Gold prices rose $9.66 an ounce on Monday, lifted by a slump in the dollar ahead of this week’s Federal Reserve meeting. President Donald Trump continued his public campaign against tighter monetary policy, saying that it was incredible that the central bank was considering hiking interest rates again. Further support for the precious metal came from weaker global stock markets and lower U.S. Treasury yields.

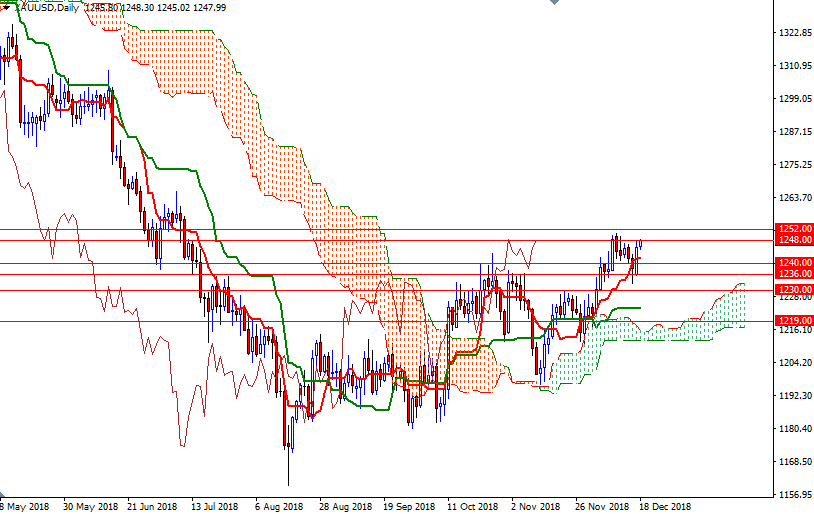

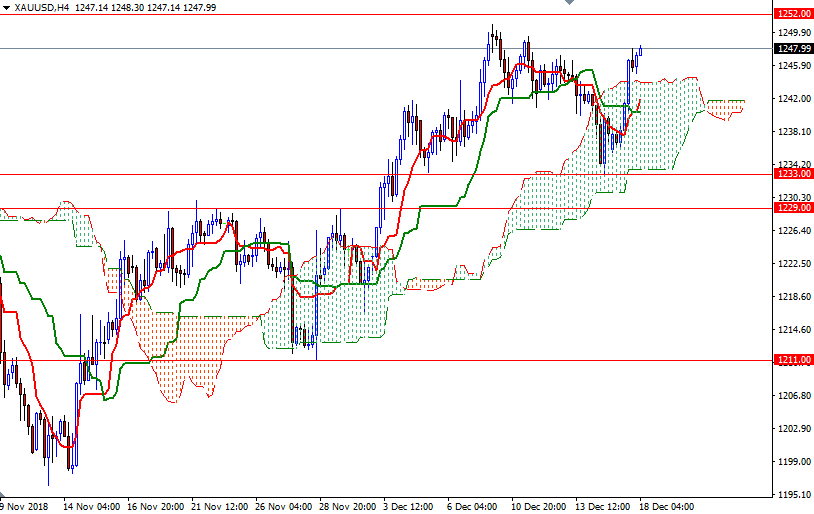

XAU/USD reached the 1248 level as expected after a technical resistance at 1245.50 was broken. The market is trading above the Ichimoku clouds on the daily and the 4-hourly charts. In addition, The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned, and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices. It looks as if the market will grind higher and visit the next barrier in the 1252/0 zone. The bulls have to confidently lift prices above 1252 to challenge 1266-1265.50.

To the downside, the initial support stands in 1245.50-1244, the top of the 4-hourly cloud. If this support is broken, the market will be targeting 1241.80-1240, where the daily Tenkan-Sen sits. The bears need to capture this strategic camp to make an assault on 1236. A break below 1233 implies that XAU/USD will test the support at 1230.