Gold prices ended Tuesday’s session up $3.42 an ounce as the dollar fell on expectations that the U.S. central bank will ease up on interest rate hikes next year. The U.S. central bank will publish updated economic projections, and Chairman Jerome Powell is scheduled to give a post-meeting press conference. While economists expect the median Fed forecast to drop to two rate rises for next year, the markets are pricing in only one more rate rise next year.

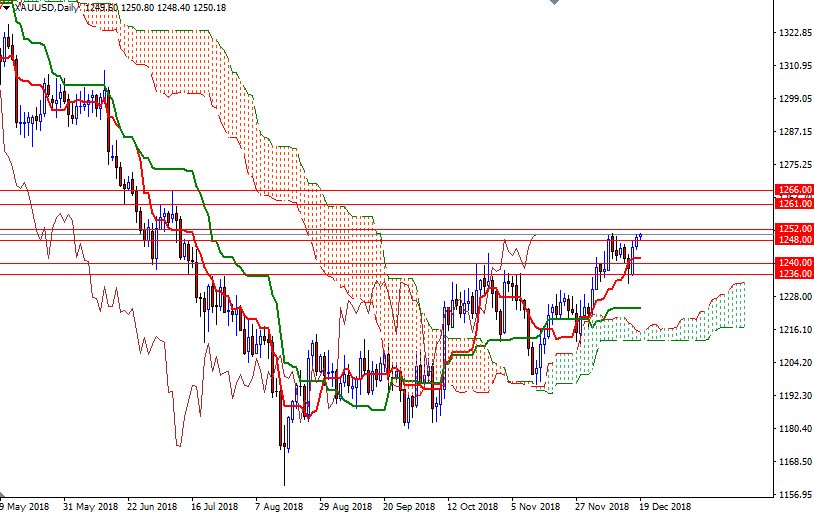

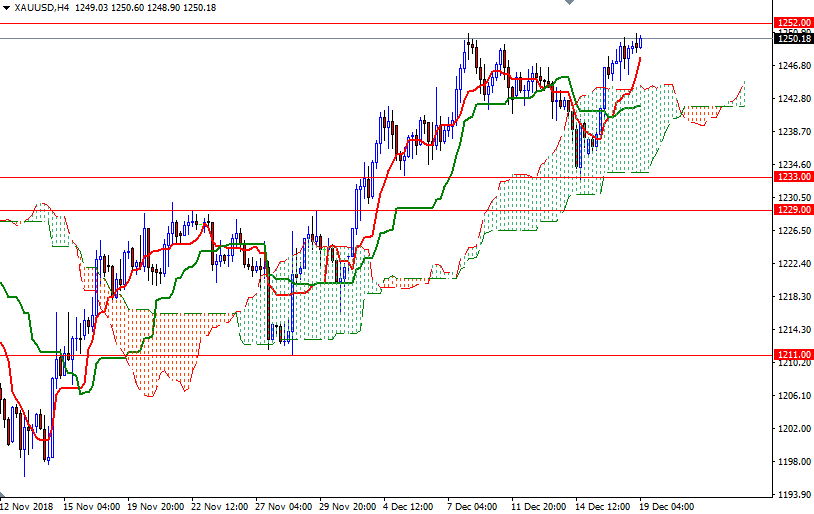

From a chart perspective, the bulls have the near-term technical advantage, with the market trading above the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned, and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

XAU/USD is currently in the process of testing the resistance in 1252/0. If the market successfully passes through, prices will head higher towards 1257/6. Once above there, the market will be aiming for 1261/0. The bulls have to capture this strategic camp to challenge 1266-1265.50. To the downside, the initial support sits in 1248-1247.50. If prices dive below the Ichimoku cloud on the M30 chart, we may return to 1245.50-1244, the top of the 4-hourly cloud. The bears have to pull prices back below 1244 to visit the bottom of the hourly cloud standing in the 1241.80-1240 area. A break below 1240 could trigger a drop to 1236/3.