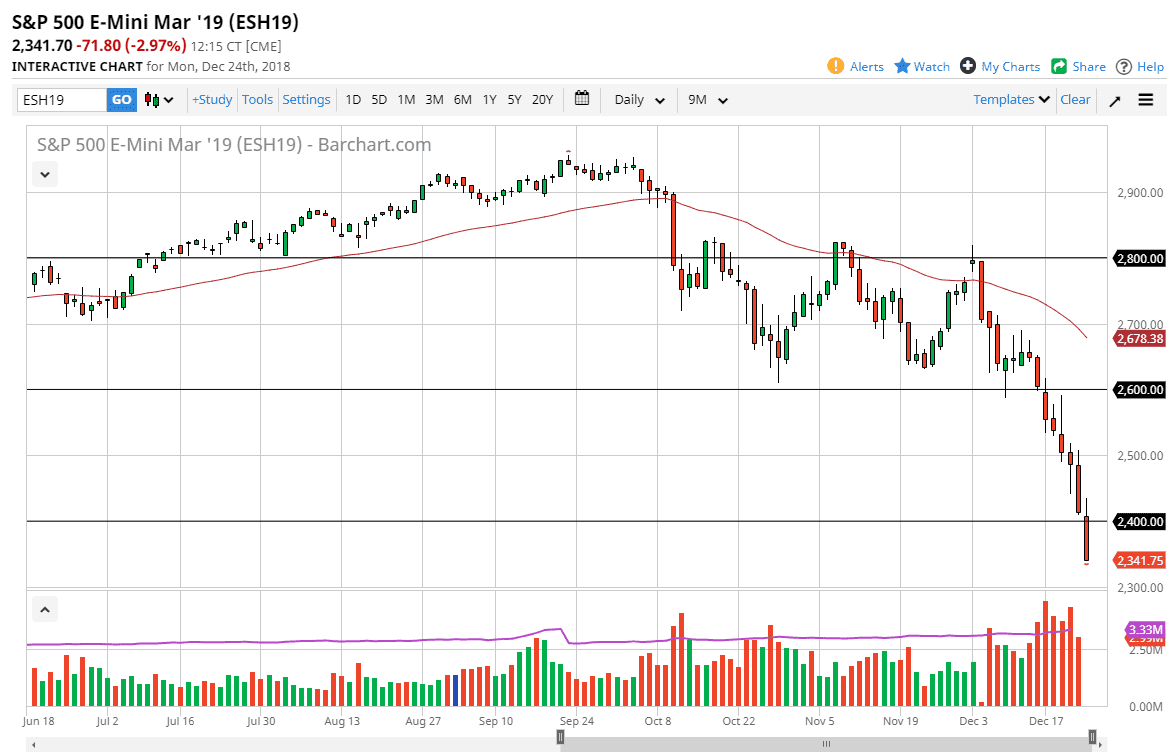

S&P 500

The S&P 500 initially tried to rally in the futures market on Monday, but then got hammered and we sliced through the 2400 level. That level was a target based upon the previous consolidation between 2600 and 2800 above, and now that we have broken through that it looks like we are seeing even more bearish pressure. The S&P 500 looks absolutely horrible, and although we will more than likely bounce, it should just be a nice selling opportunity happening. This is a market that is most certainly in a bearish trend and trying to buy it down at these extraordinarily low levels is a fool’s errand. Look for rallies that show signs of failing to start shorting again. I would anticipate that the 2400 level above should be resistance, followed by 2500.

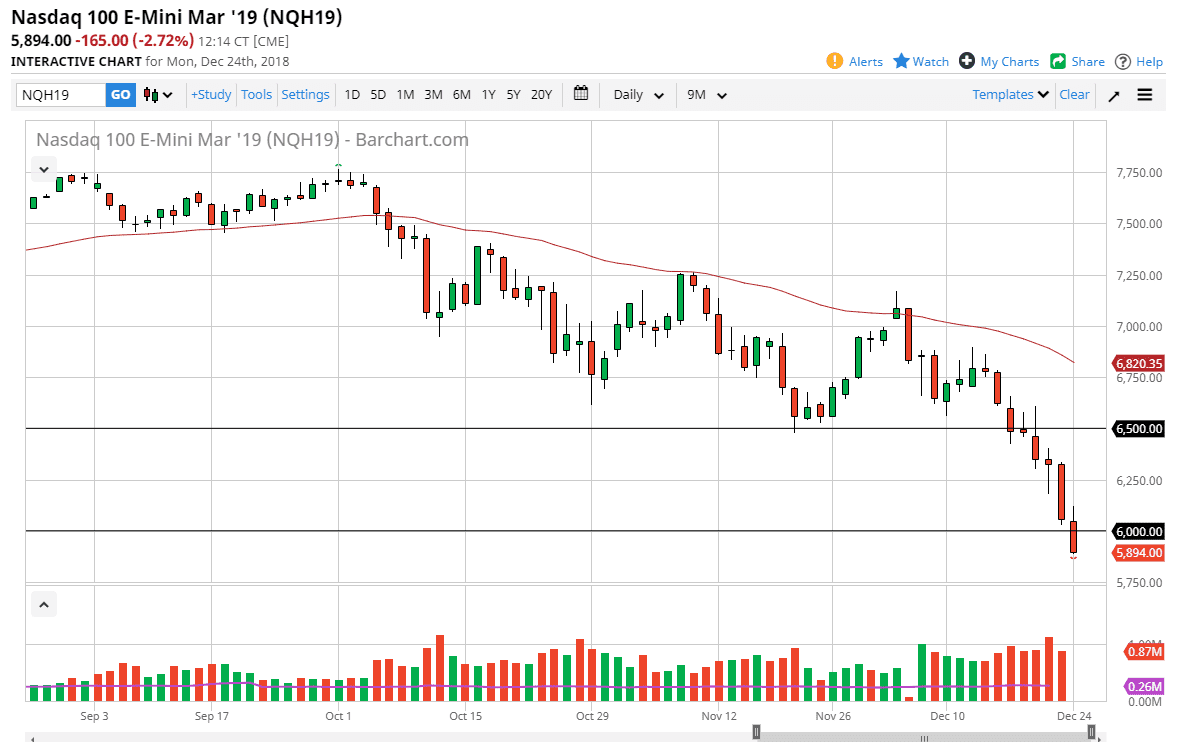

NASDAQ 100

The NASDAQ 100 tried to rally during the trading session on Monday as well but broke down through the 6000 level. By doing so, the market looks terrific, and it looks like it is ready to fall apart as well. These types of moves are very violent, and although it looks like the negativity is picking up, I believe it is only a matter time before we rally, but that should be looked at as an opportunity. Overall, it’s very likely that the pressure in this market should continue based upon the US/China problems, as the NASDAQ 100 is chock-full of companies that are highly sensitive to that dynamic. Beyond that, anything remotely involving risk appetite right now is getting slaughtered, and the fact that Apple is getting hit so hard is it helping the situation as it was the one bright spot in the stock market until recently.