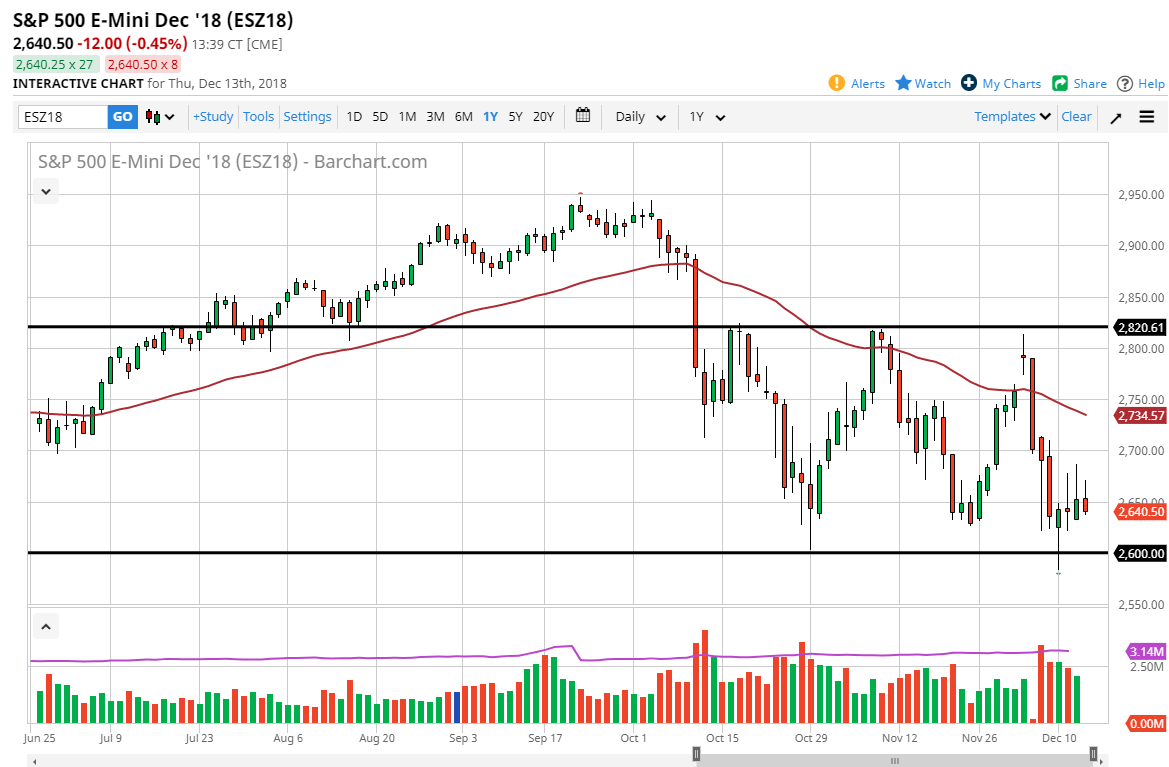

S&P 500

The S&P 500 initially tried to rally during the trading session on Thursday, but as we have seen more than once, we have given up the gains to roll over later in the day. It’s obvious that the S&P 500 simply cannot keep gains, so therefore I think that rallies are to be sold that show signs of exhaustion. At this point, if we can break above the highs of the Wednesday candle, then we will test the 2700 level, and a break above there would send the market to test the 50 day EMA. Overall, I think we are destined to make another crack at the 2600 level based upon the really bad action that we have seen over the last couple of days. The buyers simply have no conviction or follow-through at this point.

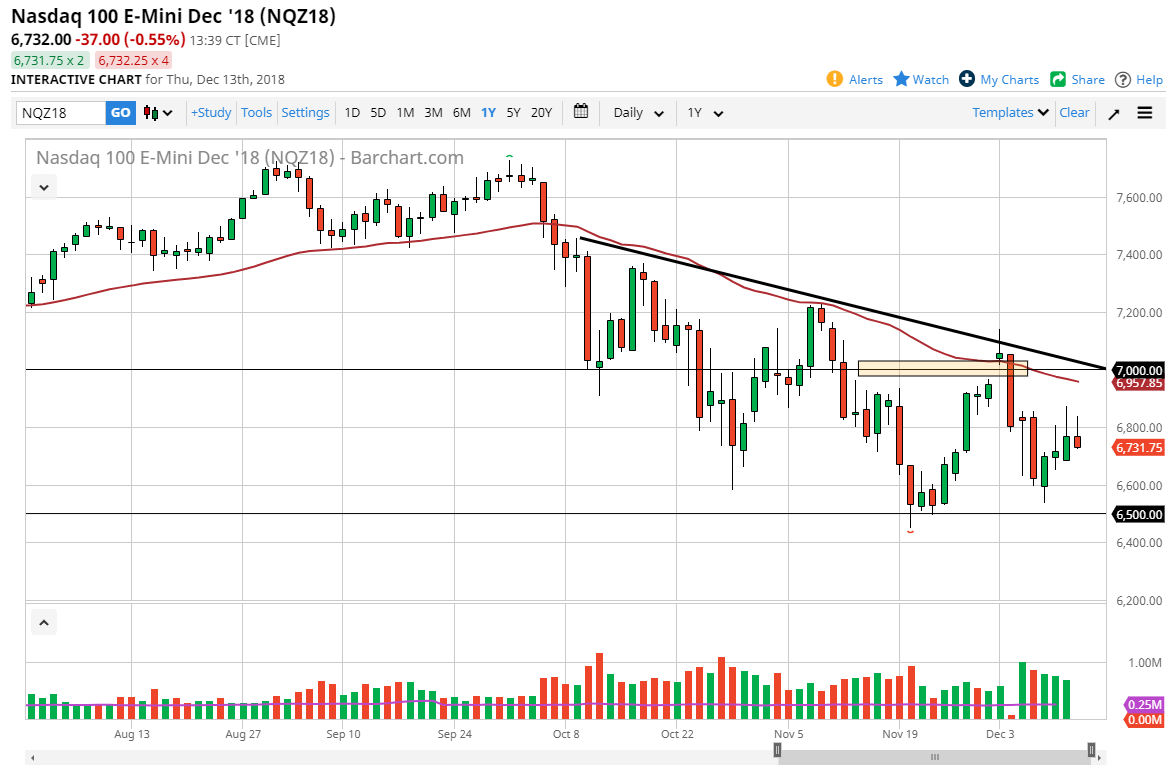

NASDAQ 100

The NASDAQ 100 initially tried to rally during the trading session on Thursday, running into resistance at the 6800 level. We gave back the gains though and rolled over to form a bit of a shooting star. This market continues to struggle and I think it’s only a matter of time before the NASDAQ 100 will roll over due to the Sino-American trade spat. At this point, the 50 day EMA is appointed decidedly to the downside, and we have a downtrend line just above there. I think it’s only a matter time before rally selloff, and although the NASDAQ 100 had outperformed the S&P 500, I believe this is an ominous sign for stock markets overall as suddenly we are struggling to hold gains over here as well. I think the 6500 level underneath is massive support, so if we were to break down below there it’s likely that we could go much lower.