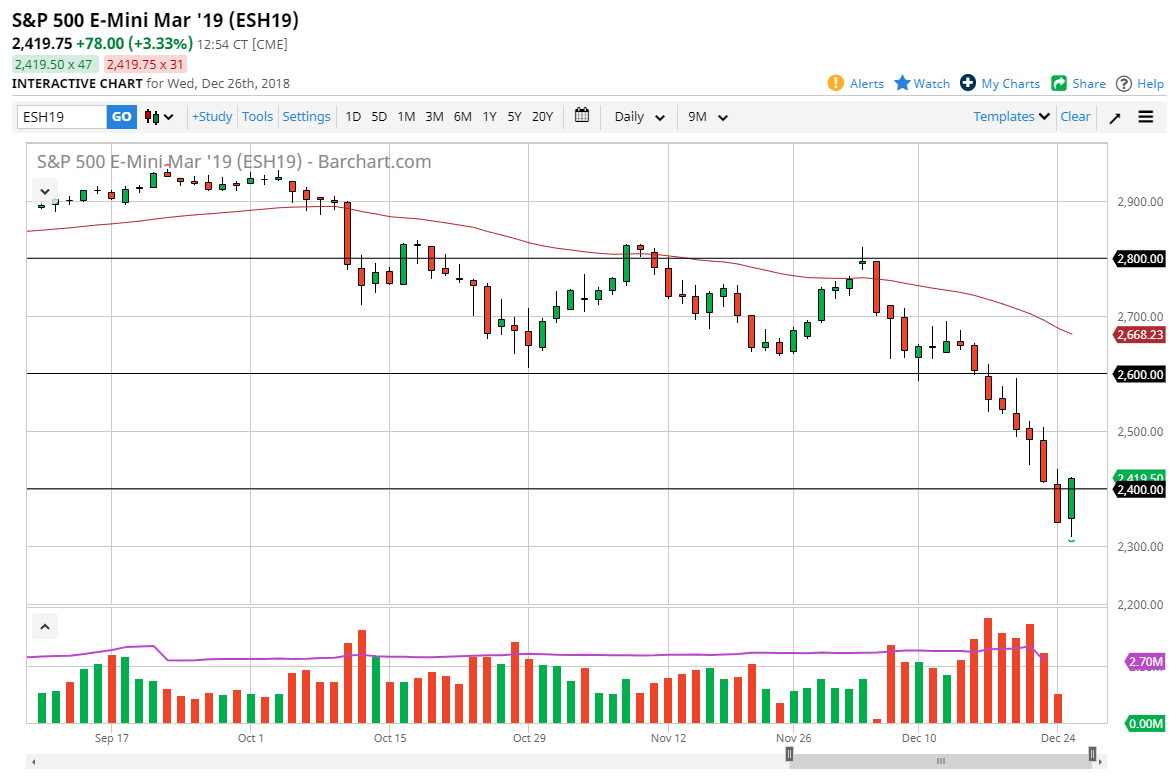

S&P 500

The S&P 500 initially fell during the trading session on Wednesday but found enough buying pressure to turn things around and break above the 2400 level. Because of this, it’s likely that we could get a little bit of follow-through, but given enough time I think that the sellers will come back in. The 2600 level above is massive resistance, just as the 2500 level is. Any time we rally in this market in this type of environment you should look at it with a bit of skepticism. Signs of exhaustion should be selling opportunities, and therefore it’s likely that the overall negativity isn’t gone, and I believe that the “dead cat bounce” should only offer a nice selling opportunity. If you take a couple of days, you should get a nice opportunity. With the lack of liquidity, I do not expect much to stick at this point.

NASDAQ 100

The NASDAQ 100 initially dropped during the trading session on Wednesday but bounced enough to break above the 6000 handle rather drastically. By doing so, it shows signs of short-term strength, but at the end of the day it’s very likely that there is a lot of resistance, especially at the 6500 level. That’s an area that was massive support, so it should be another opportunity to start shorting this market. The 50 day EMA above is turning lower, and although we could get a bit of a bounce from here, I believe that we will see a lot of negativity as there are so many different negative headlines out there to push the NASDAQ 100 lower that I think it’s only a matter of time. This bounce could be short covering heading into the new year, or it could just be technical in nature.