Gold prices fell $2.49 an ounce on Wednesday as investors took profits from a recent rally to a five-week high. XAU/USD initially headed lower, but found support above the $1232.60-$1231.50 area and recovered some of its losses. Global stocks slid, following sharp losses on Wall Street, on worries about a slowdown in the global economy.

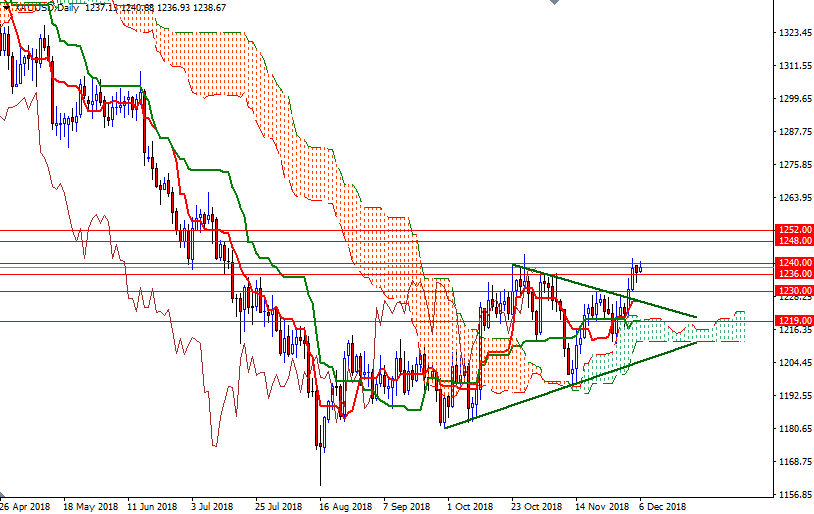

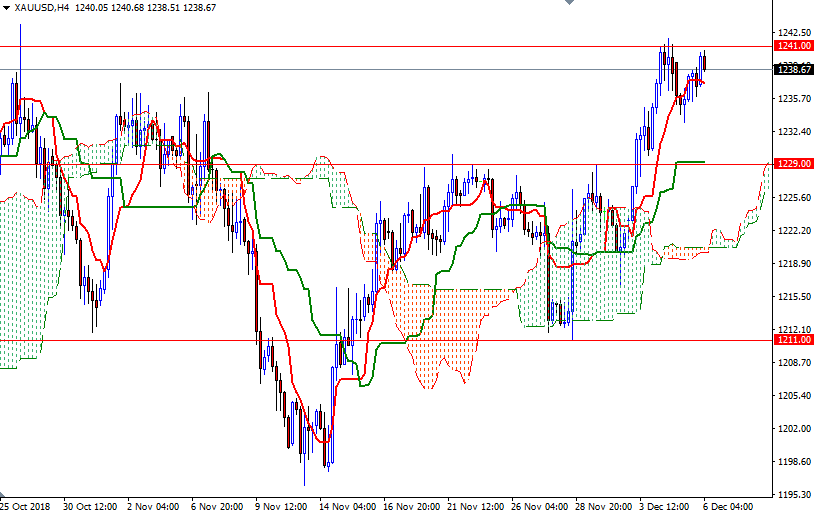

XAU/USD is trading above the daily and the 4-hourly Ichimoku clouds, suggesting that the bulls have the near-term technical advantage. The market is in the process of testing the resistance in the 1241/0 area. If the bulls successfully lift prices above this barrier and take out Monday's high, they may have a chance to challenge 1245.50. A break through there brings in 1252/48.

To the downside, keep an eye on the 1238 level. A break below 1238 indicates that the market will retest 1236/5. If prices get back below 1235, then look for further downside with 1233.80 and 1232.60-1231.50 as targets. The bears need to drag prices below 1229 to gain momentum for 1226/5, the daily Tenkan-Sen (nine-period moving average, red line).