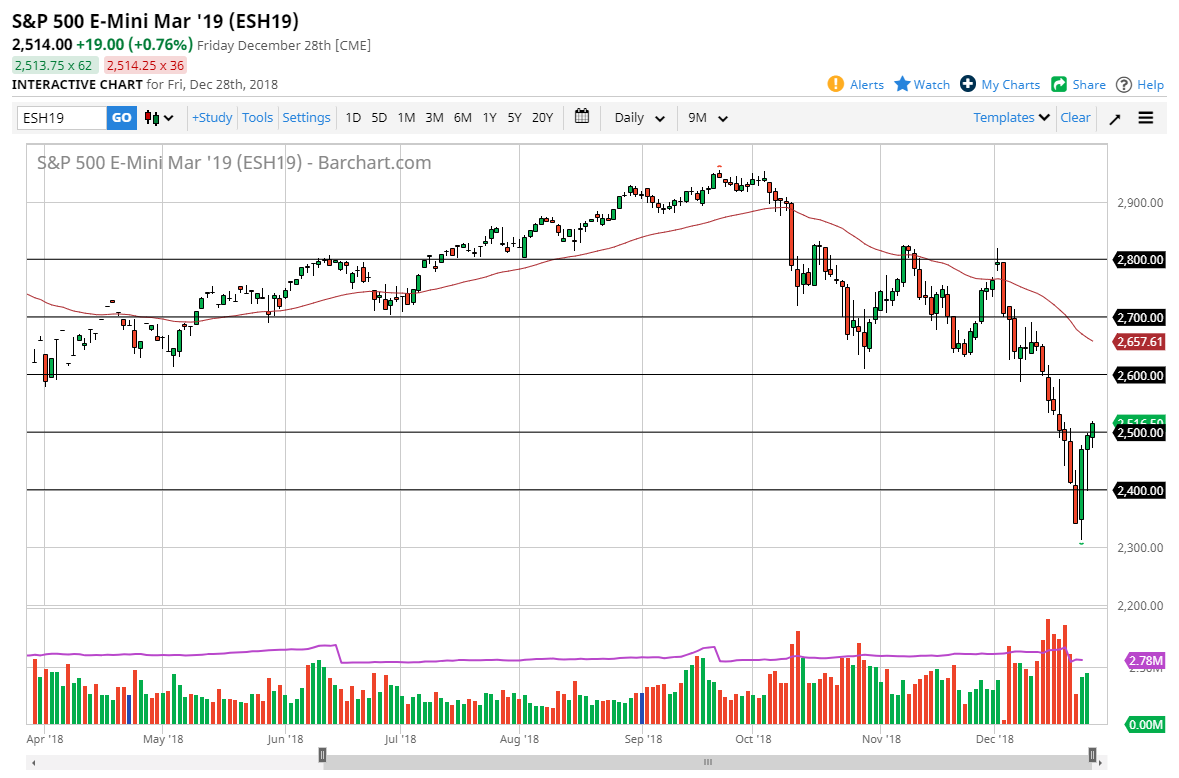

S&P 500

The S&P 500 initially fell during the trading session on Friday, but we rallied yet again to break above the 2500 level. This is a very bullish sign and I think it’s only a matter time before we continue to rally. This makes sense, because a lot of large funds out there are going to have to put money to work at the beginning of the year. This is also a nice rally after a significant break down, and I suspect that we are going to go looking towards the 2600 level. The 50 day EMA above could also cause resistance, so I think somewhere in that general vicinity is where we will probably role right back over. In the short term though it looks like we do have an opportunity to start buying after the massive bounce. If we get a daily close above the 50 day EMA, then we could continue to go even further to the upside.

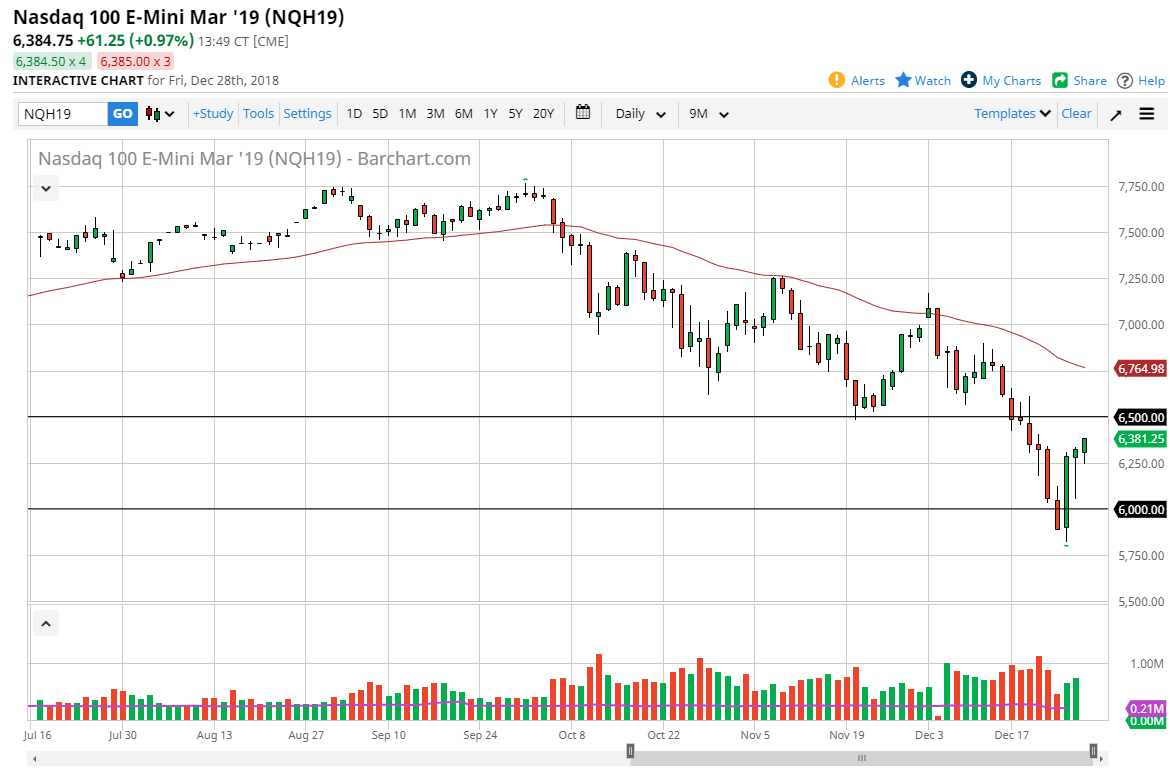

NASDAQ 100

The NASDAQ 100 initially pulled back a bit during the trading session on Friday but found enough support near the 6250 level to turn around and rally. I think that the 6500 level above is the initial target, and I think if we can break above there it’s likely that we could go looking towards the 50 day EMA. I suspect we will probably see some signs of exhaustion around the 50 day EMA, so I could be a seller in that general vicinity. If we close above there on a daily candle stick, then I would be willing to start buying. Ultimately, I think there is still a lot of uncertainty ahead but as money flows back into the market for the beginning of the year, it makes sense we get a bit of a bounce.