Gold prices ended Wednesday’s session down $6.85 an ounce, reversing earlier gains, as the dollar recovered following Fed Chairman Jerome Powell’s press conference. The Federal Reserve raised interest rates for the fourth time this year and said it expects two more rate hikes next year. While the central bank lowered its predicted path of rate increases, Powell said that “policy does not currently need to be restrictive.” That comment was interpreted by some observers as a sign that the Fed is not looking at an immediate pause.

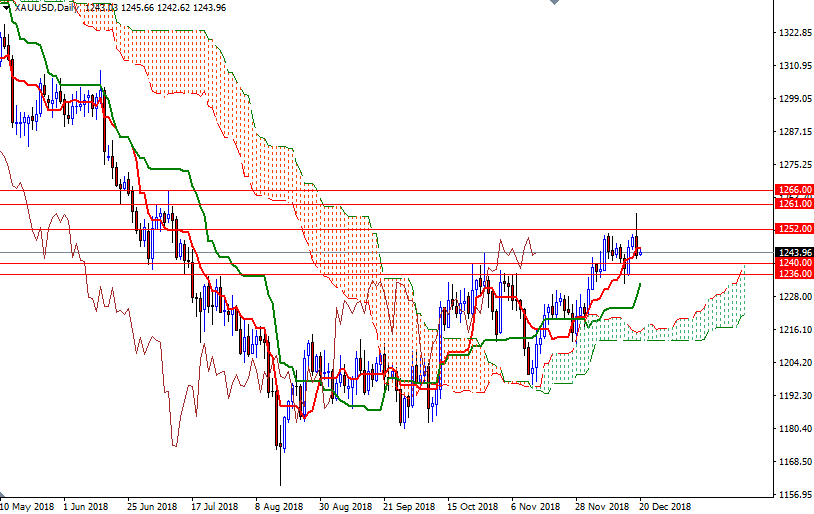

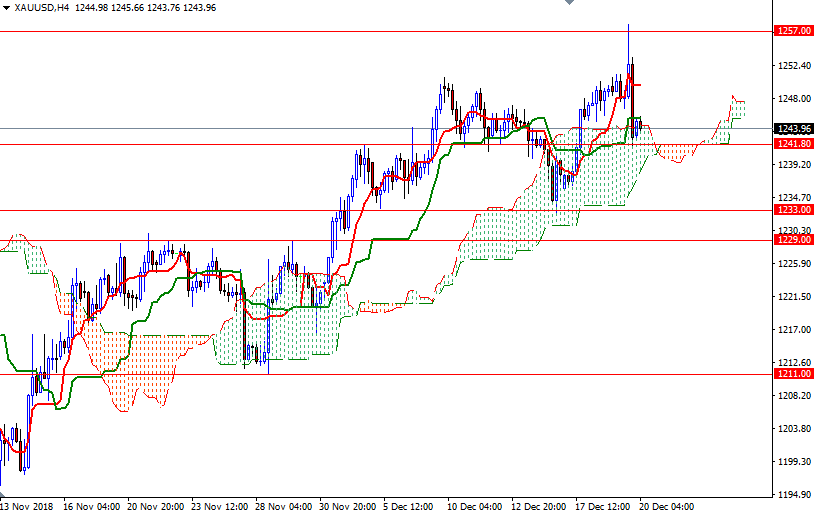

XAU/USD reached the 1257/6 area after prices climbed above the 1252 level. However, technical selling pressure increased after XAU/USD failed to sustain a push above 1257. Ultimately, the market broke below 1245.50 and tested the support in the 1241.80-1240 area. XAU/USD is currently trading within the borders of the hourly Ichimoku cloud, and it looks like the 4-hourly cloud will continue to act as support.

The bulls have to push prices above 1246/5 to march towards 1250/49, the confluence of the 4-hourly Tenkan-sen (nine-period moving average, red line) and the top of the hourly cloud. If this resistance is broken, the bulls will have another chance to challenge 1252. A daily close above 1252 indicates that we will revisit 1257/6. The bears, on the other hand, need to drag prices below the aforementioned 1241.80-1240 zone to test 1237/6, where the bottom of the 4-hourly cloud sits. Breaking below 1236 opens up the risk of a fall to 1233. If this support is broken on a daily basis, the market will be targeting 1230/29.