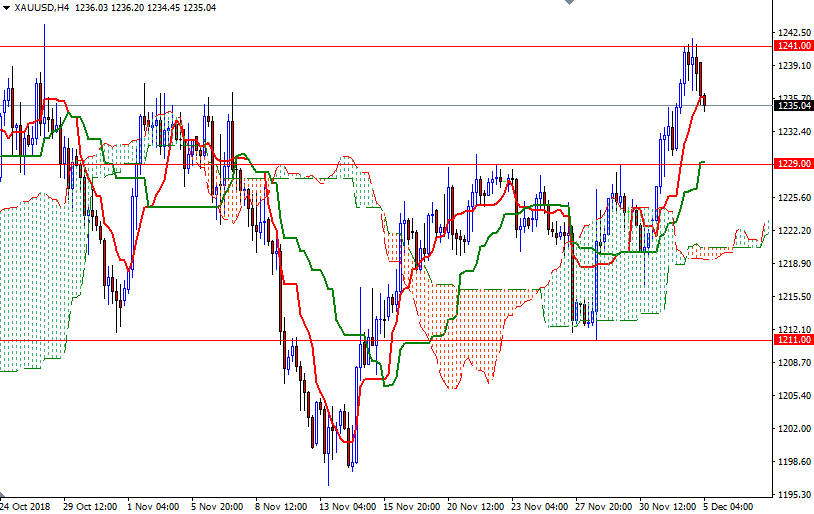

Gold prices ended Tuesday’s session up $7.63 an ounce as rising volatility in global equity markets and falling U.S. Treasury yields bolstered demand for gold. The precious metal also benefited from an improved technical outlook. XAU/USD reached the $1241-$1240 area as anticipated after prices climbed above the $1236 level.

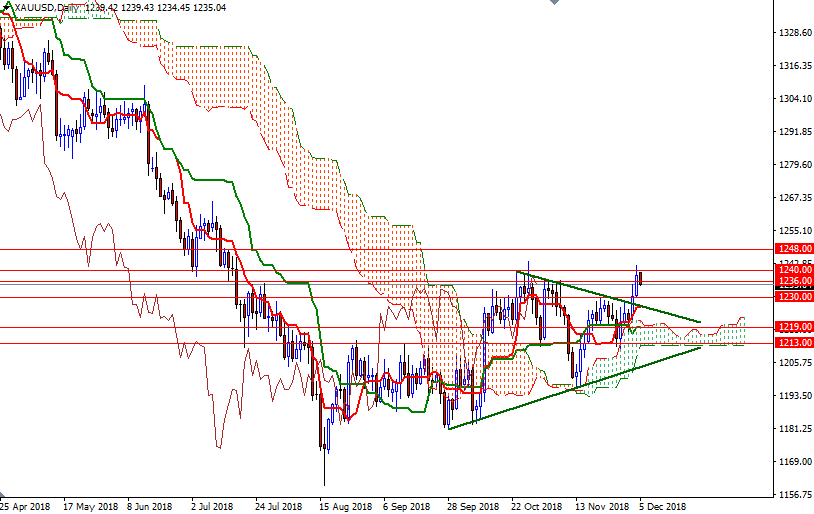

The bulls have the near-term technical advantage, with the market trading above the Ichimoku clouds on the daily and the 4-hourly charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned; plus, the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices. However, having been rejected at 1241 makes me think that XAU/USD is heading back to 1233.80. If this intra-day support is broken, then the 1232.60-1231.50 area will be the next stop. Below there, the 1230/29 zone stands out as a strategic support and the bears have to push prices below 1229 to challenge 1226/5, the daily Tenkan-Sen.

The bulls, on the other hand, need to convincingly lift prices above 1241/0 to set sail for 1245.50. A break above 1245.50 indicates that the market is getting ready to test a key technical resistance in 1252/48. Closing above 1252 on a daily basis could trigger a push up to 1261/0.