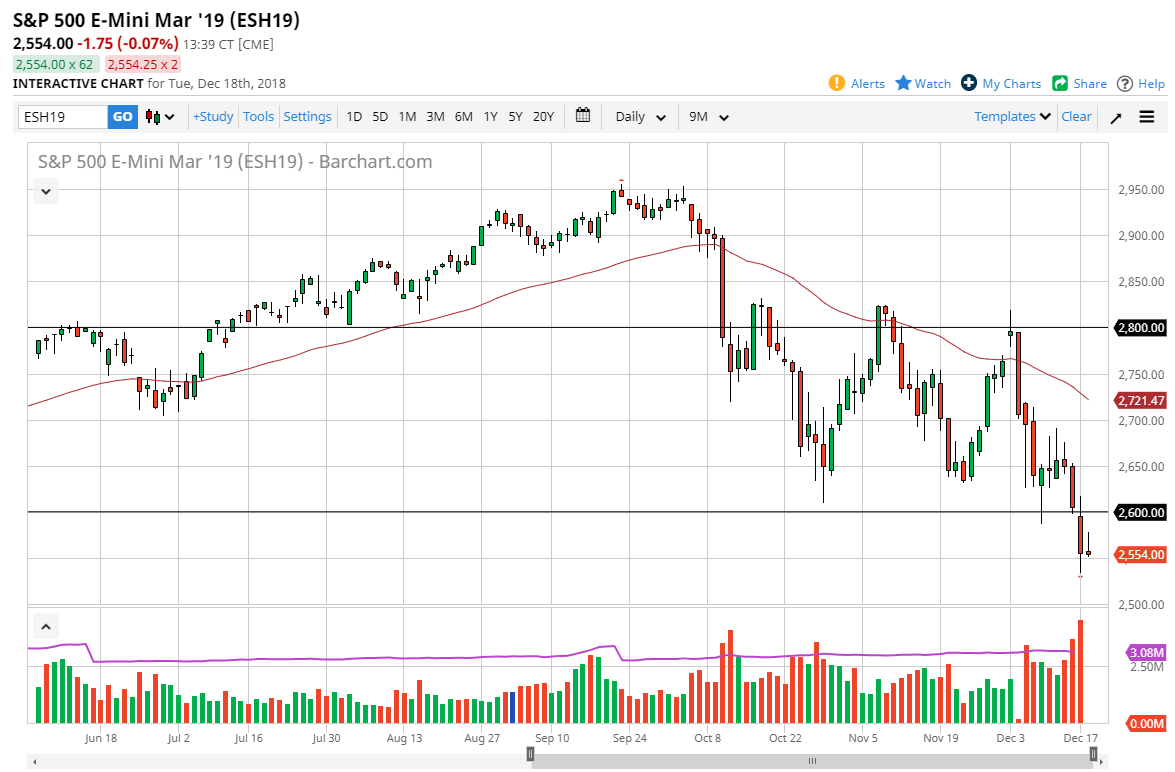

S&P 500

The S&P 500 rallied a bit during the trading session initially on Tuesday but gave back all of the gains as we continue to see selling pressure. With the Federal Reserve coming out with a statement on Wednesday, and of course the market has been sitting around waiting on it. I think at this point, the statement will be parsed, because an interest rate hike is all but assured. I think that the market is going lower regardless, no matter what the initial reaction is. We may get a bit of a bounce if the Federal Reserve starts talking about being “data dependent”, but once the euphoria wears off, it’s likely that traders will be worried about the economy, suggesting that things may be worse than we thought. As we start to close out the session, we are certainly seeing a decided negativity creep back into this market. I think rallies are to be sold.

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Tuesday, struggling just below the 6600 level. We have given back all of those gains, and it looks as if the NASDAQ 100 is ready to start breaking down yet again. Ultimately, this is a market that continues to be very volatile, and with the concerns that we see around the world as far as global trade is concerned, it makes sense that the NASDAQ 100 would struggle again. Ultimately, I think rallies are to be sold, and I believe that the market is already showing us that it wants to go lower. In fact, the 50 day EMA on the chart looks to be offering resistance so it’s not until we break above there that I would be convinced of bullish pressure.