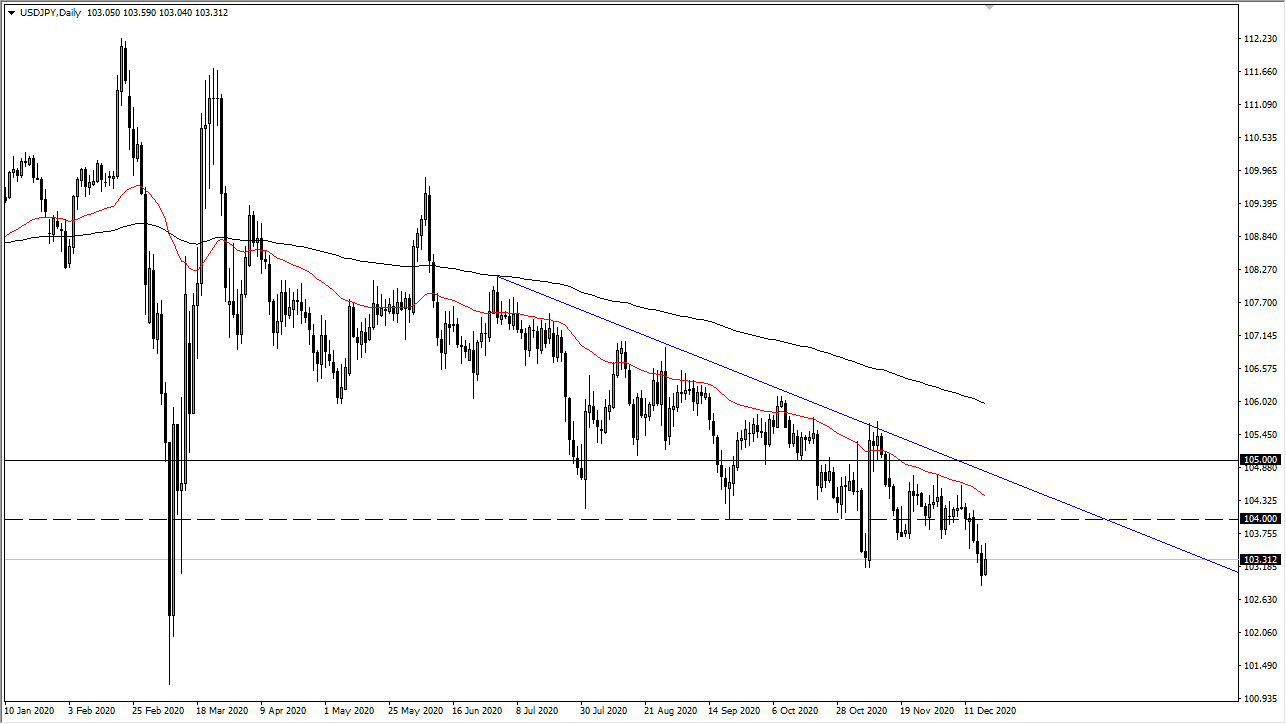

USD/JPY

The US dollar initially dipped lower during the day on Tuesday, but then turned around to rally again. It looks as if we are going to continue to try to reach towards the ¥114 level, an area that is massive resistance. I think that we could very well pull back from that area again, but we also have a massive uptrend line underneath that is continues to offer support, just as the 200 day EMA and the ¥112 level underneath. I think that the market needs to break the ¥115 level to continue to the upside for the longer-term, but I don’t think will be able to do that in the short term. If we were to turn around and break down, it’s very likely that we go down to the ¥110 level. I think the only thing you can count on at this point is probably volatility.

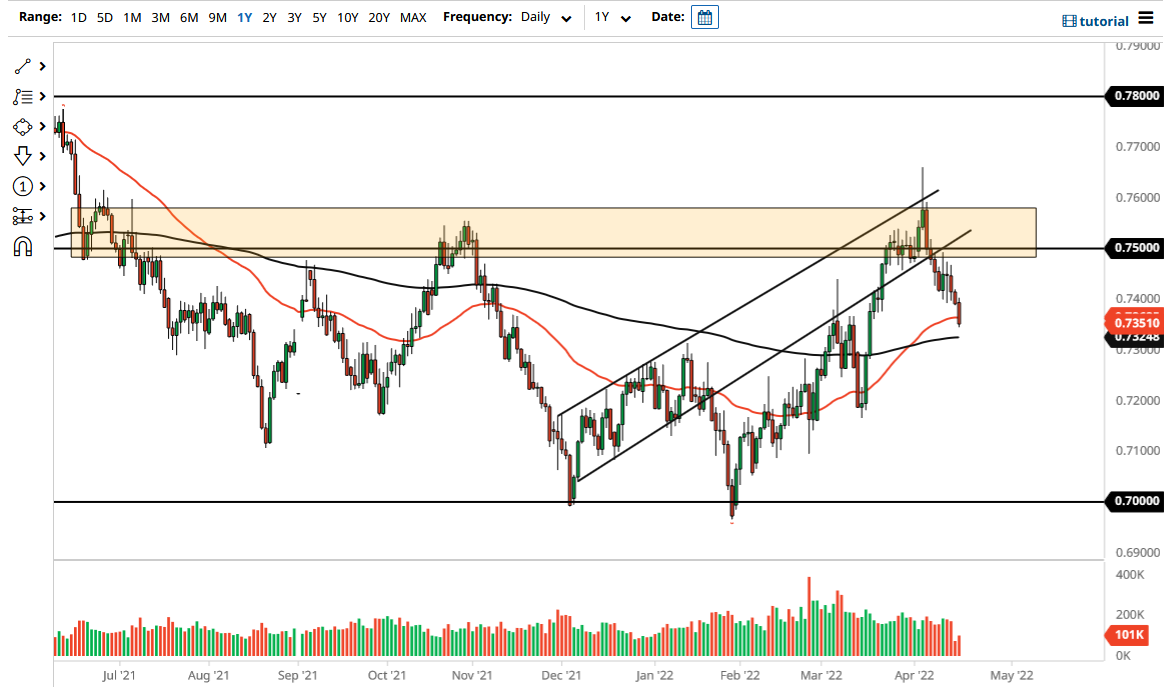

AUD/USD

The Australian dollar initially tried to rally during the trading session on Tuesday but failed again near the highs from the previous session. It looks as if the market is forming yet another shooting star, so it shows to me that we simply cannot hold onto rallies. That makes sense, as the United States and China are currently in a war of trade tariffs and bickering, and until that gets resolved it’s likely that the Australian dollar will struggle a bit. I believe that the 0.7250 level is the short-term resistance and breaking above there could open the door to the 0.7350 level. Otherwise, if we break down below the 0.7150 level, then the market could unwind quite a bit. Either way, expect a lot of choppiness but I prefer to fade rallies that show signs of exhaustion more than anything else for short-term “smash and grab” trades.