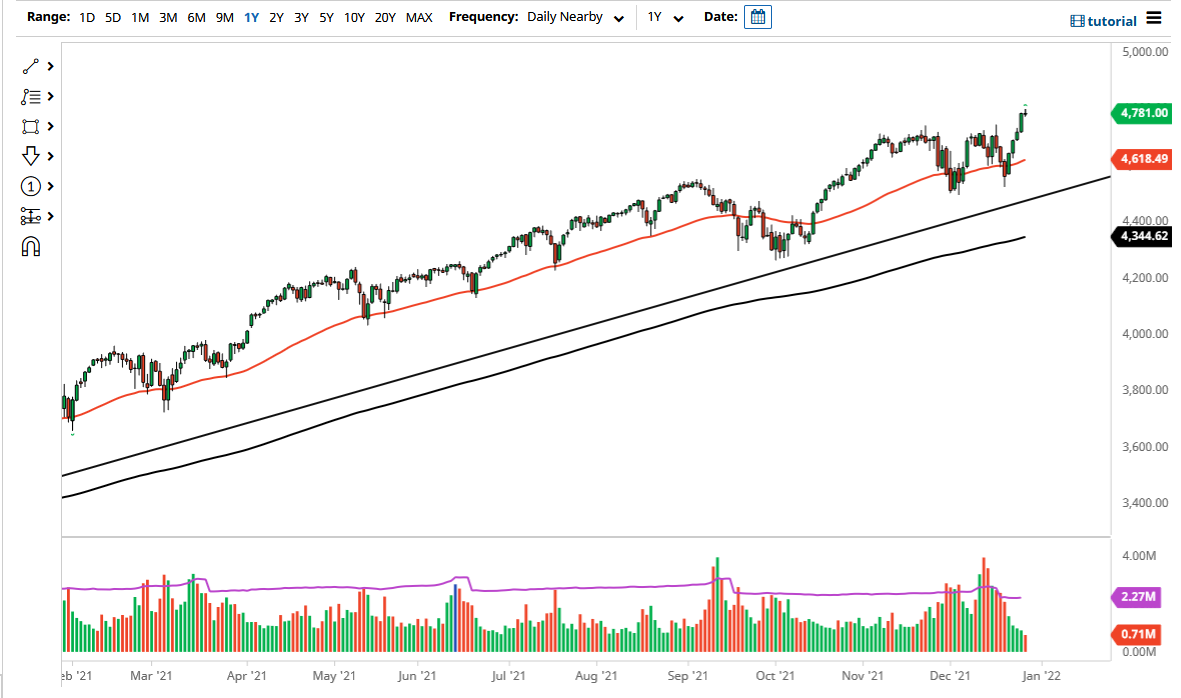

S&P 500

The S&P 500 was very noisy during the trading session on Tuesday, as we broke above the top of the hammer from Monday, which typically is a very bullish sign. However, as President Trump and a few members of Congress decided to argue during a press conference it seems as if the market got a little bit shaken by that. Beyond that, I think that we simply have far too many issues out there to stay bullish for long. Overall, the 2600 level continues to be very supportive, so while I think we may get a short-term pullback, I think it is still going to be possible to continue to the upside. The next major resistance barrier is the 2700 level, followed by the 50 day EMA. If we do turnaround, and break down below the Monday candle stick, that would be rather negative.

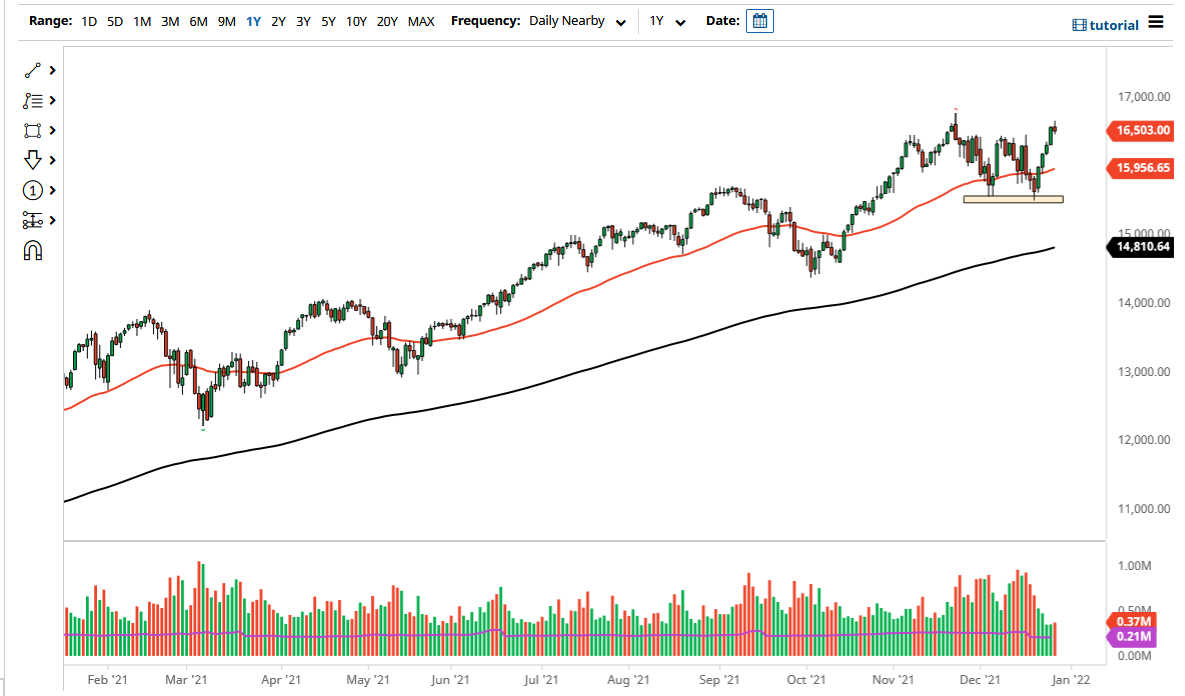

NASDAQ 100

The NASDAQ 100 rows as high as 6800 before pulling back a bit during the day, and as the situation between the West and China continues to deteriorate, I anticipate that the NASDAQ 100 will be troubled by this. I see a lot of resistance above though, especially near the 50 day EMA, and the 7000 handle. I feel it is only a matter of time before we get an opportunity to short this market again, but I would necessarily do so right now. It would not surprise me at all to have another day or two of slightly positive action, before we get more negativity. However, we are close to the end of the year, so there is less liquidity, meaning that we will trade on headlines much more erratically than usual. That normally means fear.