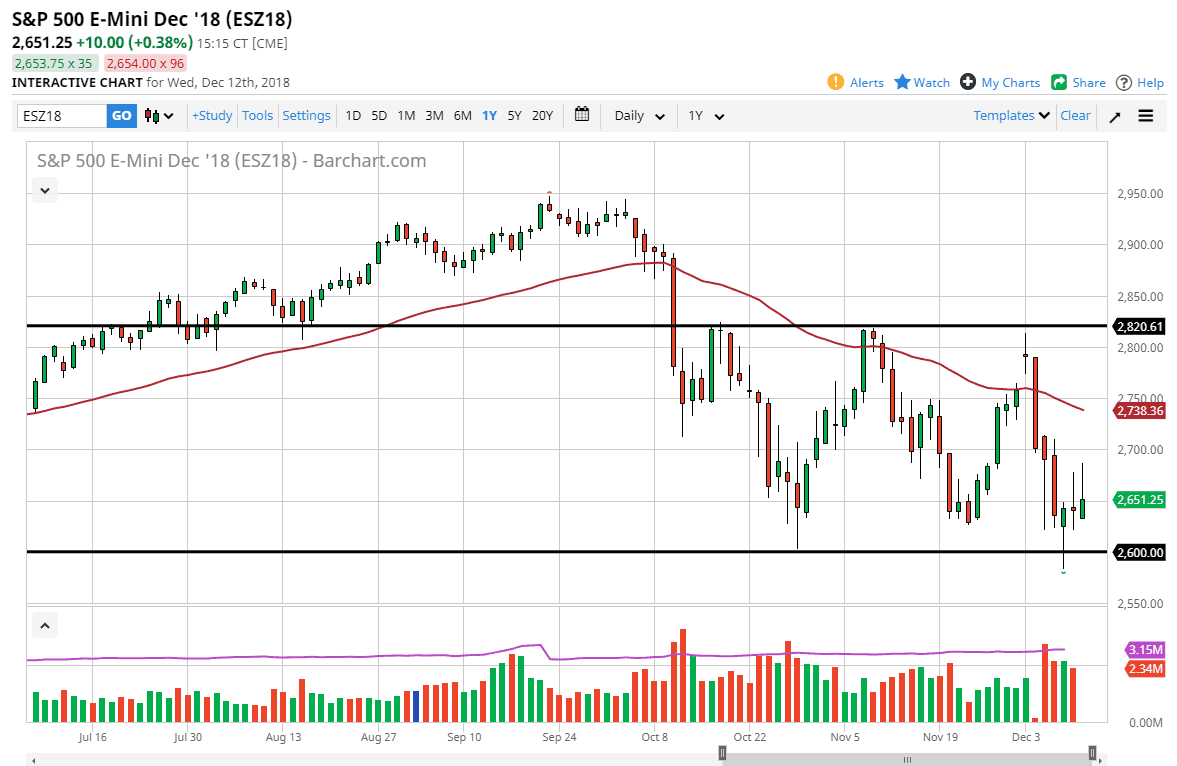

S&P 500

The S&P 500 initially rallied during the trading session on Wednesday but ran into a ton of resistance just below the 2700 level. By doing so, we have formed a massive shooting star, and therefore it suggests that we are in fact going to break down from here. There is massive support underneath, and I don’t think it’s good to be easy to break down, but clearly the market isn’t ready to go higher anytime soon. By doing this again, I have become a bit more bearish of the market, and I think that it is only a matter time before we break down in this environment. Considering that things are starting to look a little bit better between the Americans and the Chinese and we can’t take off to the upside, that is a very ominous signal indeed. A fresh, new low is a shorting signal. Rallies are to be faded at this point.

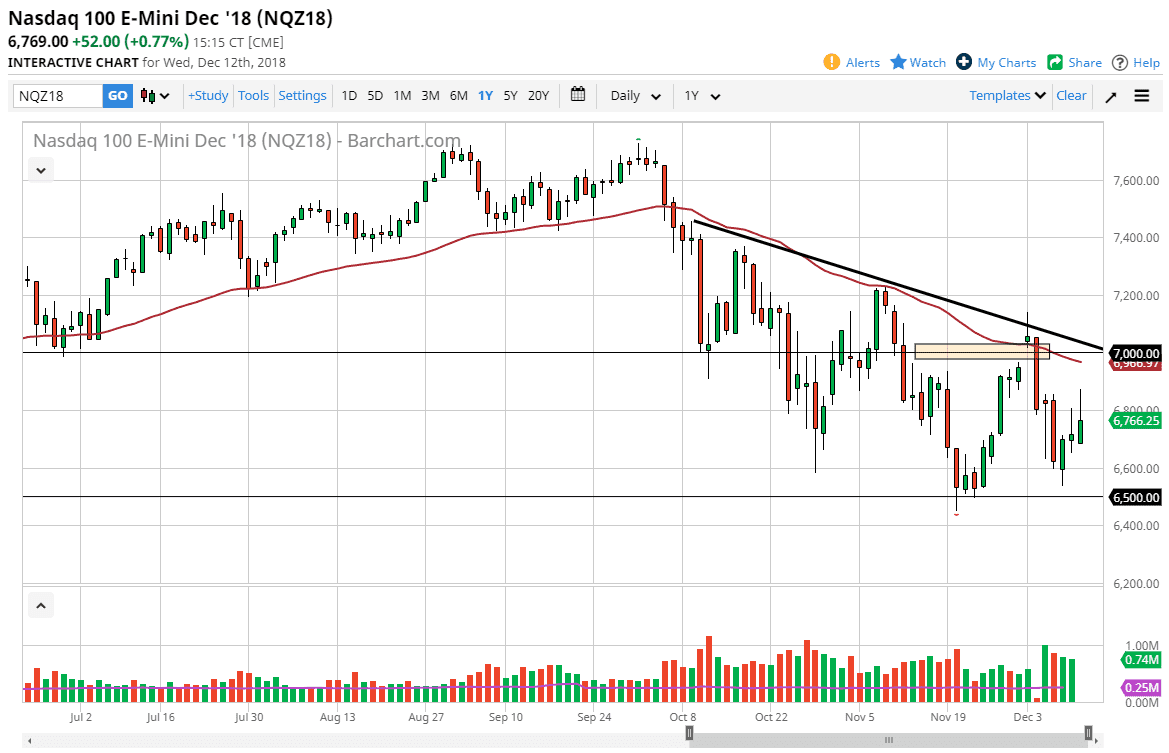

NASDAQ 100

The NASDAQ 100 also rallied a bit, breaking above the recent highs, and the top of the shooting star from Tuesday. We have broken back down though, and it shows me just how fragile this market is. Given enough time, I think rallies will continue to sell off. The 50 day EMA above continues to be massive resistance, and at this point I just don’t trust rallies. I think we will revisit the 6500 level again. However, if we break above the 50 day EMA and the downtrend line, then we could be talking about something completely different. Markets look very unhealthy at this point, and therefore I think that it’s going to be difficult to hang onto gains for any significant amount of time between now and New Year’s Day.