Gold prices ended Thursday’s session with slight gains. A softer dollar index and a downturn in world stock markets were supportive daily elements for the yellow metal, but some profit-taking pressure was featured ahead of ahead of key U.S. economic data. The Institute for Supply Management said its index of non-manufacturing activity rose to 60.7 from 60.3 a month earlier. Automatic Data Processing Inc. reported that the private sector added 179000 jobs in November, below the expectations for a gain of 195000. Focus of the market place now turns to the Labor Department’s non-farm payrolls report which will be released later today.

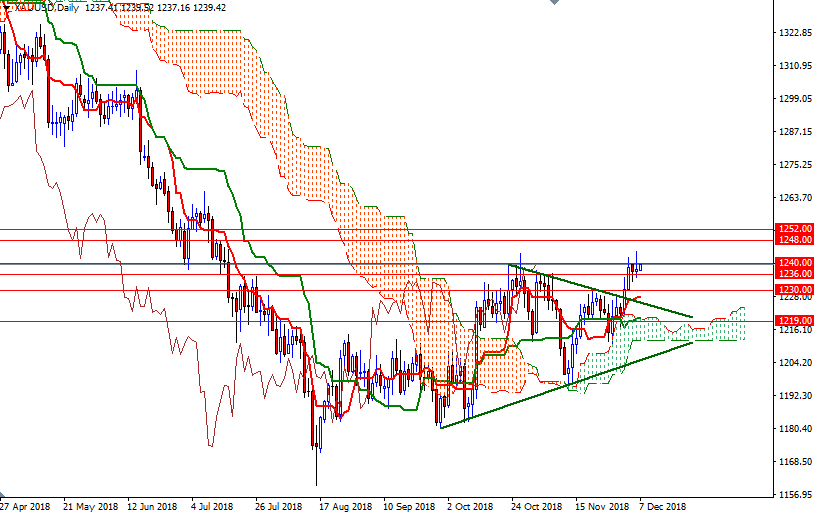

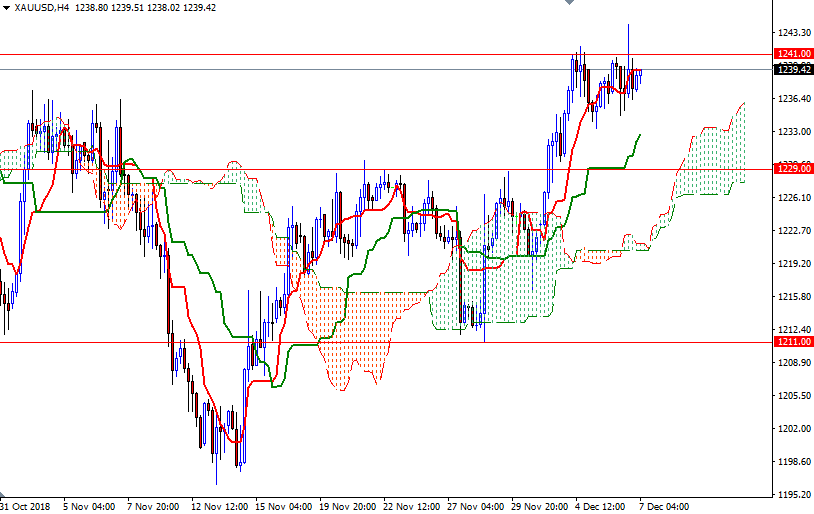

From a chart perspective, the bulls have the near-term technical advantage, with the market trading above the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned on both charts. However, the market continues to stay range bound roughly between 1241 and 1234. The bulls need to hold prices above 1241 to tackle the next barrier at around 1245.50. If XAU/USD breaks through 1245.50, it has the potential to rise to 1252/48.

The bears, on the other hand, have to pull prices below the 1236/5 area to challenge 1233.80 and 1232.60-1231.50. If prices fall through 1231.50, then the 1230/29 area will be the next target. A break below 1229 could foreshadow a move to 1226/5.