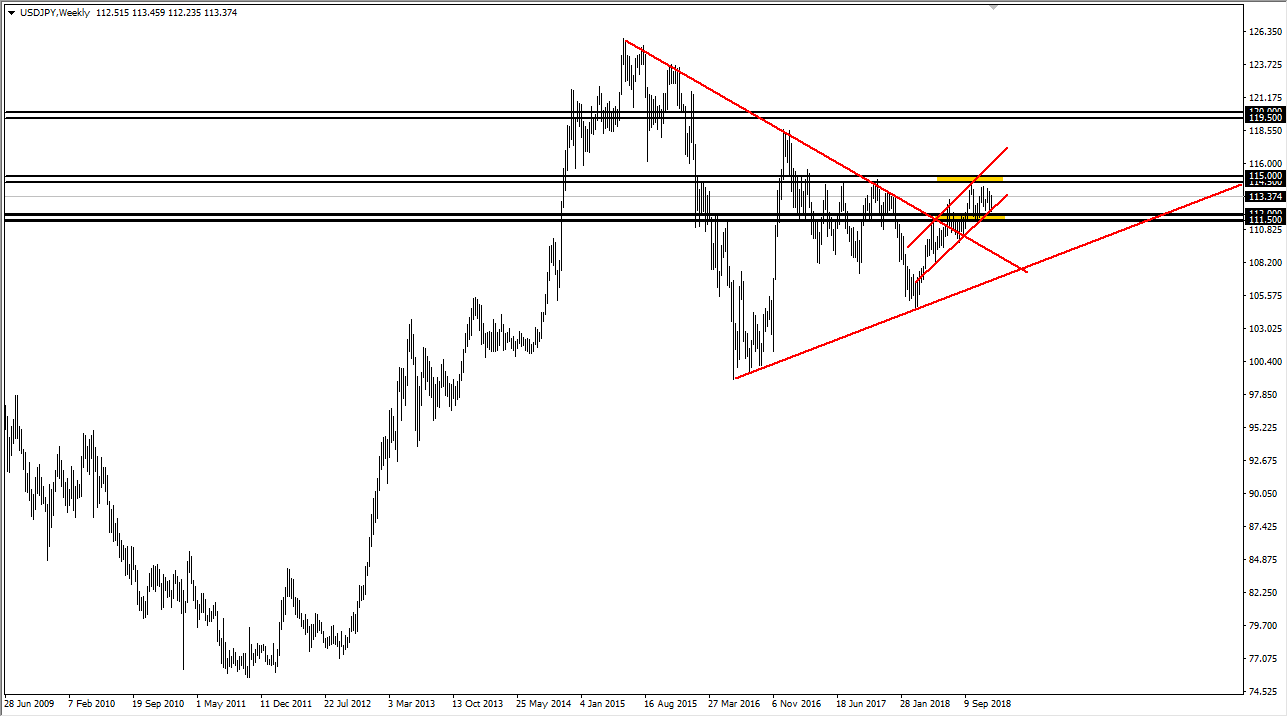

The US dollar has been rising against the Japanese yen for the entirety of 2018, in a clearly defined upward channel. Since then, we have tested the ¥115 level, an area that has continues to offer major resistance. In fact, that resistance goes back to March 2016, so it of course has a certain amount of importance attached to it.

I suspect at this point we will continue to struggle to get above the ¥115 level, and we may even need to break down rather significantly during the year. I anticipate that with the shrinking GDP figures coming out of Japan, this market is going to be looking at one major thing, the Federal Reserve. Currently, there are a lot of people who are debating whether there are going to be three interest rate hikes in the United States during the year of 2019, and I think that’s still up in the air.

At this point, the Federal Reserve is starting to soften its tone and talking about being more “data dependent.” I think we very well could find the market breaking below the up trending channel, and possibly even below the crucial ¥111.50 level. However, if we do get that pullback I think it is only a matter of time before the buyers come back. Why is this? Because the Bank of Japan will almost certainly have to continue to stay ultra-loose with its monetary policy. I think we may get an initial pullback, perhaps even lasting a few months before the buyers come back.

The alternate scenario is that the Federal Reserve goes ahead with the interest rate hikes, and we will eventually break above the ¥115 level. If we do at this point, I think the target would be ¥118, followed by the crucial ¥120 level. I suspect this is going to be one of the more difficult pairs to trade this year.