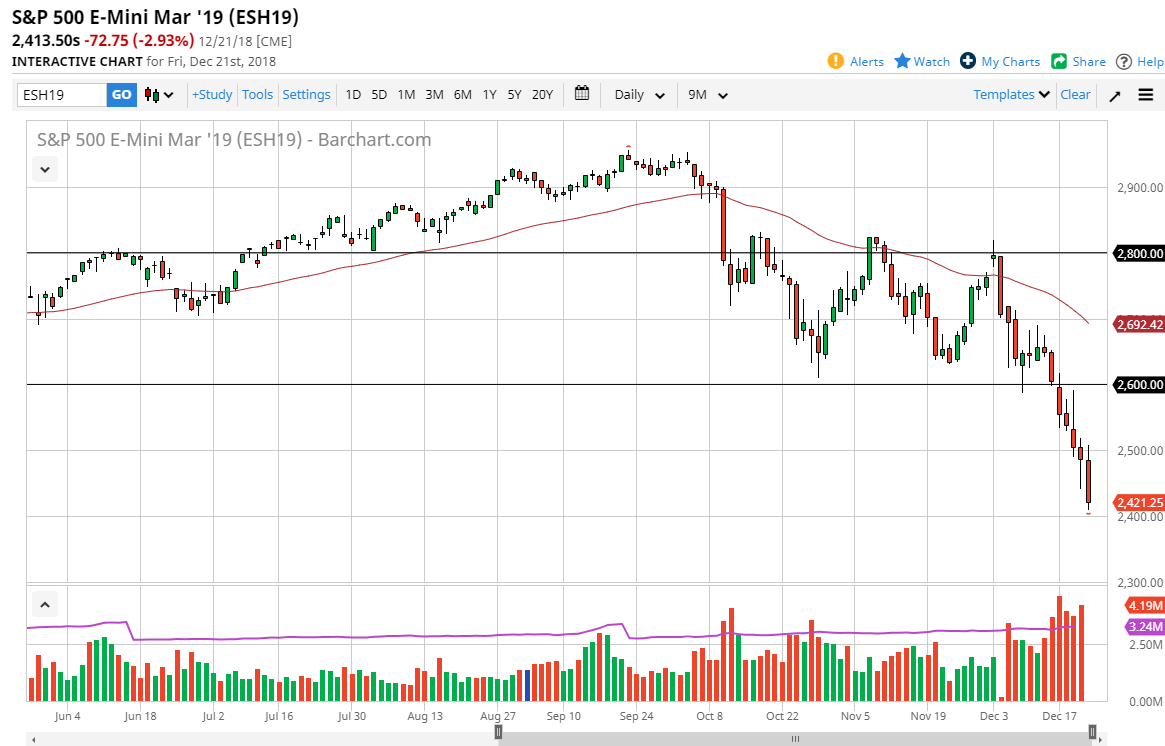

S&P 500

The S&P 500 fell again during the trading session on Friday, testing the 2400 level. This is an area that should be supportive, based upon the previous consolidation area that we just broke down through. It was 200 points, so it makes sense that breaking below the 2600 level should send this down another 200 points. Ultimately, we could get a little bit of a bounce but I think at this point it’s only a matter time before the sellers would come in and punish any type of rally. If we did break above the 2600 level, it’s likely that we could turn things around, but right now that looks very unlikely without some type of external catalyst. Right now though, I don’t see that coming down the road and as a result I remain very bearish and think that a rally should give you an opportunity to load up on shorts again.

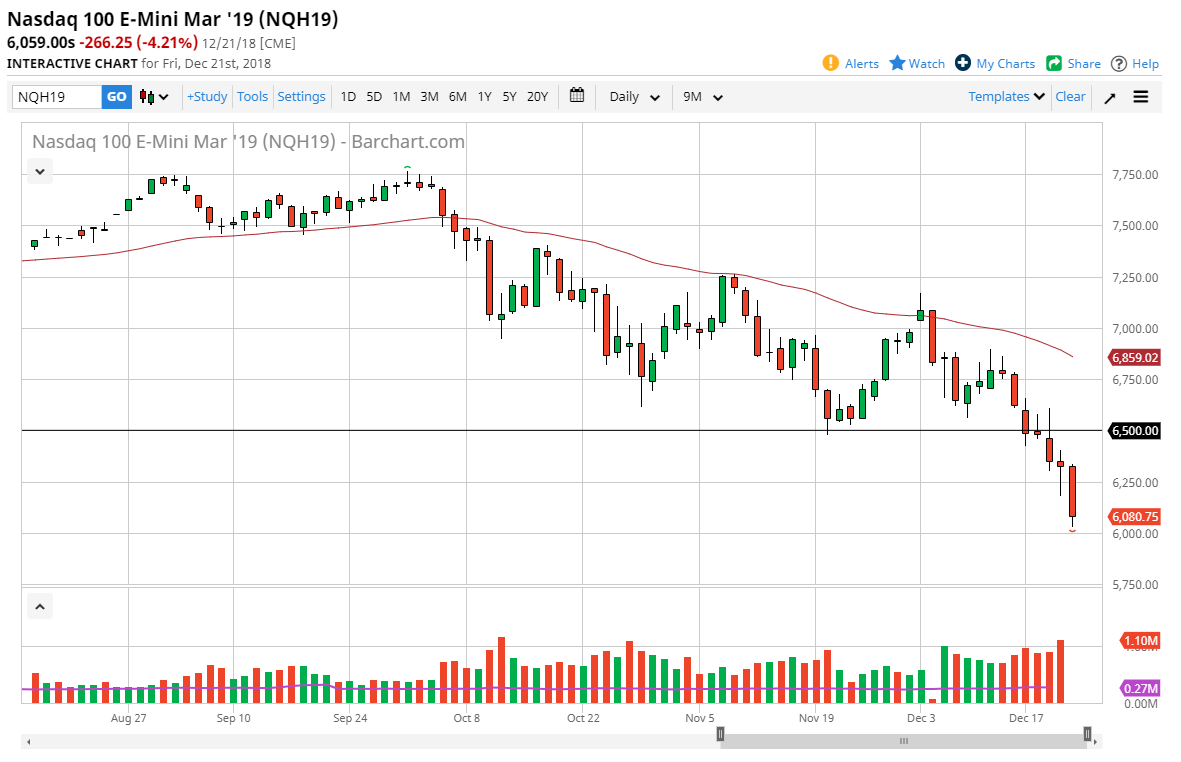

NASDAQ 100

The NASDAQ 100 broke down significantly during the trading session on Friday as well, reaching towards the 6000 handle. This market has been getting crushed for some time, and as a result I think that rallies should be sold over here as well. Sitting on top of the 6000 level should offer some psychological support though, so it’s possible that we could get a little bit of a bounce. That bounce should be a selling opportunity though, and I would be more than willing to short exhaustive candles between here and the 6500. If we break above the 6500 level, then we could rethink some things. However, I think the NASDAQ 100 is going to suffer as long as there are trade tensions between the Americans and the Chinese.