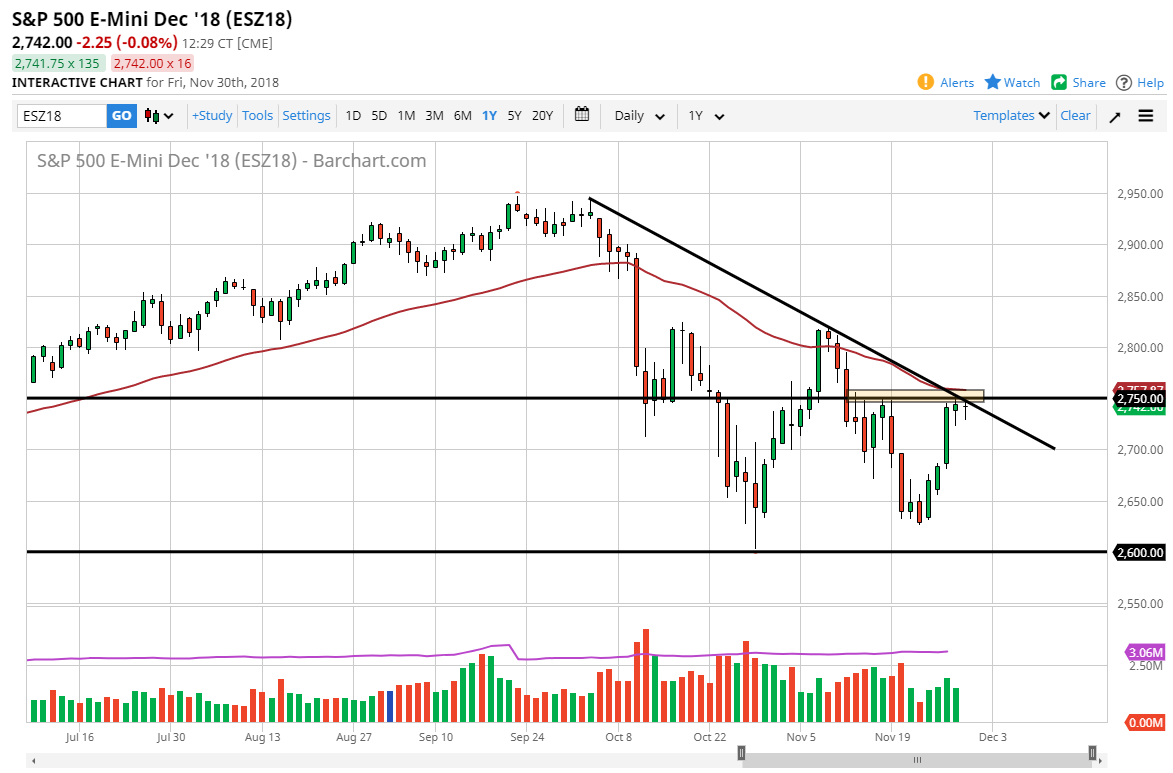

S&P 500

The S&P 500 initially pulled back a bit during the day on Friday as the world awaits the results of the meeting between Donald Trump and President Xi on Saturday, which of course will give us a window into how trade negotiations may work out. As you can see on the chart, there is a major downtrend line as well as significant horizontal resistance at the 2750 level that coincides with the 50 day EMA. Ultimately, if we can break above there, it’s a very bullish sign in the market could go to the 2800 level. This will all come down to whether or not the Americans and Chinese can play nice, and if they do that should kick off the rally. Otherwise, if the meeting becomes cantankerous, that could send this market lower. At this point, it’s a binary event.

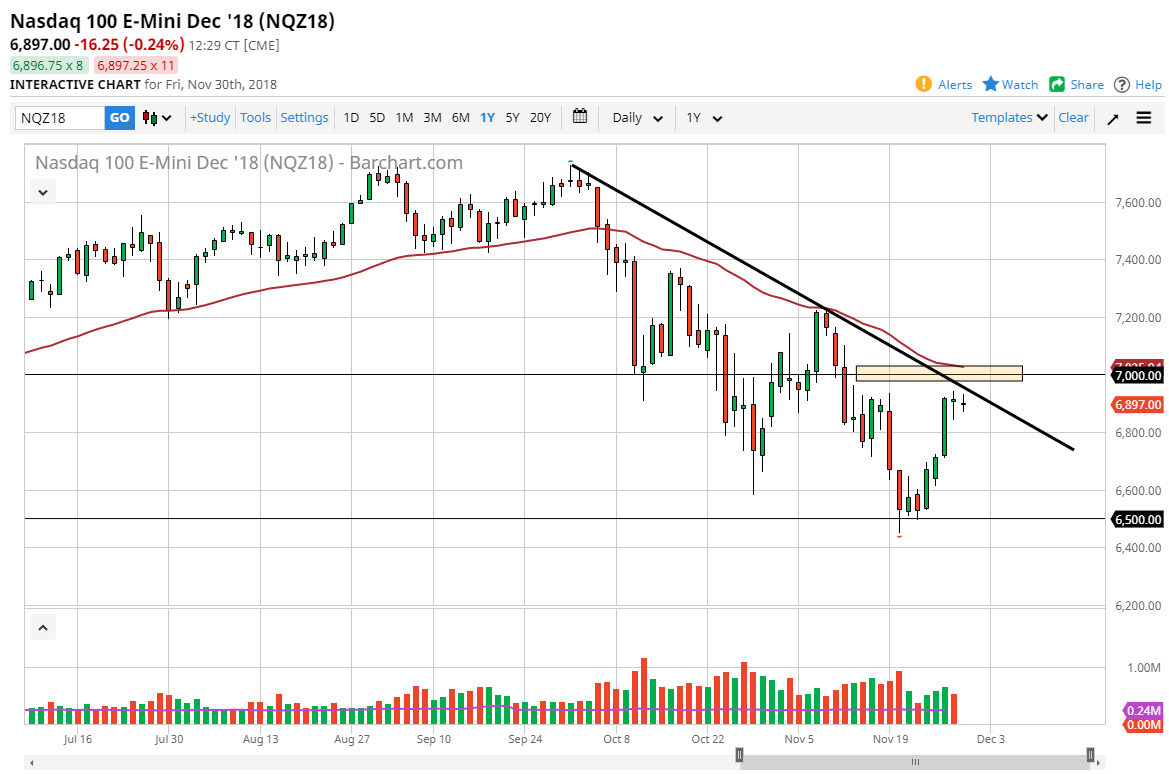

NASDAQ 100

The NASDAQ 100 also is at a major crossroads as well, with the 50 day EMA just above offering resistance at the 7000 region. Beyond that, there is a downtrend line, and therefore I think we should have a lot of noise in the short term area. However, at this point I think that the fate of the NASDAQ 100 is almost entirely resting on the idea of the meeting as well, and therefore I think that if we can break above the 7000 handle, then the market should continue to go towards the 7200 level, possibly higher than that rather quickly. Otherwise, if we get bad news out of the meeting it’s likely that we go to the 6800 level, and then possibly even the 6600 level after that. The NASDAQ 100 is highly levered to the US/China trade relations, as most companies in this list do business in both countries.