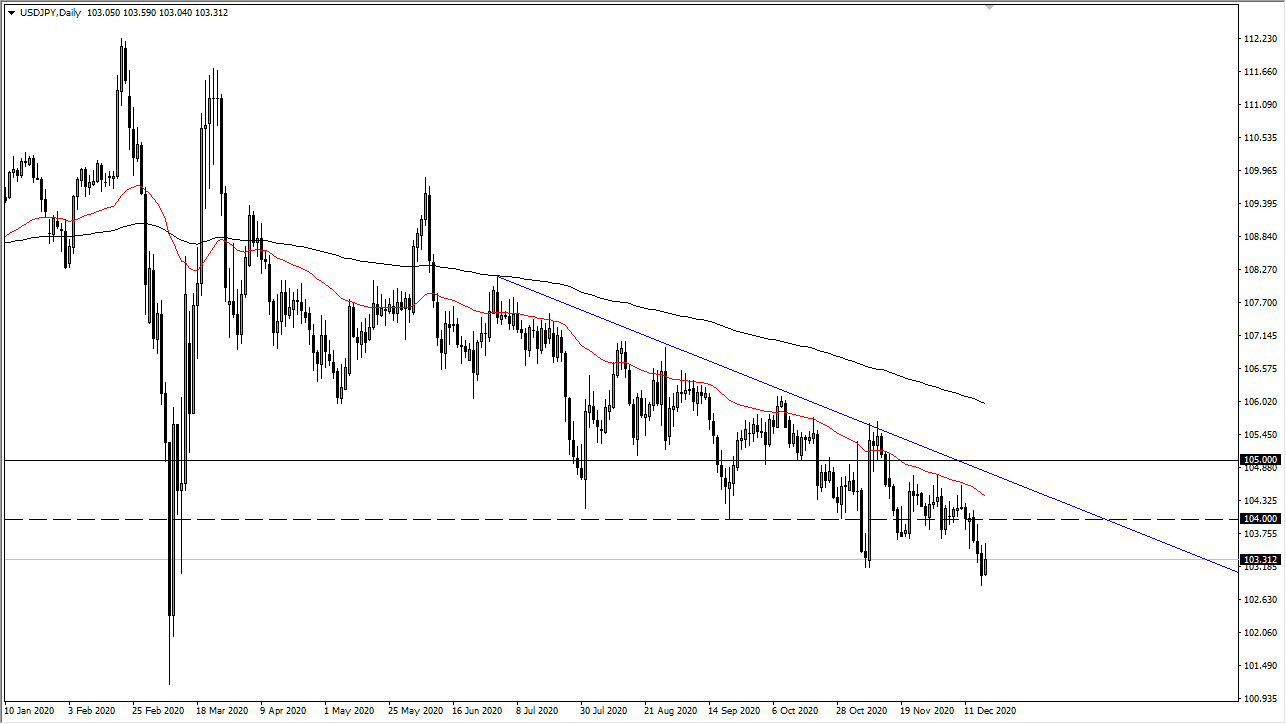

USD/JPY

The US dollar fell rather hard against the Japanese yen during the day on Tuesday, slicing through the ¥113 level, which of course is a very sign. However, there are plenty of reasons underneath the think that the buyers are jumping into the market given a chance, considering that the ¥112 level underneath has been important, so as the trend line as well. The 200 day EMA offers dynamic support as well, so I think it’s only a matter time before the value hunters should come back in. If we break down below the 200 day EMA, that would be a very negative turn of events. During the day on Tuesday, I believe that a lot of this comes down to interest rates dropping rapidly in the United States. The yield curve inversion has put pressure on the greenback, but I think buyers are waiting underneath.

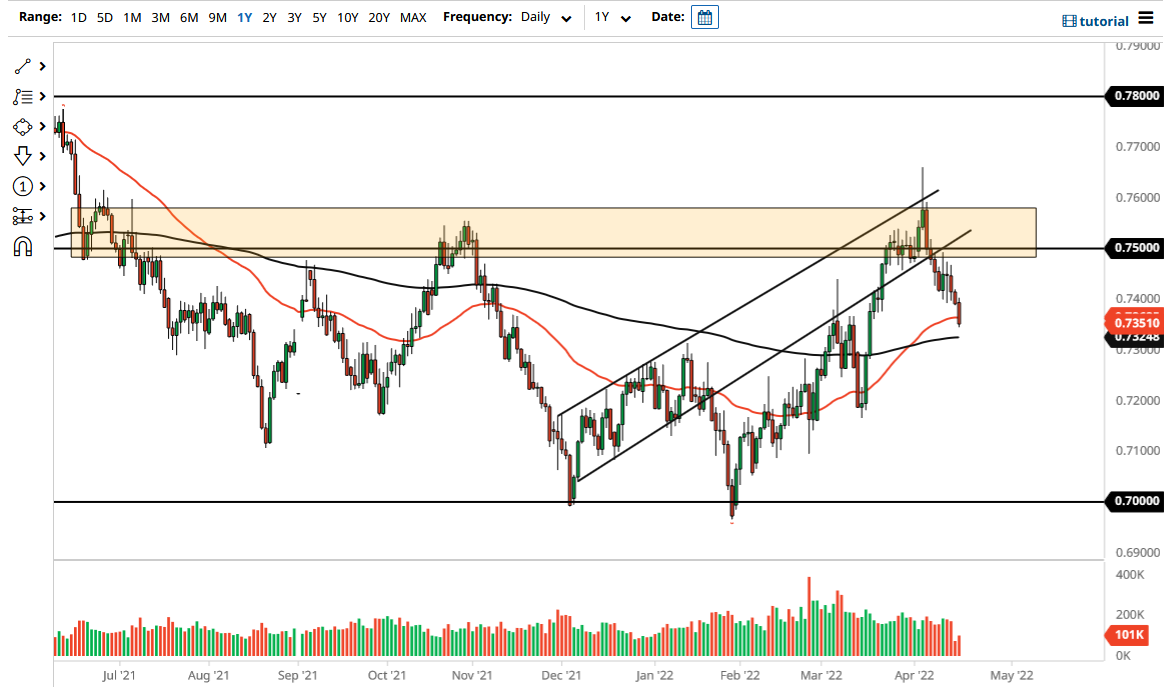

AUD/USD

The Australian dollar fell a bit during the trading session on Tuesday, filling the gap that had formed from the beginning of the week. I think that the Australian dollar is getting a bit of a bashing during the day due to the questioning of the US/Chinese trade war negotiations. There is a lot of uncertainty out there, and I think that it’s only a matter of time before we get headlines in both directions. If we break down below the 0.7150 level, the market could drop down to the 0.70 level. If we get some type of bounce from the gap, then we could go looking towards the 0.7350 level, perhaps even the 0.75 level after that. Expect volatility regardless what happens next.