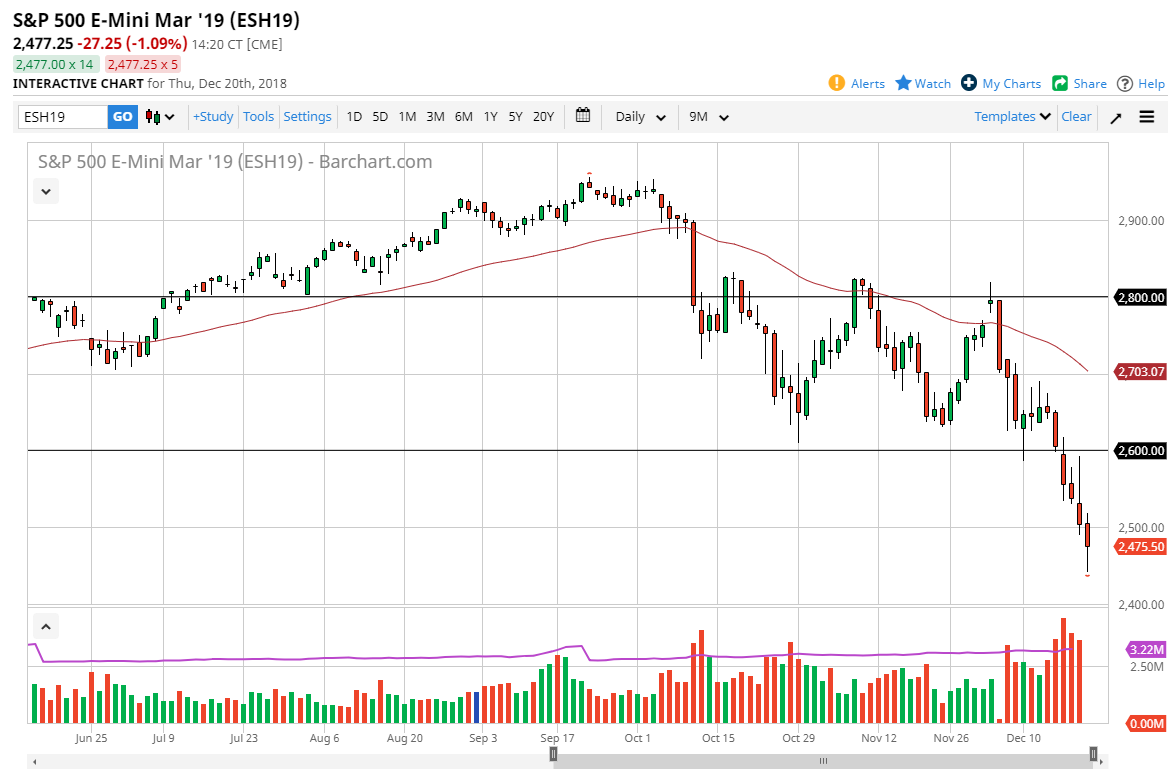

S&P 500

The S&P 500 fell hard again during the trading session on Thursday, in a continuation of massive selling pressure that we have seen over the last several weeks. What really got the market moving was Donald Trump suggesting that he was not willing to sign a continuing resolution to keep the government working until there was proper border funding. We are starting to form a bit of a supportive looking candle, so it’s possible that we may be entering a bit of consolidation. However, I think that the 2600 level above is massive resistance that we will not be able to break out of and in the short term, so I’m looking for signs of exhaustion to take advantage of and start shorting yet again. If we break down below the hammer, we could go reaching towards the 2400 level.

NASDAQ 100

The NASDAQ 100 also showed a bit of a recovery late in the trading session, forming a bit of a hammer. By bottoming the way it did during the day, that is a hopeful sign and I think that the next question be whether or not we can break above the 6600 level. If we do, then I think that we could possibly see some bullish pressure into this market for a little bit bigger of the move. I think it’s more likely that we will see sellers sooner than later, and that short-term rallies will give us an opportunity to short this market yet again. There’s been a lot of technical damage, and I think it’s probably not until next year that people were comfortable enough to put serious money to work.