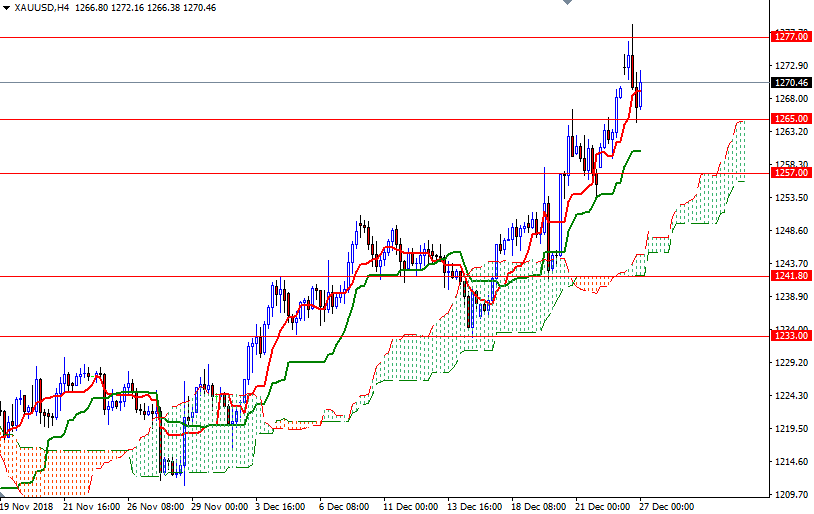

Gold prices ended Wednesday’s session down $5.89 an ounce, pressured by a firmer U.S. dollar index and a rebound in the U.S. stock market. U.S. stocks surged and the dollar strengthened as early data on the holiday shopping season appeared robust. XAU/USD challenged the resistance at around the $1277 level, but the bulls run out of steam. As a result, the market fell through $1273-$1272 and tested the support in the $1266-$1265 zone.

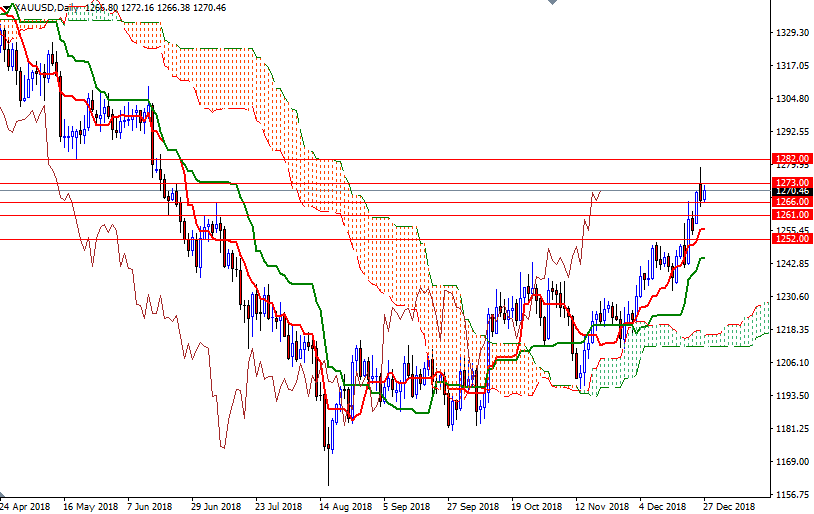

From a chart perspective, the bulls have the overall near-term technical advantage, with the market trading above the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned; plus, the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

To the upside, the initial resistance comes in at 1273. If XAU/USD climbs above 1273, we will probably visit 1274.60-1274.50. The bulls have to capture this strategic camp to tackle the next barrier at 1277. The bears, on the other hand, have to push prices below the 1266/5 area to gain momentum for 1261/59, where the 4-hourly Kijun-sen sits. A break below 1259 suggests that the market is aiming for 1257-1255.80.