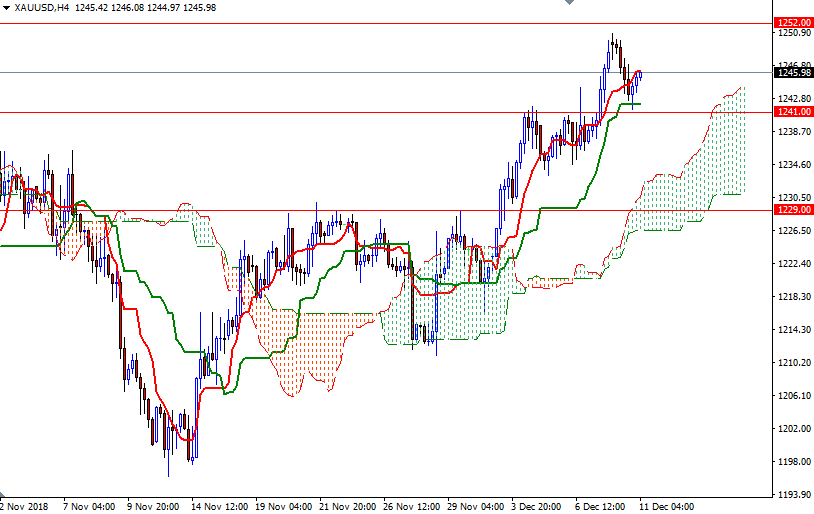

Gold prices fell $5.41 an ounce on Monday as a rebound in the dollar prompted some investors to lock in gains from a recent rally to a five-month high. XAU/USD initially headed higher, but was unable to pass through the resistance in the $1252-$1248 zone. As a result, prices broke below $1245.50 and visited the support at $1241 as anticipated.

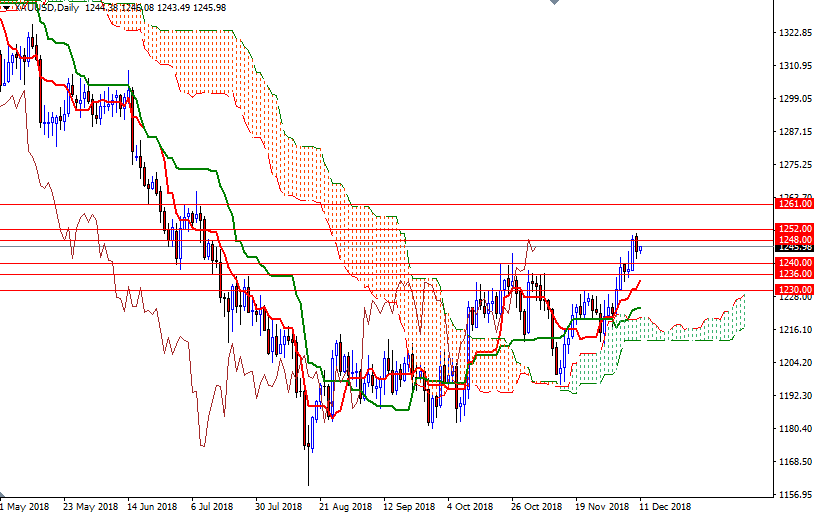

XAU/USD is trading above the Ichimoku clouds on the daily and the 4-hourly charts, suggesting that the bulls have the overall near-term technical advantage. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned on both charts; plus, the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

If the bulls can defend their camp in the 1241/0 zone, we will probably revisit 1252/48. A break above 1252 could foreshadow a move to 1261/0, which is the next solid resistance on the charts. The bears, on the other hand, have to pull prices back below the hourly cloud (1242.40) to gain momentum for a test of 1241/0. If XAU/USD drops below 1240, look for further downside with 1236 and 1233 (the top of the 4-hourly cloud) as targets.