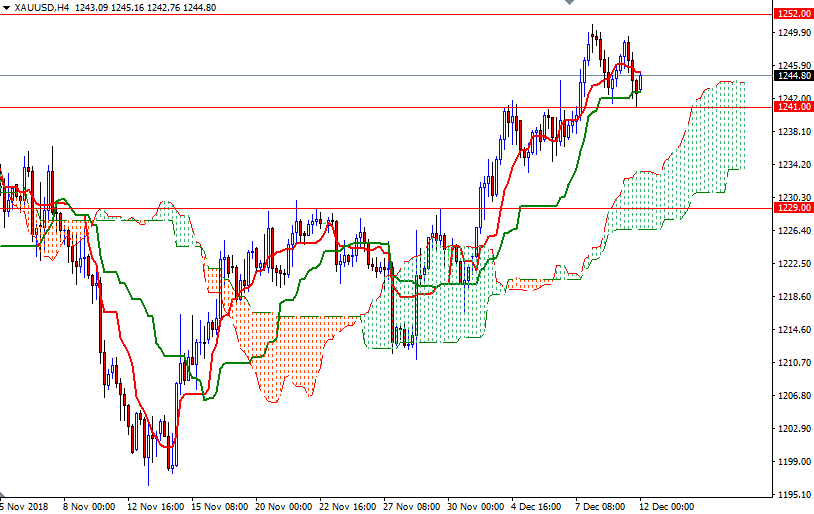

The key technical levels remain the same as the market continues to consolidate in a relatively tight range. The bulls have to push prices above the 1252/48 zone to march towards the next barrier located in 1261/0. Closing above 1261 on a daily basis paves the way for a test of 1266-1265.50.

To the downside, the initial support is located in 1241/0. If XAU/USD dives below 1240, expect a move back towards 1236 or even 1233. Below there, the 1230/29 area stands out as a strategic support. The bears have to produce a daily close below 1229 to challenge 1226/4.